Considered to be the world’s largest and longest-running financial education and matched savings program, Saver Plus is expanding from its current 60 sites to a new, fully online model designed to better serve participants across the country.

The Saver Plus program’s aim is to help more people hit their savings goals, develop life-long savings habits, and receive up to $500 in matched savings to help pay for education related costs.

Since its inception in 2003, the Saver Plus program has attracted more than 57,000 participants who’ve saved more than $28 million.

How does the Saver Plus program work?

Saver Plus is a free 10-month savings program that provides financial education through ANZ’s MoneyMinded program.

Eligible participants set their savings goals for education related items, and must open an ANZ Progress Saver account. Participants are asked to save $50 a month over the 10-month period, which equates to $500.

After a participant completes the course and reaches their savings goal, the program will match them dollar for dollar, up to $500 to spend on education items (either for themselves or their children’s education expenses) such as a laptop, textbooks, uniforms, etc.

Over the course of the program, participants must also complete the required MoneyMinded financial education workshops.

Essentially, the program provides financial education, budgeting, and savings tips to people looking to meet a savings goal.

According to the Brotherhood of St Laurence’s Senior Manager of Financial Inclusion Claire Lindsay-Johns, programs such as this lead to better outcomes in people’s lives.

“One of the key impacts of Saver Plus is that it leads to a range of secondary outcomes for participants, such as: increased confidence and motivation to achieve goals; reduced stress levels; expanded social networks; enhanced education experiences; and increased employment opportunities,” Ms Lindsay-Johns told Savings.com.au.

The program is run by a number of institutions, most notably ANZ and the Brotherhood of St Laurence, and supported by the Australian Government Department of Social Services.

How is the $500 distributed?

While your own money that you save can be used at your discretion, any matched savings you receive must be used according to the Saver Plus program rules and the education-related goals you agreed with the Saver Plus Coordinator.

At the end of the savings period, the program will arrange for an electronic funds transfer (EFT) into your ANZ Progress Saver account. If you have closed your account, you can nominate another active bank account at another banking institution.

The process of distributing the $500 matched savings will commence in the month following your final deposit and upon contact made by the Saver Plus Coordinator to you.

Who can qualify for Saver Plus?

To participate in the program, an individual must meet the following requirements:

- Must be at least 18 years old

- Must have a current Health Care or Pensioner Concession Card and an eligible Centrelink payment

- Must be studying themselves or have a child in school (can be starting school next year)

- Must have a regular income from work (either themselves or their partners)

How does the program help?

According to ANZ, Saver Plus participants increased their financial wellbeing score by 77% to 64% on average. This is higher than the average Australian financial wellbeing score of 59%.

ANZ’s Head of Financial Inclusion Michelle Commandeur said the program helps people by encouraging active saving and learning resilience in the face of adversity.

“Concerns about money can vary significantly, and there are many reasons why people might be struggling from time to time. Having confidence and resilience through those times is really important,” Ms Commandeur told Savings.com.au.

“We have learned through our research that financial wellbeing is not all about knowledge and information (financial literacy), or even income!

“We can significantly improve our financial wellbeing through key behaviours like active saving and not borrowing for everyday expenses.”

The Saver Plus savings tips

Most of the advice parroted in the media is centred around things like ‘cut out daily coffees’ which may not be all that useful to someone who’s struggling financially, as there’s a good chance they already forgo such things.

According to Ms Lindsay-Johns, cutting out coffee might be one way of saving money, but for the kind of people they talk to in their programs, the best approach is to review your spending as a whole and understand where the money is going.

“Savings tips and budgeting can seem overwhelming but it doesn’t have to be,” she said.

“Small changes do really add up in this instance!”

Here are her six tips on sticking to a savings goal for people who are struggling:

Start small

“Track and review your spending and identify any ‘spending leaks’ – i.e. what are small savings you can make each day /week/month to free up a small amount of money that can be redirected to savings,” Ms Lindsay-Johns said.

“This might be buying a coffee or two less per week, cooking dinner instead of having takeaway, shopping on days that shops have their specials available, buying and cook and freeze meals in bulk.”

Pay down high-interest debts first

“Pay down high-interest debt such as credit cards and shop around for better deals on utilities and other services you use,” Ms Lindsay-Johns said.

The strategy of paying off the debts with the highest interest rate first is known as the avalanche strategy.

Another useful strategy – the snowball method – involves paying off the smallest debts first to help build momentum.

Put a budget in place

There are many apps and great tools that can help you. Have a look at ASIC’s ![]() Home - Moneysmart.gov.au

Home - Moneysmart.gov.au

Some of Australia’s most popular budgeting and savings apps include the likes of Frollo, Goodbudget and Raiz, which is also a micro-investing app.

Set small, specific and achievable goals

“Start with something small and keep reassessing those goals as you achieve them,” Ms Lindsay-Johns said.

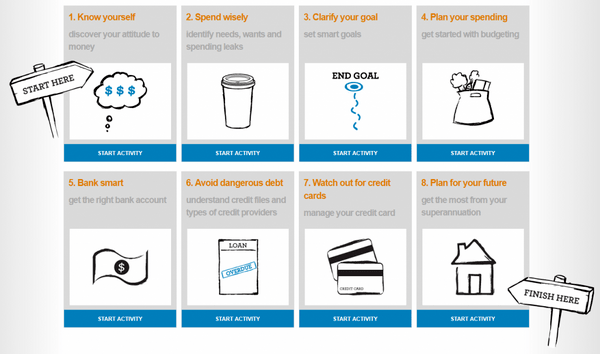

Do the eight activities at moneyminded.com.au

“These will help you learn easy and practical strategies to manage your money including budgeting, debt reduction and saving for the future,” Ms Lindsay-Johns said.

Source: moneyminded.com.au.

Get help

“There are lots of organisations out there who can assist depending on what you need assistance with,” Ms Lindsay-Johns said.

“These include community legal centres and financial counsellors through to programs such as MoneyMinded, Saver Plus, NILS and Step Up.”

Advertisement

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest interest rates on the market.

Provider | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 4 | 0 | 0 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

| FEATURED | High Interest Savings Account (< $250k)

| ||||||||||||

High Interest Savings Account (< $250k)

| |||||||||||||

| 4 | 0 | 0 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

| FEATURED | Savings Account (Amounts < $250k)

| ||||||||||||

Savings Account (Amounts < $250k)

| |||||||||||||

| 0 | 1000 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

| FEATURED | Saver Account (<$250k)

| ||||||||||||

Saver Account (<$250k)

| |||||||||||||

| 0 | 200 | 0 | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | More details | |||||||

| No monthly fees | Save Account

| ||||||||||||

Save Account

| |||||||||||||

Image provided by ANZ

Brooke Cooper

Brooke Cooper

Harrison Astbury

Harrison Astbury