This is where the amount owing on a homeowner’s mortgage is higher than the value of their home.

In its six-monthly financial stability review, the RBA warned that if the housing correction were to continue worsening, “the share of borrowers in negative equity would increase significantly”.

The RBA also warned that big price falls would see “a large share of household’s housing equity eroded or even turn negative”.

“Even then, negative equity need not be problematic for financial stability as long as the unemployment rate remains low and households continue to be able to repay their debt,” the RBA said.

Currently, the incidence of negative equity remains low, with just 2% of borrowers in that situation, according to the RBA.

The highest rates of negative equity are in Western Australia, the Northern Territory and Queensland. A combination of housing price falls coupled with low income growth and increases in unemployment have reduced the ability of borrowers to repay their loans.

However, the RBA noted that housing prices would have to fall “significantly further” for negative equity to become a widespread problem.

“Households are currently well placed to meet their debt obligations given low unemployment. Indeed, households have continued to make substantial voluntary repayments on their loans, albeit at a slower rate.”

The RBA said indicators of financial stress remain low outside mining-exposed regions, but the value of home loans in arrears has risen.

“With weak housing market conditions, borrowers experiencing difficulties making loan repayments find it harder to resolve their situation by selling their properties.

Australia’s personal wealth falls

As house values dissipate, so too does the personal wealth of Australians.

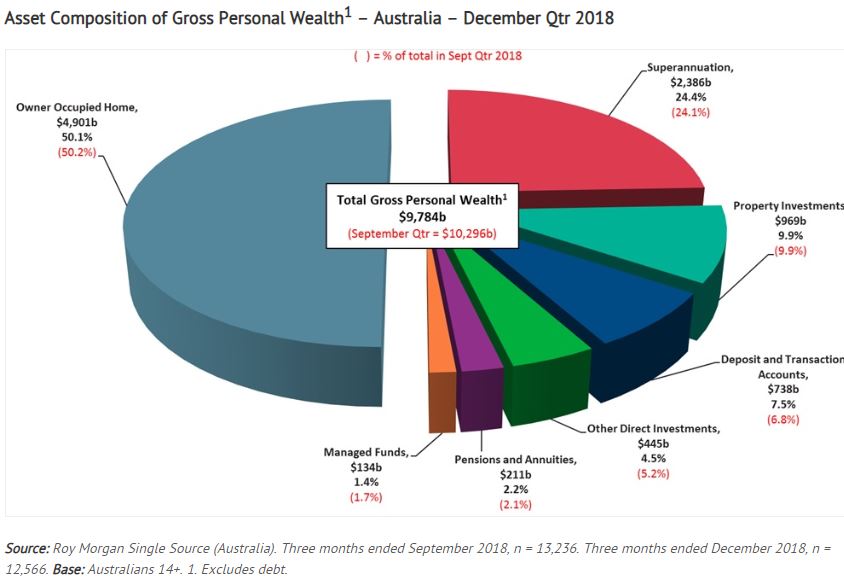

According to Roy Morgan research, owner-occupied homes shed $270 billion of their value during the December quarter.

Owner-occupied homes remain the key factor of personal wealth, accounting for half of Australia’s personal wealth, despite the major drop in property values.

Other major losses were seen with superannuation and pensions down $93 billion, while property investments fell by $54 billion, and ‘other’ down $95 billion.

Making up the ‘other’ were managed funds, other direct investments, and deposit/transaction accounts.

Roy Morgan Industry Communications Director, Norman Morris, said there’s a tendency to focus on the value of homes when looking at Australian’s personal wealth, despite the fact other assets account for half of the total gross assets of Australian households.

He believes the slowdown in the ASX in the December quarter had a major negative impact on household wealth – particularly on superannuation.

“This combined with falling house prices and the uncertainty around the coming federal election has the potential to further negatively impact household wealth.

“Despite the current mainly negative wealth environment, it is important to note that average gross household wealth still stands at over one million dollars and in fact, at $1.016 million it is 26% higher than it was five years ago,” Mr Morris said.

The RBA said any further falls in house prices would have adverse impacts on households’ wealth.

“Housing constitutes a large share of households’ wealth and further large declines in housing prices could cause households to pull back on consumption, particularly for those who are highly leveraged.

“This, in conjunction with falling dwelling investment, could add to rising unemployment. Such a scenario would have adverse consequences for financial stability to the extent that it increases households’ likelihood of default and the losses banks would experience in the event of default.”

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

William Jolly

William Jolly

Harry O'Sullivan

Harry O'Sullivan