The Australian Competition and Consumer Commission (ACCC) inquiry, which was commissioned by Treasurer Josh Frydenberg, looked into the important competition and consumer issues on products like international money transfers (IMT), foreign cash, travel cards, and credit cards or debit cards.

The ACCC’s report found it can be challenging for customers to shop around due to a lack of disclosure on exchange rates and fees for these products, leaving many customers at the mercy of the big four banks “despite the availability of much cheaper alternatives”.

For example, customers who used the big four banks to make IMTs in US dollars and British pounds could have saved about AUD$150 million collectively if they’d just used a cheaper option.

“Shopping around could save Australian consumers hundreds of millions of dollars each year,” ACCC Chair Rod Sims said.

“Consumers and small businesses tend to default to their usual bank to send money overseas, but this may not be the cheapest option. This is another example where consumers may end up paying more for their loyalty.”

Key findings from the report relating to consumer savings include:

- Big four customers could save up to $200 USD if they used

a debit card and credit card instead of a travel money card - Big four debit card and credit card users could save up to $13 on a $200 USD purchase if the card has no international transaction fees

- Debit and credit cards are generally cheaper than using foreign cash, travel cards and international money transfers.

- Consumers and small businesses who used the most expensive bank to transfer $7,000 USD could have saved more than $500 if they had used the cheapest supplier.

- Foreign cash is more expensive at airports – $100 USD bought at an airport in February 2019 was $40 more expensive than the cheapest non-airport supplier.

Additionally, a 2018 study by the World Bank found the cost of sending money overseas from Australia was approximately 11% higher than the G20 average and 40% higher than the US.

To combat this price gouging, the ACCC has published several recommendations in its final report:

- IMT suppliers must take the necessary steps to inform customers of the total price of a transfer upfront, including correspondent banking fees

- IMT suppliers should offer digital tools like calculators on their websites to help customers calculate the total price of those services

- Foreign cash suppliers should ensure that they provide price information that will enable customers to understand the total price of foreign cash transactions

- Merchants should inform consumers if they are likely to be charged an international transaction fee.

According to Treasurer Josh Frydenberg, the Government “strongly supports” the ACCC’s recommendations to increase competition and lower fees.

“The ACCC found that in some circumstances Australian consumers are paying 30 per cent more than those in the US for the same service,” Mr Frydenberg said.

“The ACCC will now assess the industry’s implementation of the recommendations and report back to Government within 12 months to ensure that action has been taken.

“If the ACCC finds the industry is not complying with these recommendations, or that the implementation of these recommendations has failed to address the concerns that have been identified, the Government will consider taking further action to ensure that consumers are properly informed and not being taken advantage of.”

To help consumers shop around on foreign currency services, the ACCC has also released an in-depth guide on its website to provide the relevant information.

“The guide will help consumers to shop around, carefully select where and how they pay for their purchases and to identify fees so they can get the best deal,” Mr Sims said.

“For example, the guide explains how foreign exchange services with low or no fees are not always the best value for money.

“We have also tried to clear up a few misconceptions, such as the assumption that paying in Australian dollars when shopping overseas is always best, when that is not the case.”

How to save when sending money overseas

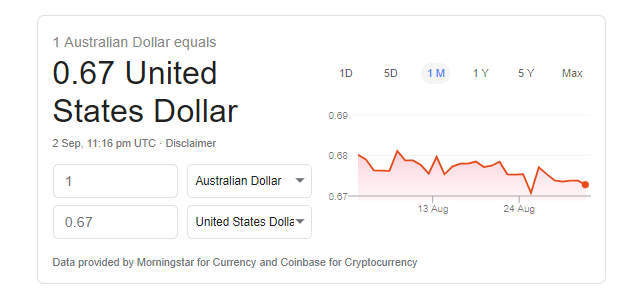

In Australia, the majority of suppliers offering money transfer services will charge an exchange rate margin, which is the difference between the mid-market exchange rate seen on Google and the rate charged by the company.

Most companies charge an exchange rate margin in order to make money. There are some exceptions: TransferWise, for example, instead charges a percentage-based service fee that increases with larger transfers.

But the majority would offer a worse exchange rate than this one.

Currency exchange rates can vary significantly between providers. Where one might offer an exchange rate with a relatively small margin, another might offer a terrible exchange rate that can leave customers hundreds of dollars worse off.

As at 3 September 2019, here’s what you’d get for transferring $10,000 Australian overseas to America for the following providers:

| Bank | $USD Received |

|---|---|

| ANZ | $6,515 |

| CBA | $6,363 |

| NAB | $6,426 |

| Westpac | $6,357 |

| Money transfer specialist | $USD Received |

|---|---|

| OrbitRemit | $6,651 |

| OFX | $6,624 |

| TransferWise | $6,681 |

| Currency Fair | $6,679 |

Calculations made using each individual website.

By comparison, the mid-market rate of 0.67 USD:AUD would return $6,714 US dollars.

In this instance, it’s the smaller money transfer specialists who are the closest to the actual exchange rate, potentially saving customers several hundred dollars.

Brooke Cooper

Brooke Cooper

Harry O'Sullivan

Harry O'Sullivan

William Jolly

William Jolly

Hanan Dervisevic

Hanan Dervisevic