A survey sponsored by Australia’s first super fund for women, Verve Super, says millennial women are in for a rude awakening come retirement.

Over 85% of millennial women say they want to be financially independent in retirement, but 73% say the system is stacked against them and hasn’t been designed to support women.

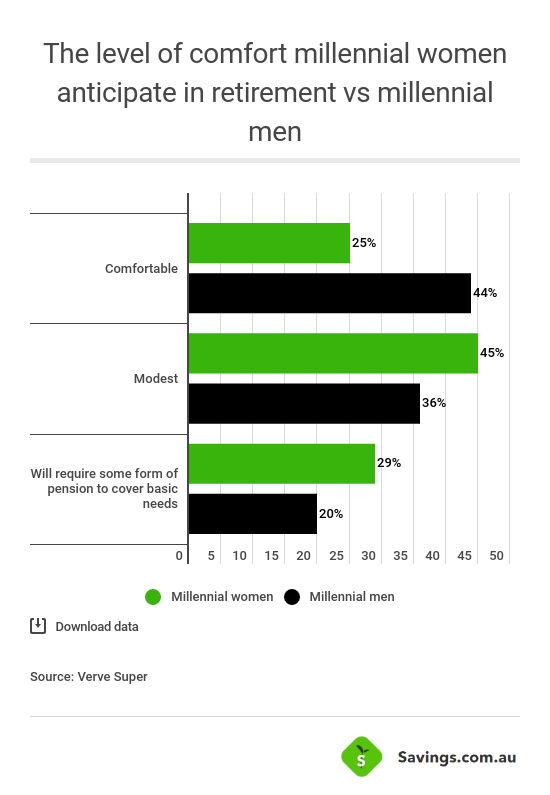

Because of that, only one in four millennial women think they’ll be able to live comfortably in retirement, while one in three is expecting to have to rely on the age pension.

Co-founder and CEO of Verve Super, Christina Hobbs says millennial women have grown up with a strong expectation of financial independence, but they will be forced to confront the realities of a retirement system that was “never designed to support women to retire comfortably and independently”.

“Compared to the generations of women before them, millennial women have grown up with a strong expectation of financial independence. They have been taught from a young age not only to believe that they can do whatever their male peers can, but that they will receive the same professional opportunities and rewards.

“This is a generation that has wholeheartedly embraced the mantra that ‘a man is not a financial plan’.

“As this study shows, millennial women do not want to rely on the government, their parents or their partners for financial security.

“The problem is, Australia’s superannuation system was never designed for women to retire comfortably and with financial independence. Instead, our superannuation system relies on an implicit assumption that women – who undertake two-thirds of unpaid care in Australia – will be able to retire comfortably reliant on a partner’s income.”

Ms Hobbs said the results of the study should be a “clarion call for our federal politicians to elevate women’s retirement outcomes to the forefront of the superannuation reform agenda”.

“The super balances of millennial women are already lower than their male peers and this will continue to grow unless the system is significantly reformed.

Photo by Ayo Ogunseinde on Unsplash

“Tinkering at the edges of superannuation policy will not be enough. Bold reform of superannuation and retirement policy is needed to support millennial women, and women of all generations, to retire comfortably and independently.”

According to the Associate of Superannuation Funds of Australia (ASFA), a single woman should have $545,000 in super to live comfortably in retirement.

The average women approaching retirement actually has $96,000 in super – 73% less than the average man who has a balance of $166,000, according to ABS figures.

“As a result of Australia’s retirement inequality, single women are more likely than other household types to be reliant on the full aged pension as their only source of income and are at the greatest risk of persistent poverty… elderly single women are now experiencing the fastest-growing rates of homelessness in Australia,” Ms Hobbs said.

Close to one in three millennials (29%) said they believe they will retire into poverty and require government support to cover basic needs, like housing, electricity and food.

How superannuation is failing millennial women

The findings of the study show that millennial women are more disillusioned with Australia’s superannuation system than any other generation before it.

Over half of millennial women (55%) are disillusioned with the superannuation system compared to just 33% of Baby Boomers. While Australians of all ages agree the retirement system is stacked against women, millennials feel this most acutely (73%) compared to a national average of 67% for women and 59% for men.

Even though millennial women have embraced the mantra “a man is not a financial plan”, over 30% said they anticipate having to rely on their partner’s superannuation in retirement.

Ms Hobbs said these fears are well-founded because the system magnifies the economic inequalities women experience throughout their lives.

“There is currently no reward for unpaid caring labour or compensation for the life-long pay inequality that women face. As a result, women are retiring with close to 40% less super than men.

“Not only are women typically retiring with less than men, but women are also living longer. This means women will spend more years of their lives in retirement, and so they must target a higher level of savings than men.

“The system implicitly assumes that women will be able to benefit from the superannuation balance of a male partner to retire comfortably. Yet, this assumption simply does not match modern-day family structures or the expectations of Australia’s millennial women,” Ms Hobbs said.

“It doesn’t need to be like this”

Ms Hobbs said one of the most striking findings from the study is that most Australians believe the superannuation system is not designed to support women.

“It doesn’t need to be like this, and it shouldn’t be. Australia is one of the wealthiest countries in the OECD yet has some of the highest rates of elderly people living in poverty.”

Natasha Janssens, financial adviser and founder of Women With Cents told Savings.com.au opening up a dialogue about the issue can help fix the superannuation gap.

“Raise awareness of the issue and help families shift the conversation of cost of childcare being a woman’s expense to being a parent’s expense. A 25-year-old woman earning $60,000 a year will lose roughly $170,000 in super if she takes five years out of the workforce in her 30s and as much as $400,000 if she takes 10 years out between the age 30-40.

“These are significant numbers, and at the moment women aren’t making financial decisions based on all the information.”

Ms Janssen said there are many ways women can improve their retirement outcomes.

“Simple things such as increasing their super contributions while they are working and taking advantage of available government incentives and tax deductions can go a long way.

“Also, splitting super contributions with their spouse now, rather than doing it if they happen to get a divorce. Given that a stay at home mum is contributing to the household just as much as a working father, then it is only fair that a portion of his employer super guarantee contribution is split into her super account.”

Ms Janssen said women should look for a super fund that is transparent with how it invests your money.

“If you call your super fund you should be able to receive a clear and direct answer as to specifically which companies or which assets your money is invested in.

“For example, if you hold Australian or international property, do you know precisely which property it is you part own? If you own Australian shares – which companies?” she said.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!