Common credit card fees & charges

- The annual fee

- Currency conversion fees

- Cash advance and ATM fees

- Balance transfer fees

- Late payment fees

- Over the limit fees

- Dishonour fees

- Replacement card fees

The Reserve Bank of Australia (RBA) recently reported that most Aussies could save up to $250 per year in credit card costs by switching to a more suitable one. These costs are primarily caused by interest rates and fees being too great compared to the benefits gained from using a card – think rewards programs and special features.

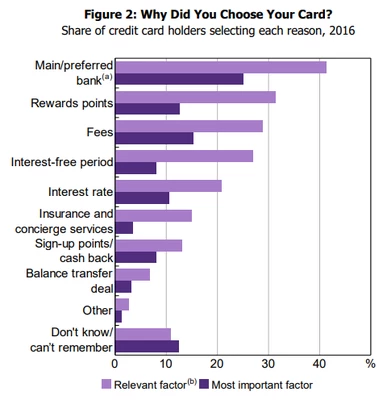

As a reason for choosing a credit card, fees were identified as the most important factor by around 15% of credit card holders, while 25% said the most important factor was whether the card belonged to their main/preferred bank.

Interest can be a not-so-silent killer when it comes to costing you money, but even those that avoid interest by paying off the balance each month can be stung by credit card fees.

Source: RBA.

Below are the most common credit card fees and how much they cost.

1. Credit card annual fee

A credit card annual fee is a yearly fee charged by credit card companies to pay for the account maintenance and extra features the card offers, such as travel insurance and airport lounge access. Most of the cards that charge a high annual fee tend to be rewards and premium cards, while cards with a low annual fee tend to be more basic ‘no frills’ products.

Various market sources show that cards with an annual fee charge anywhere between $20 and $750.

Case study: Oliver pays a high annual feeOliver has a credit card that charges a $395 annual fee. He spends about $2,000 a month – or $24,000 a year – which earns him around $240 worth of rewards points – not enough to cover this annual fee.

BUT, he also travels a lot for work, and his credit card grants him several free entries to the Qantas Club airport lounge, valued at around $510 per year. After factoring this in, he decides that the card pays for itself.

|

Credit cards with no annual fee

There are plenty of cards available that charge $0 in annual fees too, either permanently or in the first year of activation. Such a card might be suitable for people who don’t use their credit card every day and spend small amounts every month.

The table below shows some cards with no annual fees.

2. Foreign currency conversion fees

Also referred to as ‘international fees’, this is the fee charged for purchases made on your card in other countries, as the credit card company (think Visa or MasterCard) needs to convert this money into Australian dollars.

This fee tends to sit between 1% and 4% on all foreign purchases, with 3% being common, and is usually pretty visible when applying for a card.

Credit cards with no international fees

As with the annual fee, there are plenty of cards that charge 0% for currency conversion, but don’t forget that the credit card provider’s exchange rate (which has margins built into it) will still cost you.

Below are a handful of credit cards with no foreign currency conversion fees.

3. Cash advance charges

A cash advance fee is the fee charged for withdrawing money from an ATM using your credit card. Credit card cash withdrawal charges are often around 3%, but you are also charged interest on cash advances the moment they occur (interest-free periods don’t apply). The term ATM fee is used interchangeably with cash advances, but your specific provider might charge another fee for using a different ATM network.

Cash advances can be expensive, so it’s best to use a debit card when withdrawing from ATMs. Otherwise, compare credit cards on the market that charge low cash advance fees and interest rates.

4. Balance transfer fees

Some credit card providers charge a ‘balance transfer handling fee’ when shifting credit card debt across to a new one. This fee is only charged once unlike annual fees, but can easily be forgotten about, and again this fee will be around 1-3% of the balance transfer amount. So if you were to balance transfer a $5,000 debt to a 0% card for 12 months, you’d be charged a balance transfer fee of $50-150.

Not every card charges a balance transfer fee, but this shouldn’t be your reason for using one. ASIC’s review of credit card lending found 30% of consumers who used a balance transfer between 2012 and 2017 actually increased their debt by 10% or more. This could be for any number of reasons, but we Aussies are notoriously bad with credit cards, and balance transfers can sometimes charge higher interest rates for purchases made during the introductory period.

So if you’re serious about paying off that debt, don’t make any new purchases on your balance transfer card until it’s all paid off. Alternatively, check out a 0% balance transfer offer that also charges a low fee.

5. Late payment fee

For any unpaid balance at the end of every billing period, credit cards require that you at least meet a minimum repayment, either 2-3% or $20, whichever is higher. If you fail to make this repayment, you can be charged anywhere up to $35 in credit card late payment fees each time. According to credit bureau Experian, two in five credit card users miss their repayment deadlines.

You can avoid this fee by setting up a direct debit to make your desired repayment every month, and the closer to the full amount you can get the better. If this isn’t an option for you, you can contact your provider to ask for an extension on your payment or apply for financial hardship provisions.

Again, not all providers charge a late payment fee, and if they do, they might give you a warning or wait until they have to contact you.

6. Over the limit fees

Going over the agreed-upon credit limit can lead to an over the limit fee, which can be up to $35. Although these fees were banned from 2012 onwards, cards from before this year can still be charged existing over the limit fees.

If you find you’re regularly getting close to your credit limit each time or have been charged a fee or two in the past, you can ask your provider for a credit limit increase.

7. Dishonour fees

The dishonour fee is similar to the late payment fee but occurs when a direct debit payment bounces back due to lack of funds (aka a dishonour). This one usually incurs a payment of only a few dollars, but that’s a few dollars you otherwise wouldn’t have to part with.

8. Replacement card fees

Lost cards are really common in Australia. Commonwealth Bank found in 2018 that nearly 700,000 people reported lost bank cards (credit or debit) over a 12 month period. Most providers won’t charge you a fee for a replacement if you’re in Australia, but for emergency or overseas replacements you might have to stump up more than $100.

Related: Common credit card frauds and how to avoid them

Ask your provider for a fee waiver

A hot tip for credit card fees is that you can potentially keep your current card but have the fees waived. How? Try ringing your bank and say you want to cancel your card because you’ve found a better one (this works better if you have actually found another card).

The fact is, as a credit card user you are valuable to your provider. Putting aside interest repayments or regular fees paid, they also get a cut of every transaction made due to merchant fees and surcharges. If you are a regular spender with your card, call them up and say you want to switch. They could offer you:

- A discounted annual fee

- A waived annual fee

- A retention bonus, such as free rewards points.

Savings.com.au’s two cents

According to a 2018 discussion paper published by the RBA, 60% of Australians are not getting any monetary benefit out of using a credit card, as their benefits are outweighed or equaled by the costs. If you’re one of them, then why not find an alternative?

Most if not all of these credit card fees are avoidable in some capacity. Some are avoidable by choosing a different card, while others are avoidable based on your spending habits. It’s entirely possible to never pay over the limit fees, dishonour fees or replacement card fees by properly managing your credit card repayments and keeping it safe and secure. Keeping your credit card debt manageable will remove the need to pay a balance transfer fee too.

With savvy searching, you can also find cards that don’t charge annual and currency conversion fees. It’s not necessarily true that such cards come with either high interest rates or disappointing perks either – there are plenty of cards in today’s uber-competitive market that offer a satisfying combination of fees, relatively low interest rates and useful rewards. You just might have to actually take the time to find one yourself.

Brooke Cooper

Brooke Cooper

Harry O'Sullivan

Harry O'Sullivan