Westpac Chief Economist Bill Evans said on Thursday that the major bank now expects the Reserve Bank to cut the cash rate by 25bps (basis points) in both August and November this year.

This would leave Australia’s already historically low cash rate at a mere 1%.

According to Mr Evans, Westpac’s revised growth, inflation and unemployment forecasts now make a “convincing case” for lower rates.

“Since the last rate cut in August 2016 Westpac has consistently held the line that the RBA cash rate would remain on hold for the foreseeable future (a standard 2-3 year window),” Mr Evans said.

“That has been despite markets, the RBA and most economists expecting higher rates.”

Mr Evans wrote in Westpac’s release that Westpac had cut its GDP growth forecast for this year and next from 2.6% to 2.2%.

“With the slower growth

“That makes a strong case for official rate cuts to cushion the downturn and, in turn, meet the RBA’s medium-term objectives.”

The Reserve Bank repeatedly said last year the next rate movement would be up, not down, but broke this mantra last month by saying there was a possibility of an upcoming rate cut.

RBA Governor Philip Lowe said at the time:

“Over the past year, the next-move-is-up scenarios were more likely than the next-move-is-down scenarios. Today, the probabilities appear to be more evenly balanced.”

Bill Evans said this change of tune from the RBA was “profoundly important”.

This prediction capped off a busy day for Westpac, after it was announced they are on the receiving end of a class-action lawsuit for failing to meet their responsible lending obligations.

What does a lower cash rate mean?

If passed down by lenders, a reduced cash rate can have a significant impact on customer’s dollars.

Westpac is predicting a 50 basis point reduction in the cash rate – this could mean certain lenders reduce their own interest rates by the same.

This is good news for home loan customers – on a $500,000 home loan, an interest reduction from 4% p.a. to 3.50% p.a. could save someone as much as $40,000, or about $130 a month.

But it’s bad news for deposit holders.

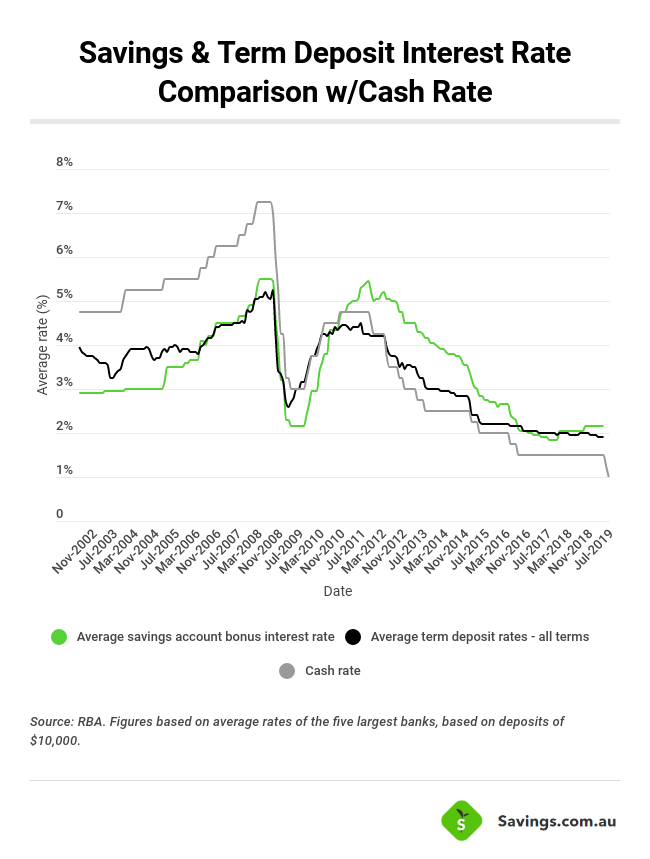

Savings accounts and term deposit rates are already extremely low as it is, with the latest RBA data showing the average term deposit rates across the five largest banks are:

- One month: 1.40% p.a.

- Three-months: 1.85% p.a.

- Six-months: 1.90% p.a.

- One-year: 2.15% p.a.

- Three-years: 2.35% p.a.

On a three-year term deposit, that 2.35% interest rate could fall to 1.85% p.a. – below the rate of inflation.

The highest three-year interest rate on term deposits at the time of writing (22 February) is 3.00% p.a.

If reduced to 2.50%, the interest earnt on a $10,000 deposit could fall from $900 to $750.

A $50,000 deposit could see you lose $750 in interest.

The cash rate is heavily linked with term deposit and savings account interest rates, so savers might have to look elsewhere for decent returns if Westpac’s prediction comes true.

Harry O'Sullivan

Harry O'Sullivan

Brooke Cooper

Brooke Cooper

Harrison Astbury

Harrison Astbury