A checklist to teaching your kids about money:

- Talk to your kids about money

- Use clear jars to store savings

- Open a high interest savings account

- Use fake money

- Start pocket money early

- Teach them the difference between needs and wants

- Delayed gratification

- Give them a savings goal

- Let them make mistakes

- Avoid impulse buys

- Lead by example

Why teaching kids financial literacy?

The value of money? The importance of saving? How to file a tax return? Pffffft. We all know you’re supposed to magically figure all that stuff out overnight as soon as you become an adult. Right?

Which is why it’s so important for parents to talk to their kids about money and teach them the importance of saving from an early age. The money values you teach your kids when they’re young could help them avoid debt and manage their money wisely as they get older.

A study by ME Bank found that 40% of Australians said they wished they had been taught more about money as children. Worryingly, 6% of respondents said they had never been taught any valuable lessons about money growing up.

Coming as a surprise to approximately no one, not being taught how to manage money caused those people to be less effective savers, and less financially comfortable in adulthood.

Here are a few ways to teach your kids how to manage and save their money.

When to teach kids about money

It’s never too early to start teaching your kids about money - children as young as three can begin to understand the concept of counting, saving and spending, so it’s a good age to begin introducing your child to money.

According to Moneysmart, most children from the age of five understand the difference between ‘needs’ and ‘wants’.

Benefits of saving money at a young age

Saving money as a child could set your kids up for a more secure financial future, so it’s important to introduce them to good savings techniques from an early age. Understanding the value of money and how to budget will help them build better money habits and avoid getting into debt.

How to teach your child to manage money

1. Talk to them about money

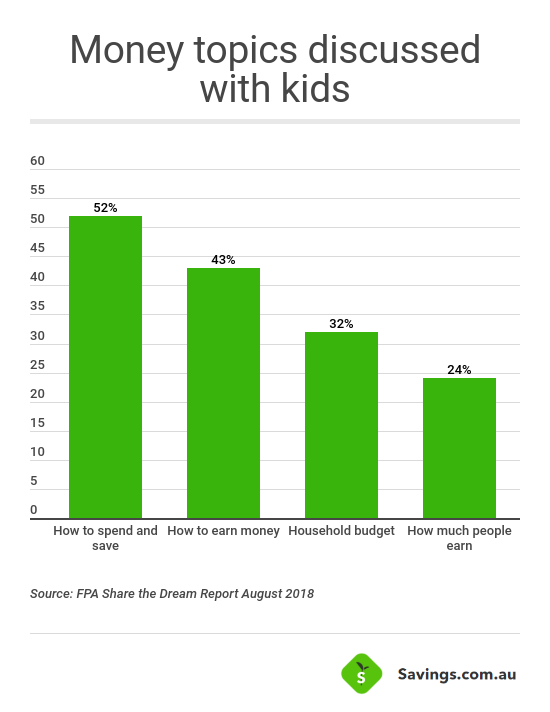

Money shouldn’t be a scary or taboo topic, yet for some reason, people really don’t like talking about it. Avoiding the topic of money may send the wrong message – that there’s something wrong or inherently shameful in talking about it.

You don’t need to schedule a five-hour lecture complete with a PowerPoint presentation on savings accounts right through to what on earth franking credits are. Just start off small by answering your child’s money questions at a level that’s age-appropriate.

Teaching younger kids about money through real life situations and examples will help them understand where money comes from and how it is earned. If you’re at the ATM for example, explain to them that the ATM holds the money you have made by working hard and saving, and that it’s not just a magical hole in the wall where free money comes out of, unfortunately. Explain to them that when you take money out of the ATM, that money is coming out of your bank account and that you’ll have less money to spend later because of that.

Involve your kids in discussions about the family budget. By explaining how much money your family has to spend each week and how that money is spent will help them understand the costs of family life. Explain to your kids how items are priced at the supermarket, and that you can get cheaper or more expensive versions of the same product. That is also an opportunity to explain how to shop around for something at the best price. You can get your kids to help compare prices for you and pick the cheapest one.

When you receive bills, explain to your kids that your internet connection costs money, and that a $250 electricity bill took you so many hours at work to earn that money. It may also, hopefully, make them think twice about leaving appliances running.

Talking to your kids about money is an ongoing dialogue, not a one-time conversation. As your kids grow, your conversations around money will change too.

2. Use clear jars to store savings

We all had traditional piggy banks growing up, but using clear jars to store your kids savings is probably better because unlike with money boxes, kids can actually see the money growing when it’s stored in a clear jar.

Barefoot Investor author, Scott Pape suggests using three clear jars: Smile, Splurge, Give.

- Smile: This is for saving up for something, like a special toy.

- Splurge: This is money that can be spent on anything, because you don’t want a tightwad for a kid.

- Give: You also don’t want them to become entitled brats, so this jar is for giving back to the community.

3. Open up a zero-fee, high-interest savings account

It’s never too early to open up a savings account for your child. Getting a bank account for the first time is an important financial milestone and a great opportunity to introduce your child to money concepts like earning, saving, and responsible spending.

Banks often attract little ones to their junior accounts by offering them a higher rate of interest than the rates their parents can get on their own accounts. But keep your paws off, parents! The Australian Tax Office (ATO) has very strict rules in place governing the funds that are being held in a child’s savings account, so you won’t be able to sneakily hide your savings in your kids account to take advantage of the high interest rate. Nice try…

Provider | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 5 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||||

Kids Saver | |||||||||||||

| 0 | 1000 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

| For customers aged 14-35 years | |||||||||||||

Future Saver Account ( < $50k) | |||||||||||||

| 0 | 0.01 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Life (< 30 years) (Monthly deposit) | |||||||||||||

| 0 | 500 | 1 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

Goal Saver

| |||||||||||||

Goal Saver

| |||||||||||||

4. Use fake money

It’s not as cruel as it sounds, I promise. If your kids are still really young, fake money (like Monopoly money) is a great way to teach young children about the value of money and how to manage it, without actually entrusting them with any of your own hard-earned cash.

That way, they can spend the money through you rather than having a bundle of real money to potentially lose without your supervision. Think of it as training wheels for the budding consumer.

5. Start pocket money early

It’s pretty hard for kids to grasp the value of money if they don’t do anything to earn the money they get given. Plus, using a pocket money system can be a great way to start the process of teaching money management to your kids.

The choice to give your kids pocket money can be a controversial one. Some parents are dead set against it, arguing that it creates a Pavlovian response that tells them the only reason they should bother lifting a finger is if they’re being paid.

Other parents say it’s simply teaching your kids that money is something you have to earn.

If you do give your kids pocket money, make sure they only receive it after they’ve actually completed tasks, like chores around the house. Otherwise, if you just give them a weekly allowance regardless of whether or not they’ve done anything to earn it, it will teach them absolutely nothing about the importance of having to work for your money.

6. Teach them the difference between needs and wants

When you’re a kid, the difference between needs and wants doesn’t exist. Of course you need that Hot Wheels truck and anyone would be crazy to suggest otherwise.

Unless you have an unlimited amount of money, it’s important to understand the difference between needs and wants so you spend your money wisely.

Ask your child what would happen if they spent your entire paycheck on toys one week, with no money left to pay for food or any of your other bills. Explain that even though everyone really wants the toys because they’re way more fun than paying bills or grocery shopping, you need to allocate some of your paycheck towards things you need – like food, shelter and electricity.

7. Delayed gratification

In a ‘buy now, pay later’ world, the concept of delayed gratification is a hard skill for most adults (including this one) to learn. But being able to resist the temptation to buy anything and everything that tickles your fancy is a pretty important skill to have in your arsenal.

Kids need to learn that if they really want something, they should wait and save up to buy it. So how do you teach them this skill? When you go into a store, tell them you’re only there to buy one specific thing and nothing for them. They’ll learn pretty quickly that going into a store doesn’t always mean you’ll buy something.

Or get them to save up for something, even if it is just for a Super Soaker to terrorise their brother with. They’re learning to delay gratification and save.

8. Give them a savings goal

As a kid, being told to save without explaining why seems pretty pointless. Helping children define their savings goal is a more effective way of getting them motivated to save. This could be an individual goal like a toy, or a goal for the whole family that your kid can contribute some money towards, like a holiday or a pet.

Once they know what it is they want to save up for, help them break down that savings goal into manageable bites. Say they want to buy a $30 board game and they get a $10 allowance each week. Help them figure out how long it will take for them to reach that savings goal, and encourage them to make contributions towards it whenever they can.

9. Let them make mistakes

If you constantly bail out your kids whenever they make a bad financial decision, they’ll never learn that their actions have consequences. If they’re saving towards a specific goal and blow all their hard-earned savings on a whim at the canteen, it’s a great opportunity for them to learn that once you spend your money, it’s gone.

Plus, it’s better for them to make mistakes like that now when they’re young and blissfully free of responsibility rather than later in life – which is exactly what pocket money is for!

10. Avoid impulse buys

“Mum, I just found this really cool Barbie doll. Can we buy it? Please?”

Sounds familiar right? Kids are really good at impulse buying, especially if it’s with someone else’s money.

Put your foot down and tell them they can only have it if they buy it with their own pocket money.

11. Lead by example

Kids notice way more than you may think, and they’ll watch and learn about money based on how you behave. So make sure you’re setting a good example and think about the money lessons you may be inadvertently teaching them based on your behaviours.

If you’re always telling your kids to save their pocket money while routinely blowing all your hard-earned savings at the pokies, you can be sure your kids are going to notice and potentially model that behaviour later in life.

Or, if you and your partner regularly argue about money, your child will begin to think about money as a bad thing.

Financial literacy activities for kids

- Use a clear jar for your kids to put their saving money into, so they can see the amount growing.

- Instead of just having one ‘savings’ jar, have three: ‘spend’, ‘save’ and ‘give’. Any time your child gets money, encourage them to split the money up between the three jars - this demonstrates basic budgeting.

- Help your kids plan their own birthday party by giving them a budget and letting them decide between needs and wants.

- If they’ve spent all their pocket money and want to buy something, don’t cave and buy it for them. Teach them that once the money runs out, there’s no more. This will teach them to live within their means.

- Lead by example. Kids absorb everything. If you use your credit card to pay for everything or constantly fight about money with your partner, your child will notice that.

How much pocket money to give?

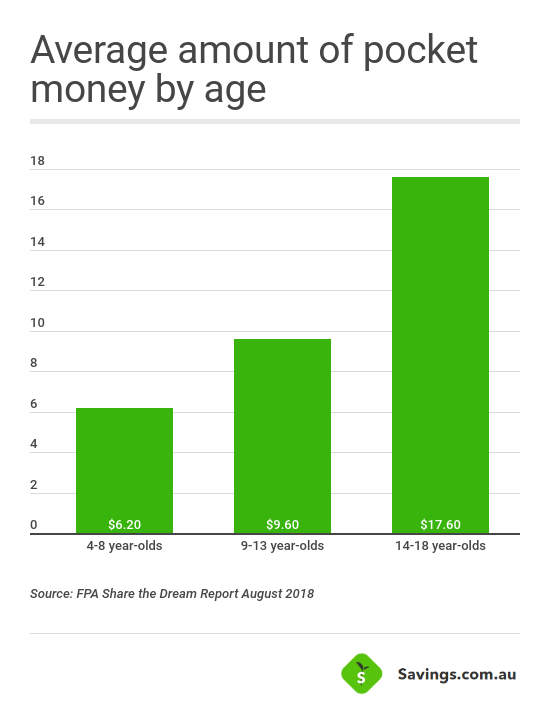

The amount of pocket money you give your child is different for every family, and it’s not something you have to do if your financial situation doesn’t allow for it. According to a report by the Financial Planning Association of Australia:

- Children aged 4-8 get $6.20 per week on average

- Children aged 9-13 get $9.60 per week on average

- Children aged 14-18 get $17.60 per week on average

- 28% of children don’t receive any pocket money at all

Savings.com.au’s two cents

Unfortunately, your kids are unlikely to be taught much about money in school.

The bottom line is this: there’s no magical fairy who’s going to teach your kids how to be good with money. Raising financially fit kids is your ultimate responsibility as a parent.

William Jolly

William Jolly

Alex Brewster

Alex Brewster