The positive market reaction has been attributed to improvements in credit availability and lower mortgage rates coupled with interest rate cuts and the Morrison Government’s tax breaks.

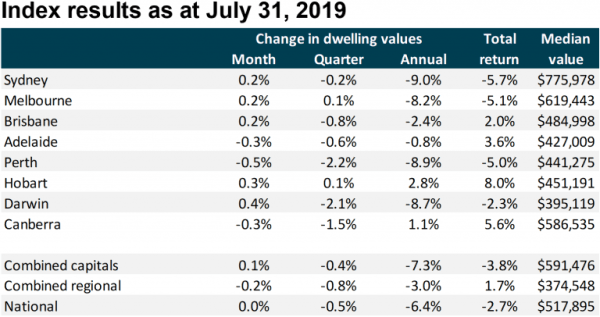

Sydney and Melbourne were the main drivers of the results, gaining 0.3% and 0.4% respectively in the past two months.

Brisbane values recorded a 0.2% rise in July, its first month on month rise since November last year.

Melbourne and Hobart were the best performing capitals over the past three months, both seeing a 0.1% increase in their dwelling values, while Perth was the weakest capital, with a decrease of 2.2%.

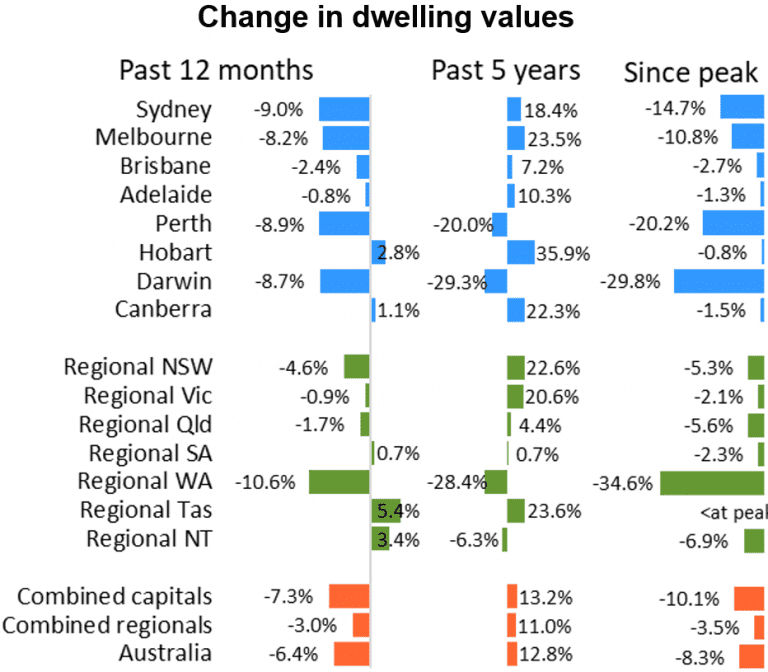

Source: CoreLogic Hedonic Home Value Index, July 2019 Results

Despite these results, Sydney and Melbourne house values remain 0.2% and 0.3% lower over the past three months respectively.

However, Melbourne unit prices were 1.1% higher over the three month period, while Sydney’s saw a minute rise (0.02%).

CoreLogic head of research Tim Lawless said the stabilisation of housing values is becoming more broad-based.

“Our national dwelling value index may have found a floor in July, with dwelling values holding firm over the month following a consistent trend towards smaller month-on-month declines through the first half of the year,” Mr Lawless said.

Although the trend towards recovering housing values is relatively fresh and centred within the largest cities, Mr Lawless said “there is no sign of a ‘v-shaped’ recovery”.

“The July home value index results provide further confirmation that the housing market has reacted positively to the recent stimulus of lower mortgage rates and improved credit availability, however the response to-date has been relatively mild.”

Mr Lawless said the stronger performance across the unit sector may be attributable to ongoing affordability challenges in Sydney and Melbourne.

“Values for higher density dwellings are generally lower, however we may see some dampening of unit values in coming months across those precincts where supply is elevated as the large number of high-rise off-the-plan apartment sales moves into the re-sale market.”

National rental market

Nationally, rents were down 0.1% in July, and 0.6% higher over the past year.

Hobart had the strongest increase in rental conditions, with a 5.5% increase in the last 12 months.

The highest rental yield over the past three months was Darwin at 5.9% while Sydney was the lowest at 3.4%.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Brooke Cooper

Brooke Cooper

Alex Brewster

Alex Brewster

Dominic Beattie

Dominic Beattie