In its meeting today, the RBA announced it would not be making a further change to the already record-low cash rate this month, following 25 basis point cuts in June and July.

This decision is not an unexpected one with markets pricing the chance of a cash rate cut at only 17%, while every economist polled by Bloomberg expected the cash rate to be held.

In his accompanying statement, Reserve Bank Governor Philip Lowe hinted at the possibility of future rate cuts, something that has already been predicted by a number of economists.

“It is reasonable to expect that an extended period of low interest rates will be required in Australia to make progress in reducing unemployment and achieve more assured progress towards the inflation target,” he said.

“The Board will continue to monitor developments in the labour market closely and ease monetary policy further if needed to support sustainable growth in the economy and the achievement of the inflation target over time.”

Mr Lowe also said the central scenario for the Australian economy is to grow by around 2.5% over 2019 and 2.75% over 2020.

“The outlook is being supported by the low level of interest rates, recent tax cuts, ongoing spending on infrastructure, signs of stabilisation in some housing markets and a brighter outlook for the resources sector.”

The #RBA has an explicit easing bias now....Unemployment rate expected to decline but only to 5% with "little upward pressure on wages". 2019 growth forecasts cut to 2.5% but still looking for 2.75% in 2020 #ausbiz pic.twitter.com/5dVyfSY0Kd

— Alex Joiner (@IFM_Economist) August 6, 2019

Stay up to date with the latest rate changes

SIGN UPHousing market benefiting from lower rates

CoreLogic head of research Tim Lawless said the lack of a cut this month gives the RBA time to “assess the effects of earlier rate cuts” on the economy and consumer spending.

“The housing market has been a key beneficiary of lower mortgage rates, with a trend towards stability over the first half of the year converting to a subtle rise in capital city housing values in July,” Mr Lawless said.

“The improvement in housing market trends can’t be attributed entirely to lower interest rates, there has also been the added stimulus of looser home loan serviceability assessments…as well as the confidence injection post federal election and tax cuts for low-income earners.”

Mr Lawless also said the housing market should move into a gradual recovery with mortgage rates set to remain low.

“However with credit policies remaining tight and economic uncertainty still elevated, we aren’t expecting a material acceleration in housing activity or housing values.”

Mortgage Choice Chief Executive Officer Susan Mitchell agreed, saying a third cut so soon wouldn’t give policymakers an idea if the cuts had any marked effect on the economy.

“The Reserve Bank’s decision to hold the cash rate steady this month was prudent,” Ms Mitchell said.

“While financial markets are expecting another 25 basis point cut this year, the important thing for borrowers and future borrowers alike to keep in mind is that interest rates are currently sitting at historic lows.”

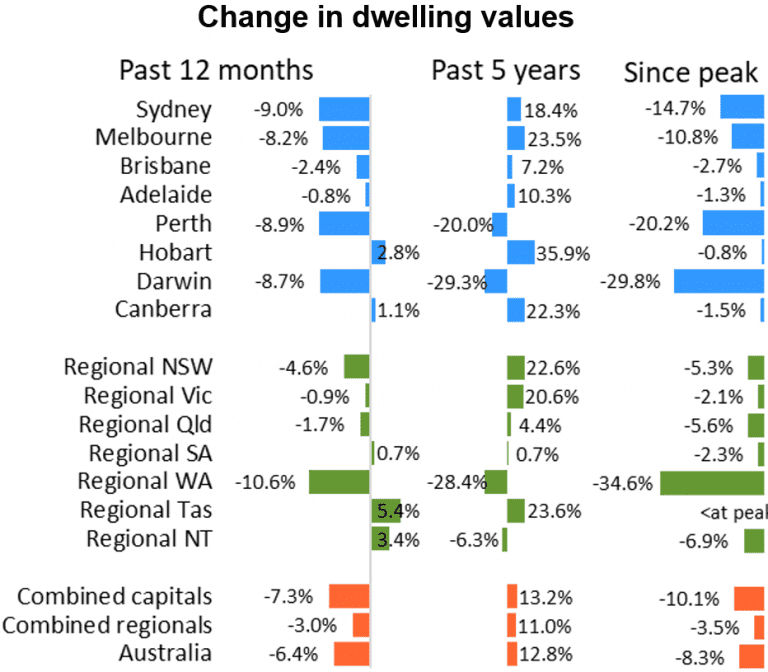

CoreLogic’s Home Value Index for July revealed national dwelling values had stabilised in five of the eight capital cities, with Sydney and Melbourne reporting 0.2% increases overall.

Source: CoreLogic Hedonic Home Value Index, July 2019 Results

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Brooke Cooper

Brooke Cooper

Harry O'Sullivan

Harry O'Sullivan

Alex Brewster

Alex Brewster