A study by REST Super has discovered the depth of Australia’s addiction to subscription services like Netflix, Spotify and Stan, with $3.9 billion being chucked away on unnecessary subscriptions, apps and services.

Nearly half (44%) of the study’s respondents said they’ve never cancelled subscriptions they weren’t using, while 42% actively avoid paying attention to their finances to pick up on unwanted fees such as these.

More than one in 10 (11%) pay more than $100 a month for subscriptions.

According to the research, the millennial generation (ages 25-39) are the worst offenders, with the average millennial having 4.7 paid subscriptions to the tune of $45 a month.

They’re also the most likely to take a passive approach to reviewing and cancelling unwanted services.

Gen-Z (18-24) on the other hand is the most likely to pay attention to what they’re using and paying for, as they use subscription services the most but also pay the least.

Rest Chief Executive Officer Vicki Doyle said this apathy towards current and future finances can have a negative impact on overall financial health.

“One-in-five Aussies have never checked their bank or credit card statements, and a fifth have never checked their superannuation account. Yet checking these statements was found to be the most common way of discovering fees they weren’t aware of,” Ms Doyle said.

“We know that people are time poor and have to juggle an enormous number of commitments. Our research shows that four-in-five Australians avoid taking action on their finances because they’re too busy, it takes too long, or they don’t know where to start.

“In fact, 64% said they knowingly pay avoidable fees, such as the fees on multiple superannuation accounts.”

Ms Doyle also said that while unused subscription fees might “feel harmless”, taking this approach to bigger things like your super can have a major impact on retirement.

“Australians with multiple super accounts are paying excess administration fees, insurance premiums and contributions tax, and these charges are whittling away one of the biggest assets they’ll accumulate in their lifetime.”

According to REST’s research, that $3.9 billion figure for unavoidable costs jumps to $6.5 billiononce excess fees on super and insurance are factored in.

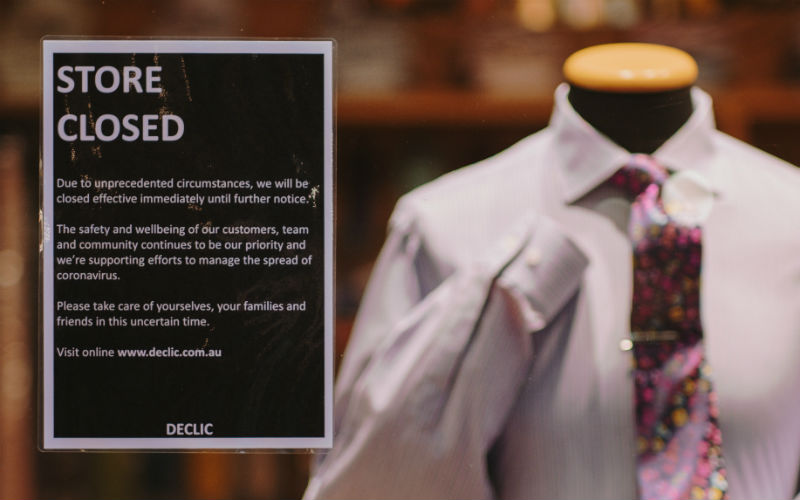

Subscription creep is a silent killer

There are subscription services available for just about everything these days.

The more popular ones are entertainment apps like Netflix, Stan and Spotify, while things like gym memberships and fitness apps can also be classed as such services.

More recently, people have turned to food delivery services like Hello Fresh or Marley Spoon, while subscription-based delivery services are now available for things like alcohol, clothes, beauty products and pet food.

There are even up and coming car subscription services like CarBar allowing customers to rent out a car instead of buying for an ongoing fee. Yes, even cars are a subscription service now.

With subscriptions so readily available, it’s easy to fall victim to ‘subscription creep’, where more and more subscriptions are acquired without much thought to how much it’s costing each month.

A dozen subscriptions costing $10 each (which is quite generous) could easily cost $120 or more each month, which is more than $1,400 per year.

Factor a gym membership in and this monthly cost can easily reach $150-plus, according to REST’s subscription service infographic.

This is why it’s important to do regular bank account audits to see where the money is going.

Brooke Cooper

Brooke Cooper

William Jolly

William Jolly