According to the Australian Bureau of Statistics’ National Accounts: Finance and Wealth data for the December 2018 quarter, household wealth (aka net worth) fell by 2.1% from the September quarter.

This is the biggest fall in household wealth since September 2011, and in dollar terms is a fall of $10,198 per household.

Last quarter, net wealth fell by $2,264 on average, marking the first time net wealth fell for two consecutive quarters since late 2011 also.

The average Australian household net worth is now $404,320.

This is the average figure, not the median, which means this figure is skewed somewhat by the extremely wealthy.

The median (considered to be a better representation) net wealth per adult in Australia is reported to be around $270,000.

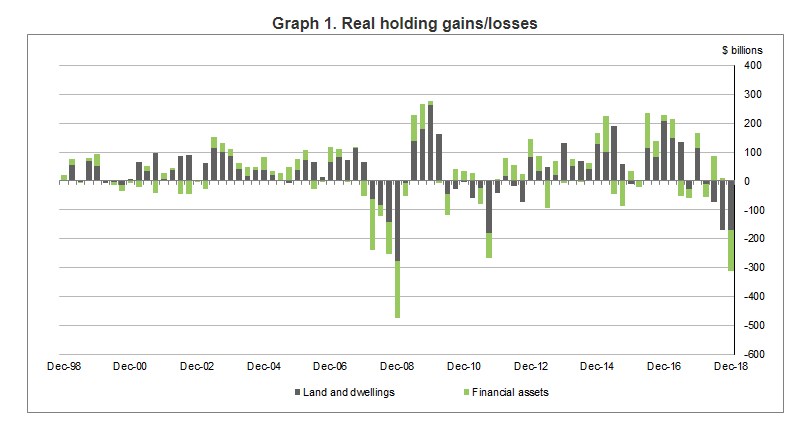

The ABS reports the household losses over the quarter

According to CoreLogic data, national dwelling values have declined by 6.8% since a peak in October 2017, with Sydney and Melbourne hit particularly hard – recording losses of 10.4% and 9.1% respectively.

Real losses on land and dwellings was $170.8 billion nation-wide, while losses on financial assets (superannuation, pension funds etc.) fell by $141.2 billion, reflecting falls in the Australian stock market.

Source: ABS

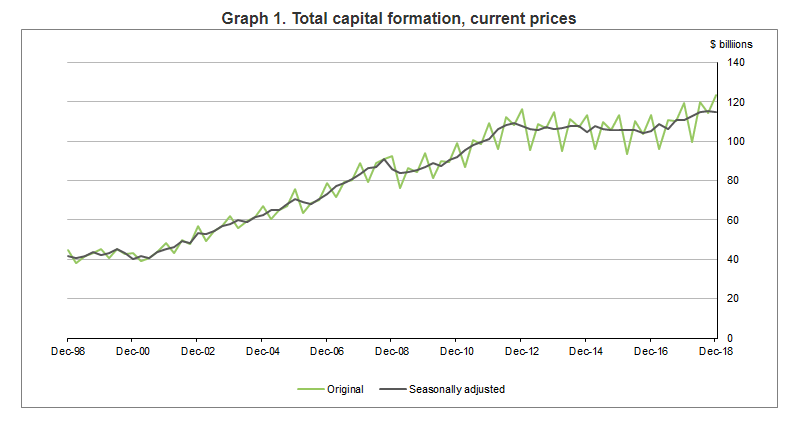

Investment grows

The data also shows Australians are taking matters into their own hands, with household investment reaching a record high.

National investment rose $9.2 billion in December 2018 to $123.5 billion, continuing the upward trend first started in September 2016.

Households invested $45.9b, up $3.2b from the previous quarter. The rest was investment by private, non-financial corporations.

Source: ABS

‘The wealth effect’ influencing spending?

Household gross disposable income fell 2.6% to $312.7b per household from $321.2b in the September 2018 quarter. Again, dwelling value losses and financial asset losses were the primary instigators.

The wealth effect is the change in spending accompanying a change in perceived wealth. When a person’s overall wealth falls – due to a drop in their house’s value or share portfolio, for example – the theory is that people save more and spend less.

The Reserve Bank on Tuesday downplayed the possibility of the wealth effect influencing spending at the moment.

Reserve Bank assistant governor Luci Ellis said the link between house prices and spending is a bit more subtle than the wealth effect theory suggests.

“It isn’t so much that people wake up one morning, realise their home is worth more, and decide to go out shopping – rather, if their home is worth more, they can borrow more against it, which matters for some people’s decision to buy a car,” Ms Ellis said.

“And because rising housing prices usually occur in the context of high rates of transactions in the market, spending on home furnishings tends to rise and fall with housing prices.”

Ms Ellis then said that fundamentally, the demand for housing rests on the household sector’s confidence and the capacity to take on financial commitments.

“Without enough income, and so without a strong labour market, that confidence and capacity would be in doubt. This is not the only reason we are watching labour market developments closely,” she said.

“But the nexus between labour markets, households and housing are crucial to our assessment of the broader outlook.”

For feedback or queries, email will.jolly@savings.com.au

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harrison Astbury

Harrison Astbury

Brooke Cooper

Brooke Cooper