That’s according to research and consulting firm Digital Finance Analytics (DFA) which defines households as stressed when net income (or cash flow) does not cover ongoing costs.

DFA’s April 2019 mortgage stress and default analysis update revealed the number of households estimated to be in mortgage stress rose to a new record of 1,050,450 – up 5,784 from last month’s 1,044,666.

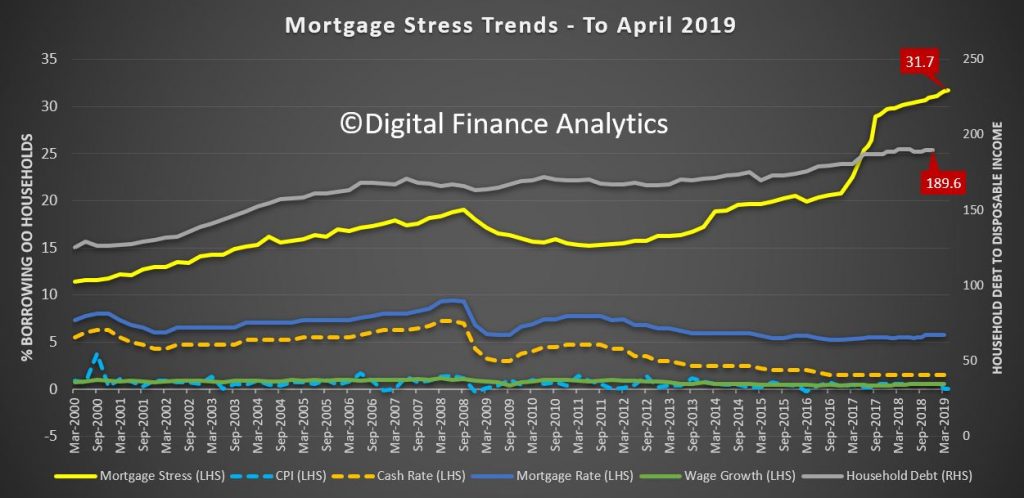

This equates to more than 31.7% of all owner-occupied borrowing households.

ource: Digital Finance Analytics

The number of those in ‘severe stress’, defined as having no leeway in their cash flows and being unable to meet repayments from their current income, rose to 30,413.

The DFA report put rising stress levels down to an “accumulation of larger mortgages compared to income whilst costs are rising, and incomes remain static”.

“Housing credit growth is still running significantly faster than incomes and inflation and continued rises in living costs – notably child care, healthcare costs, school fees and electricity prices are causing significant pain,” the report said.

“Many households are depleting their savings to support their finances or are trying to refinance.”

The new report comes after the Reserve Bank of Australia (RBA) held the cash rate at the historic low of 1.50% for the 30th month in a row yesterday.

The decision came as a surprise to a number of economists who had predicted the RBA would cut interest rates to 1.25%.

CoreLogic Head of Research, Tim Lawless said mortgage rates would reduce if the cash rate does move lower this year.

“Households who already have a mortgage, or prospective borrowers who are able to satisfy lender credit policies will be the winners if interest rates do fall later this year,” he said.

Getting on top of mortgage stress

DFA analyst Martin North said households should not ignore the signs.

“Trying to refinance to solve the problem often ends up just postponing the inevitable,” he said.

He recommends taking the following three steps to handle mortgage stress.

- Draw up a budget: See where the money is coming and going. According to DFA’s research, only half of households have any budget.

This means you can then make decisions about what is most important, and what can be foregone. Select and prioritise. - Talk with your lender: They have a legal obligation to assist in case of hardship. Many households avoid having that conversation, hoping the problem will cure itself. But in the current low-income growth, high cost environment, that’s unlikely. And rates are likely to rise at some point.

- Work out what would happen if mortgage rates rose: Pass that across your budget and examine the impact. Then you will know where you stand. Plan accordingly.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Brooke Cooper

Brooke Cooper

Harry O'Sullivan

Harry O'Sullivan

Hanan Dervisevic

Hanan Dervisevic