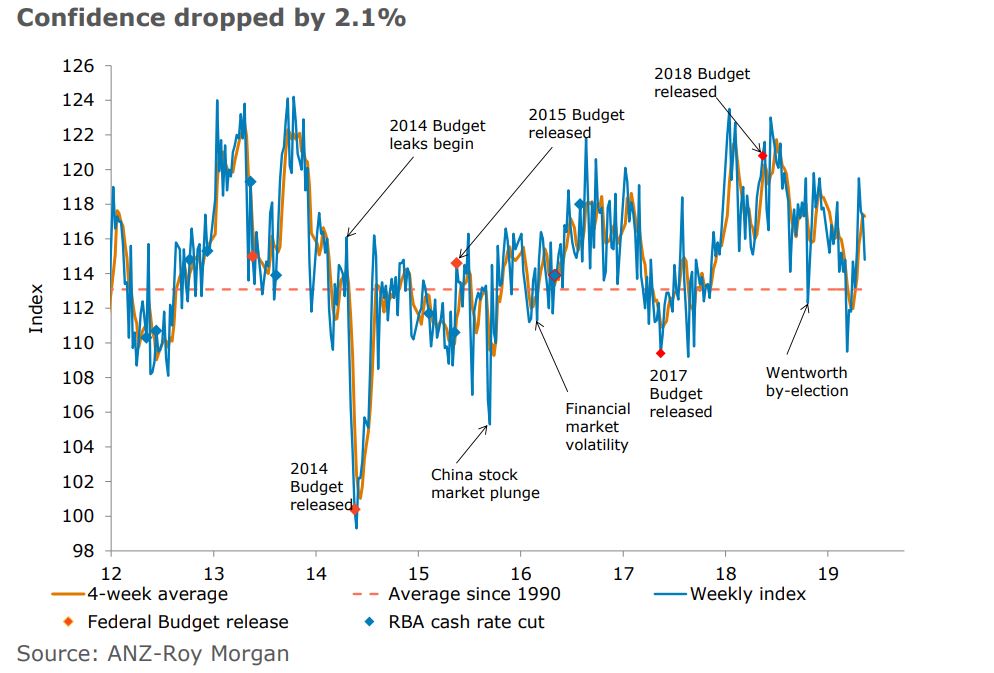

The ANZ-Roy Morgan Consumer Confidence index slid 2.1% from the previous week, with “the time to buy a household item” falling by 2.5%.

Consumer’s views of current economic conditions plummeted by a massive 8.1%, while there was a 3.5% drop in confidence over future economic conditions.

Despite the sharp fall, there was an uptick in how people felt about their current finances (up 2%) while consumer confidence about their future finances lifted 1.4%.

ANZ Head of Australian Economics, David Plank, said the fall in consumer sentiment follows recent important developments, including the RBA’s decision to leave interest rates unchanged after “considerable” speculation that an interest rate cut might occur.

“Consumers see these events as more damaging for overall economic prospects than their own finances,” he said.

“After a period of weakness, inflation expectations jumped to 4.5% for the week, pushing the four week moving average to 4.2% – its highest level since the end of January.

“The uptrend in petrol prices over the last few weeks may have supported inflation expectations,” he said.

The Westpac-Melbourne Institute Index of Consumer Sentiment, out today, rose by 0.6% to 101.3 in May, up from 100.7 in April.

Westpac Chief Economist, Bill Evans said consumer confidence seems to be up despite the RBA’s decision to leave the cash rate unchanged.

“Despite the Reserve Bank ultimately deciding not to cut the cash rate at its May Board meeting, it is likely that households are much more confident this month than previously that interest rates are likely to come down further. Media coverage both pre and post the Reserve Bank decision is pointing strongly to eventual interest rate relief,” he said.

It follows figures from Digital Finance Analytics (DFA) showing a combination of falling property prices, stagnant wage growth, rising cost of living and increasing levels of debt have pushed household financial confidence to its lowest level since the survey began in 2013.

Principal Adviser at DFA, Martin North, said the findings of the survey were “quite significant” in the lead up to the election.

“In the context of the upcoming election we think this is quite significant because clearly household financial confidence is going to be a driver in many cases of people’s decisions when it comes to the ballot box,” he said.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Dominic Beattie

Dominic Beattie

Hanan Dervisevic

Hanan Dervisevic