The KPMG Full Year 2019 Results Analysis of the big four banks – who have all released their full 2018-19 results as of this week – found their mortgage market share contracted by 92 basis points (bps).

Across each of the big banks there was a decline in cash profit of 7.8%, which according to the report is due to “pressure on margins and increased remediation and regulatory costs”.

While the major banks did grow their mortgage books by a combined 1.8% in FY 2019 (financial year), this was below total system growth of 3.1%, indicating that mutual banks and non-bank lenders grew their loan books at a higher rate.

According to the report, the majors’ application volumes for home loans were impacted by system and process changes in response to the Royal Commission, with the process of borrowing becoming slower and “more onerous” thanks to tighter lending requirements.

“The changing competitor landscape, including the rise of international banks, challenger banks and non-bank lenders, is continuing to take residential mortgage market share out of the majors,” the report said.

“Our analysis has found that since 2013, the majors’ market share has decreased by 3.4% from 84.6% to 81.2%.”

The latest Quarterly ADI Statistics released by the Australian Prudential Regulation Authority (APRA) show the customer-owned banking sector has grown at a much faster rate than the big four.

According to the latest data for September, credit unions mutual banks and building societies grew their loan books by 7.8%.

Customer Owned Banking Association CEO Michael Lawrence said consumers want institutions that put their interests first.

“With growth rates like this it’s clear that word of our sector’s customer satisfaction scores, competitive interest rates and innovative services is spreading,” Mr Lawrence said in September.

“These figures are a positive indicator of improving competition, but now is not the time to become complacent. If greater customer outcomes are the goal, then greater competition is the means.”

The table below displays some of the sharpest variable home loan rates currently on offer across the big four banks, the top 10 customer-owned institutions and the larger non-banks:

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | LVR | Lump Sum Repayment | Additional Repayments | Split Loan Option | Tags | Features | Link | Compare |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

6.04% p.a. | 6.06% p.a. | $2,408 | Principal & Interest | Variable | $0 | $530 | 70% | Featured Online ExclusiveUp To $4K Cashback |

| |||||||||

5.99% p.a. | 5.90% p.a. | $2,396 | Principal & Interest | Variable | $0 | $0 | 80% | Featured Apply In Minutes |

|

The major banks have copped a fair few tongue lashings in the months that have seen a Reserve Bank rate cut, with criticism particularly levied at their defiance in passing on the RBA’s combined 75 basis point cuts in full.

Of the 75 basis point reduction in the cash rate in 2019, the majors passed on an average of 57 basis points, and Treasurer Josh Frydenberg isn’t happy about it.

In addition to announcing a new inquiry into bank mortgage pricing, Mr Frydenberg also encouraged borrowers to switch to smaller lenders such as Athena.

“We continue to put pressure on the banks and ultimately it is the customers who can vote with their feet and go to their bank, seek the best possible deal and if not, take the business elsewhere,” Mr Frydenberg told ABC’s 7:30 .

“It is a pattern of behaviour by the banks. When the previous government was in, there were 14 rate cuts and only five were passed in full.

“The banks have a lot of explaining to do. People should shop around, get the best deal and make their displeasure known to their banks.”

During October:

- Westpac and NAB cut variable rates by 15 basis points

- ANZ cut by 14 basis points

- Commonwealth Bank cut by only 13 basis points

Five smaller lenders passed on the rate cut in full.

“So, the big banks may have thumbed their nose at their customers but some of the smaller lenders have actually done the right thing,” he said.

But can banks keep pace with rate cuts?

Just how low rates will go in the coming months is unclear.

There are many prominent economists who expect the RBA to cut again to 0.50%, with some predicting this to occur as early as next month, while others are going as far as to predict negative interest rates in the not too distant future.

According to KPMG’s report, its economic forecast includes two further RBA cash rate reductions, falling to a low of 0.25% by mid-2020.

“Should these eventuate, how much will be passed through to borrowers is the great unknown, with recent experience showing the majors are unlikely to pass on in full, given their need to balance all stakeholder interests,” the report said.

“The combination of future rate cuts, the full year impact of this year’s home loan repricing, and with no appetite for retail deposit rates to fall below zero, the majors’ margins will continue to be squeezed.”

Commbank CEO defended his bank’s choice to not pass on full rate cuts to home loans, saying their deposit customers were equally as important as their home loan customers.

“This low rate environment creates challenges for our customers and for financial institutions,” he said.

“We very much recognise that customers who rely on interest payments from savings balances have seen this income decrease.”

Customer-owned banks also rely on customer deposits to keep their businesses afloat, perhaps even more so due to their smaller size – the largest mutual is CUA with $15.62 billion in total assets, compared to Commbank’s near $1 trillion.

Many smaller banks also failed to pass on the most recent cash rate cut in full, and as interest rates continue to fall, these smaller banks might also struggle to pass on sizeable home loan cuts, according to Firstmac CFO James Austin.

“Transacting with customer-owned banks is a double-edged sword. On the positive side, they typically represent either local communities or specific industries,” Mr Austin told Savings.com.auprior to October’s cash rate cut.

“However a negative is that the majority of customer-owned banks are small, relying almost entirely on customer deposits and transaction accounts for funding.

“A high portion of these deposits are already at a zero rate – they can’t reduce this cost of funding below zero.”

No end in sight for big bank profit squeeze

One of the most damning conclusions made in KPMG’s report is that the big bank’s behaviour unveiled during the royal commission could set them back years thanks to the impact of customer remediation programs on financial results.

“The ongoing effects of the majors’ customer remediation programs continue to negatively impact financial results, which are routinely called out as ‘notable items’ within their cash profits,” KPMG reported.

“There is a continued trend of re-allocating investment spend towards compliance, regulatory and customer remediation costs, forcing investment and resources away from enhancing technology and digitalisation priorities.”

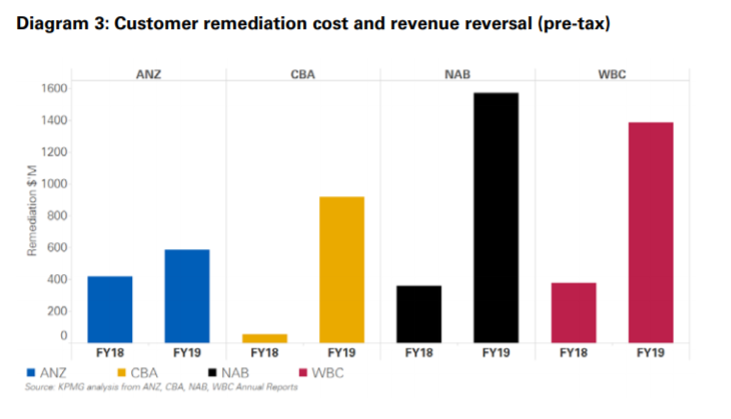

The graph below from KPMG shows just how much more the majors spent on customer remediation (aka compensation) this year compared to last.

“The cost and complexity involved in addressing previous misconduct is immense, with significant personnel time and program running costs required to investigate, address and ultimately calculate the financial impacts and customer repayments,” KPMG said.

“Given the ongoing nature of these remediation programs and the detailed reviews still being undertaken, there is potential that further provisions may continue to impact earnings into FY2020.”

This could be to the benefit of consumers however, as could the introduction of open banking, which was a prominent part of both KPMG’s report and a similar report from another major consultancy firm EY.

“Declining profits and margins have seen the banks cut dividends and preserve capital as they batten down the hatches and brace for further challenging conditions ahead,” EY’s Oceania banking and capital markets leader Tim Dring said.

“With the rapidly approaching introduction of open banking, the next few years will usher in changes that will fundamentally shift the Australian financial services landscape.

“The competitive landscape is set to benefit Australian consumers.”

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Brooke Cooper

Brooke Cooper

Denise Raward

Denise Raward

William Jolly

William Jolly