It’s the second wave of removals this year as part of a fee clean-up program by the big four banks, prompted by the Royal Commission.

By the end of September NAB will no longer charge:

- Legal fees for business lending customers, which currently attract more than 2,000 complaints per year

- ‘Repeat statement fees’ when customers request bank statements

- Fees applied when issuing or cashing foreign currency (fee applied on top of conversion rate)

Customers can also now cash cheques up to $1,500 with no fees attached using a new mobile cheque deposit feature in the NAB Mobile Banking app.

NAB Chief Customer Officer Rachel Slade said the fee blitz was part of the bank’s commitment to reduce complexity and complaints.

“NAB has built-up far too much complexity, including the way we have applied fees and charges to our products and services,” Ms Slade said.

“We’re listening to customer feedback and making changes to fees, so there’s less of them and they’re simpler and easier to understand.

“These improvements are a welcome change for our customers and we anticipate it will simplify our business too, with thousands less calls for information and support coming to our customer contact centres.”

Customers reaping the benefits of previous fee removals

The first round of scrapped fees in July included the removal of the $10 NAB Connect monthly service fee – the removal of this fee saw customer applications increase by 5%.

The bank also said more than 8,000 customers had saved on $15 credit card late payment fees, following the introduction of a waiver which rewarded customers who had made punctual minimum repayments in the 11 previous months.

NAB also launched over 1.8 million credit card payment reminders via SMS in March of this year, which in conjunction with the waiver initiative, contributed to an estimated 30% reduction in credit card late payment fee complaints.

“It’s really pleasing to see indications that the removal of fees and supporting initiatives we’re putting in place are having a positive impact for our customers,” Ms Slade said.

Bank fees in Australia

The Reserve Bank of Australia (RBA) found banks made approximately $4.19 billion in fees from households in 2018, a 6.5% decrease from 2017.

This income was largely made up of fees on credit cards (41%), housing loans (28%) and deposits(22%).

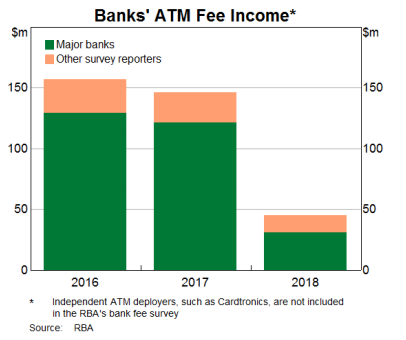

Fee income from deposit accounts fell by 20% as a result of abolished ATM fees and declining ATM withdrawals.

Income from exception fees on transaction deposits – which include overdrawn, dishonour and honour fees – also decreased substantially, due to reduction or removal of fees by banks.

Brooke Cooper

Brooke Cooper

William Jolly

William Jolly

Emma Duffy

Emma Duffy