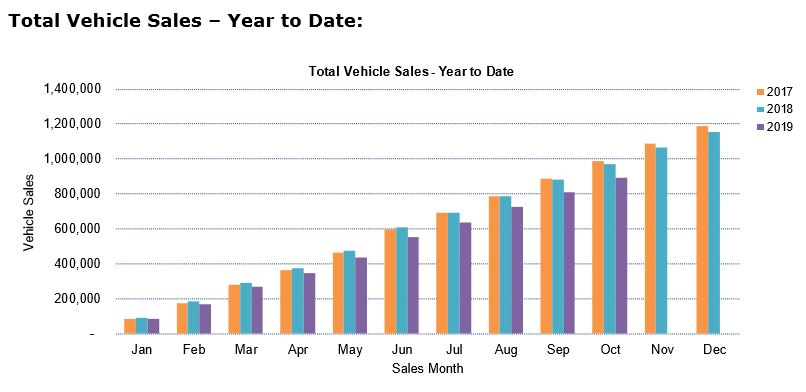

This means that 78,000 fewer cars were sold in the first ten months of this year, compared with October 2018.

A total of 82,456 cars were sold in October 2019.

The Federal Chamber of Automotive Industries (FCAI) released the new sales figures for the month.

FCAI chief executive Tony Weber said several factors are behind the lagging sales figures.

“While the drought and other domestic conditions are impacting the market, our key concern is the effect over-regulation of the financial sector is having on new vehicle sales,” Mr Weber said.

Source: FCAI

“The FCAI and our members have been concerned about the risk-averse approach to lending in Australia for some time and see improved access to finance as a key to driving economic growth in 2020.”

Sales were down across all buyer types, including private (5.2%), business (8.2%) and government (7.3%), which Mr Weber said was interesting.

Toyota remains the leader as the most popular car brand, followed by Mazda and Hyundai.

| Rank | Car brand | Total sales YTD | Total sales October 2019 |

| 1 | Toyota | 171,503 | 16,988 |

| 2 | Mazda | 85,427 | 6,370 |

| 3 | Hyundai | 73,944 | 7,455 |

| 4 | Mitsubishi | 69,317 | 4,811 |

| 5 | Ford | 53,495 | 4,891 |

| 6 | Kia | 51,422 | 5,062 |

| 7 | Nissan | 42,354 | 4,011 |

| 8 | Volkswagen | 41,929 | 4,220 |

| 9 | Holden | 37,301 | 3,086 |

| 10 | Honda | 36,971 | 2,761 |

The Toyota Hi-Lux remained the top-selling vehicle for the month with 3,516 sold, followed by the Ford Ranger (3,160), the Hyundai i30 (2,216), the Toyota RAV4 (2,132) and the Toyota Corolla (2,117).

| Rank | Vehicle | Oct 19 | Oct 18 | % diff |

| 1 | Toyota Hi-Lux | 3,516 | 4,401 | -20.1% |

| 2 | Ford Ranger | 3,160 | 3,511 | -10.1% |

| 3 | Hyundai i30 | 2,216 | 2,049 | 8.2% |

| 4 | Toyota RAV4 | 2,132 | 1,582 | 34.8% |

| 5 | Toyota Corolla | 2,117 | 2,663 | -20.5% |

| 6 | Toyota Landcruiser | 2,101 | 1,970 | 6.6% |

| 7 | Kia Cerato | 1,827 | 1,338 | 36.5% |

| 8 | Mazda CX-5 | 1,708 | 2,000 | -14.6% |

| 9 | Hyundai Tucson | 1,693 | 1,530 | 10.7% |

| 10 | Nissan XTrail | 1,592 | 1,644 | -3.2% |

The declining car sales figures are yet another sign of a struggling economy, with figures released earlier this week showing a slump in retail sales figures.

Some industry players believe the rise of car subscription services may be behind the falling new car sales.

Last month, Hyundai announced it would be joining car subscription service Carly, allowing motorists to subscribe to new and used Hyundai vehicles in Australia.

Carly CEO Chris Noone said car ownership is changing as finance gets harder to obtain.

“Car finance is getting harder to obtain and banks are cracking down on lending, especially after the banking Royal Commission,” Mr Noone said.

“This is a new age for car ownership in Australia. The goalposts have definitely shifted from outright purchase and debt financing to more flexible arrangements to suit lifestyle and personal circumstances.”

Earlier this year, Melbourne-based car subscription service Carbar launched in Sydney, with plans for a broader roll out across the rest of the country.

Jaguar Australia recently announced it would be partnering up with Carbar.

Looking for a low-rate car loan? The table below displays some of the lowest fixed car loan rates on the market for new cars.

Lender | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fixed | New | 1 year | More details | ||||||||||

| Approval within 24 hoursEarly payout available | New Car Loan - Special (Fixed)

| ||||||||||||

New Car Loan - Special (Fixed)

| |||||||||||||

| Fixed | New | 1 year | More details | ||||||||||

| FEATUREDApproval within 24 hours | Green Car Loan Fixed

| ||||||||||||

Green Car Loan Fixed

| |||||||||||||

| Fixed | New | 99 years | More details | ||||||||||

| Loan amounts from $2k to $75k | New Car Loan

| ||||||||||||

New Car Loan

| |||||||||||||

| Variable | New | 1 year | More details | ||||||||||

New / Demo Car Loan (Variable) | |||||||||||||

| Fixed | New | 1 year | More details | ||||||||||

New / Demo Car Loan (Fixed) | |||||||||||||

| Fixed | New, Used | 99 years | More details | ||||||||||

New or Used Car Loan Special | |||||||||||||

| Fixed | New, Used | 7 years | More details | ||||||||||

| No ongoing fees | |||||||||||||

Plenti Car Loan (Refinance) | |||||||||||||

| Fixed | New, Used | 99 years | More details | ||||||||||

Unsecured Car Loan Excellent Credit | |||||||||||||

| Fixed | New | 5 years | More details | ||||||||||

Fixed Car Loan (New) | |||||||||||||

| Fixed | New, Used | 7 years | More details | ||||||||||

Secured Car Loan | |||||||||||||

| Variable | New, Used | 10 years | More details | ||||||||||

Car Loan | |||||||||||||

| Fixed | New, Used | 99 years | More details | ||||||||||

Car Loan | |||||||||||||

- Available for purchasing new and demo vehicles

- $5,000 to $150,000 loan amount

- Redraw facility available up to $5000/day

- Required: Good credit history, stable employment history. Aus citizenship or PR.

Brooke Cooper

Brooke Cooper

Harry O'Sullivan

Harry O'Sullivan

William Jolly

William Jolly

Staff Writers

Staff Writers