There is currently $1.5 billion of unclaimed money sitting in government coffers, and it belongs to ordinary Australians like you and me.

This isn't just about coins slipping between couch cushions. It's substantial amounts – like forgotten bank account balances or life insurance proceeds.

That money was, at some point, inadvertently 'lost', but not through misplacement or mismanagement. Rather, it was left untouched for long enough to be transferred to the national 'lost and found' department: The Australian Securities and Investments Commission (ASIC).

Curious if you have unclaimed money?

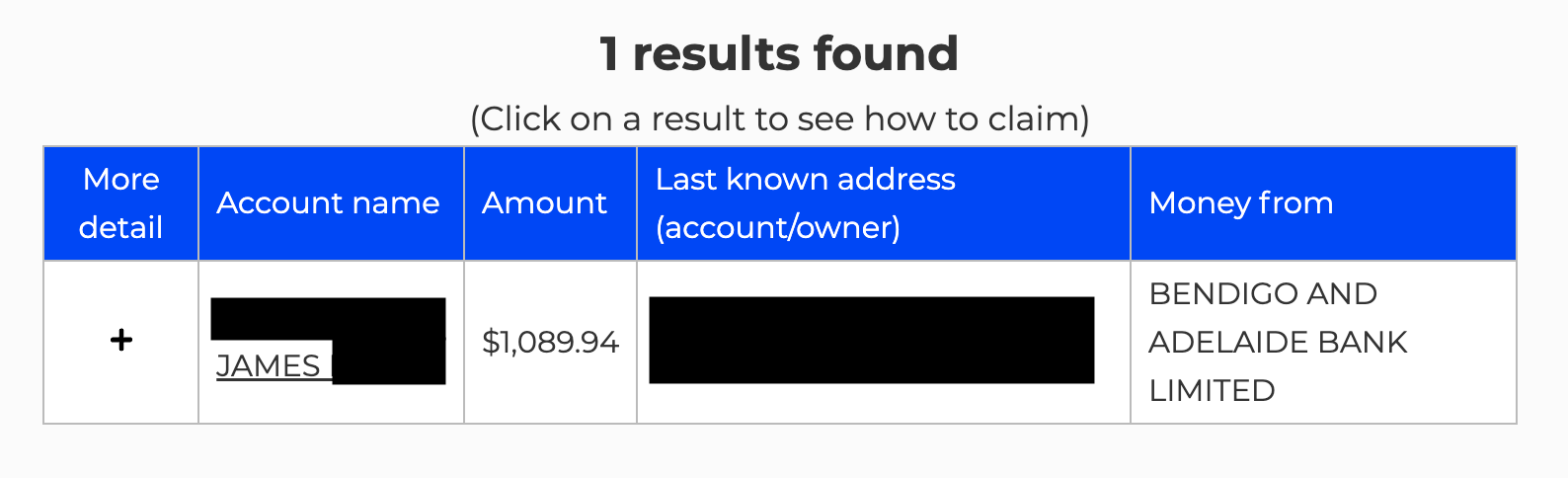

I personally checked the ASIC database and didn't find anything under my name. However, I did discover over $1,000 lost by a relative, so it might be worth taking a moment to check on MoneySmart.gov.au .

And hey, James – if you're reading this, it’s time to claim your money from that old Bendigo Bank account. Drinks on you next time!

Image source: ASIC MoneySmart

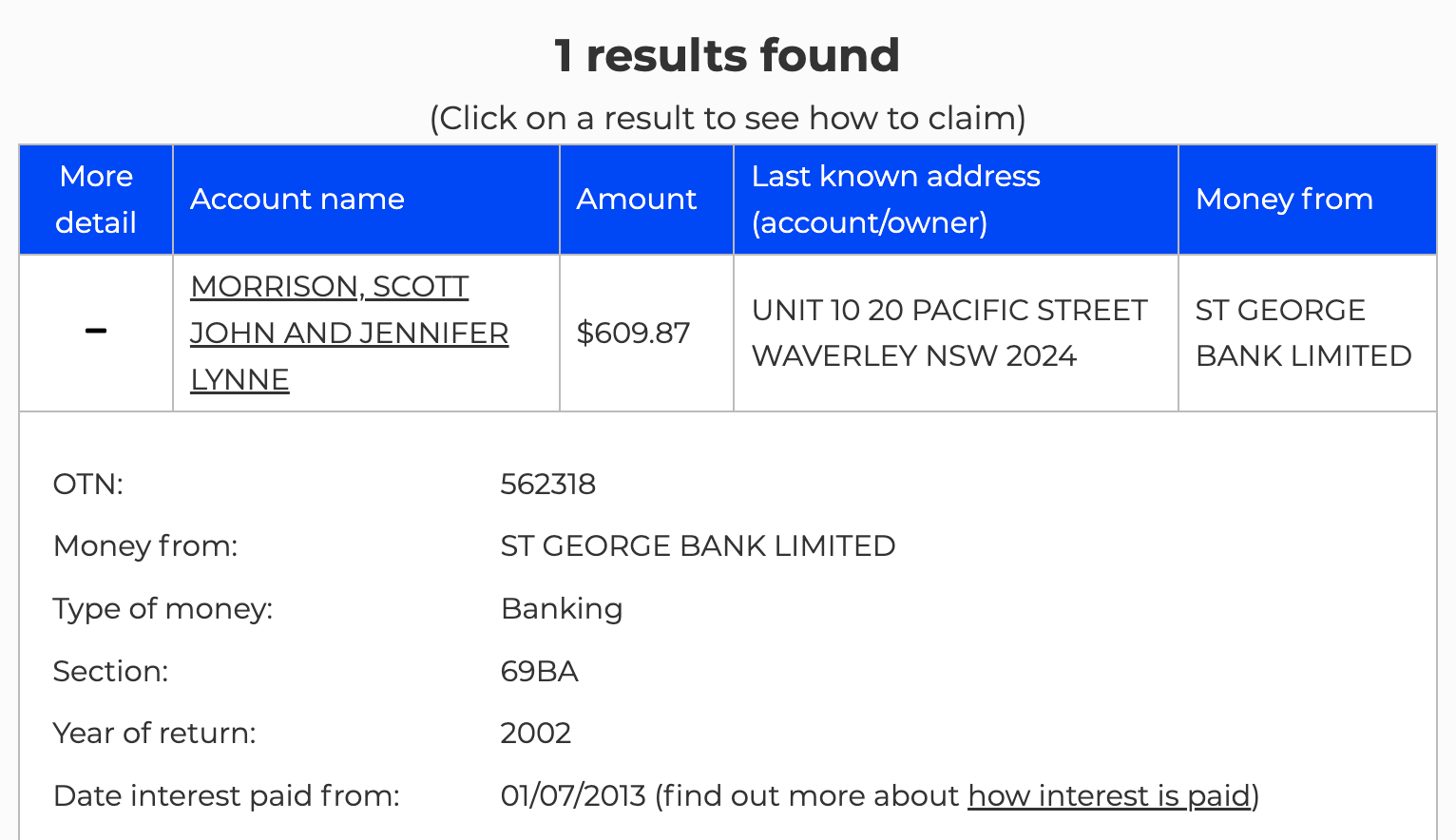

But it’s not just ‘ordinary’ Australians who have lost track of cash. There are some famous people to be found within lost money registers too.

A Queenslander by the name of Clive Palmer – not necessarily the mining magnate, once-politician, and infamous lots-of-money-haver – had around $230 handed in by Westpac over thirty years ago.

Meanwhile, former Prime Minister Scott Morrison and his wife Jenny appear to have lost $610 in an old St George Bank account.

Image source: ASIC MoneySmart

But what exactly is ‘unclaimed money’? How do you know if you have any? And how can you claim it? Keep reading to find out.

What is unclaimed money?

Australians may lose track of money in superannuation accounts, deceased estates, unclaimed share dividends, salaries, cheques, over-payments, and proceeds from sales, to name just a few avenues of misplacement.

This money can get lost when you change bank accounts, move houses and forget to change your address, or simply stop logging into an investment portal.

If an account or policy has been inactive for seven years or more, it's generally deemed ‘lost’.

For example, if you opened a new bank account for a special savings goal and over the years to come, you simply forgot about it, it could be considered unclaimed and its contents transferred to ASIC. From there, ASIC may have then transferred the money to the Commonwealth of Australia Consolidated Revenue Fund.

Lost funds can also end up in state revenue offices. This is typically the case with unclaimed proceeds of deceased estates or business liquidations, for instance.

There is no ceiling for the amount of money that can be considered unclaimed.

As of 2024, one lucky person from Box Hill, Victoria has $880,000 in unclaimed money while a Queensland resident is yet to claim more than $1.3 million from a deceased estate.

Check out these market-leading savings account rates

Have you found some missing cash? Or maybe you’re just searching for a safe place to store spare funds.

We’ve complied some of the market’s top savings account interest rates. Check them out below.

Unclaimed super is even more rampant

It isn’t uncommon for people to lose their super, either.

Modern mechanisms make it harder for Aussies to lose track of their retirement savings entirely, but the accidental abandonment of superannuation funds still occurs.

The Australian Taxation Office (ATO) held more than $16 billion of lost or unclaimed super as of mid-2023.

While the majority of Aussies who have collected super hold just one account (77%), around 4 million of us have two or more.

Typically, those who end up with more than one account do so after starting a new job and opening a new super fund, perhaps without realising they still had funds in their old account.

They might have also changed their name or their address (or both), making it harder for a super fund to contact them about their balance.

In such cases, the balance of the original account will likely slowly drain to $0 as fees chip away at it while it goes without replenishment.

Across the states and territories, the amount of missing accounts or unclaimed funds as of 2023 was:

|

State or territory |

Number of lost or unclaimed accounts |

Total value of lost and unclaimed super |

|

ACT |

29,343 |

$231.2 million |

|

New South Wales |

722,786 |

$3,468 million |

|

Northern Territory |

35,278 |

$160.9 million |

|

Queensland |

503,718 |

$1,952.3 million |

|

South Australia |

123,548 |

$798.1 million |

|

Tasmania |

34,858 |

$134.7 million |

|

Victoria |

489,398 |

$2,272 million |

|

Western Australia |

263,520 |

$1,295.5 million |

|

Invalid |

20,523 |

$514.9 million |

Source: ASIC

Guide to finding lost funds

You might’ve noticed a couple of screenshots of particular sums of unclaimed money throughout this article.

These are from the ASIC’s MoneySmart online unclaimed money search tool, which allows you to search for any name, including yours!

Depending on what state you’re in, you can also search your relevant state revenue office or public trustee, which might list other forms of lost cash:

-

New South Wales: Revenue New South Wales

-

Victoria: State Revenue Office

-

Queensland: Public Trustee

-

Western Australia: Department of Treasury

-

South Australia: Department of Treasury and Finance

-

Tasmania: Public Trustee

-

Northern Territory: Territory Revenue Office

It might also be worth checking revenue offices in states you’ve lived in previously, or even just visited for a decent length of time. Who knows what you might have left behind in the move!

How to claim lost money in Australia

If you search a database and find a result featuring yourself, then making a claim is pretty straightforward.

The search result will offer something called an Original Transaction Number (OTN), which is unique to each unclaimed money record, as well as instructions on how to claim the cash.

Make sure to write the OTN down as you’ll need it when staking your claim on the money.

The process to claim lost funds will differ depending on where they originated from.

For example, to claim his money from that Bendigo Bank account, James will need to do the following:

-

Record the OTN

-

Confirm the bank details and find out which branch (if any) he needs to contact

-

Contact the bank to begin the claims process

-

Provide them with any relevant documents

-

If the bank determines he is the rightful owner of the funds, it will notify ASIC which will release the money to him

-

Wait patiently for the money to land in his pocket

If you have unclaimed shares or dividends, however, you’ll instead need to download ASIC’s How to claim your money form and send it to ASIC, which will process the claim for you.

Don’t worry if this seems complicated. It’s all spelled out for you when you identify lost funds that belong to you.

You can also find more detailed information on how to claim lost shares, insurance money, bank accounts, and dividends on ASIC’s website.

How to find lost super

To find lost superannuation, you might want to use ATO’s online services via myGov.

By completing the following steps you could find any forgotten superannuation accounts held in your name:

-

log in or create a myGov account

-

link your myGov account to the ATO

-

select 'super'

-

select 'transfer your super'

-

You should now be able to consolidate all super into a single fund

The ATO also offers a ‘super health check’, which can help Aussies to find and consolidate lost super balances.

It also has a phone line Aussies can turn to and a paper form that can be lodged to initiate a request for help.

These days, super funds are required to report and pay inactive low-balance accounts to the ATO, which makes it easier for you to find these funds and choose which account they should go into.

Does unclaimed money earn interest?

Yes, interest is paid on most unclaimed funds held by ASIC, but only from mid-2013. Before then, no interest was paid on lost funds.

Importantly, those who find lost money don’t have to pay income tax on the interest earned while the funds were missing.

Not all missing money will be accruing interest, though. If your missing funds were derived from a company gazette or the deregistering of company trust money, you won’t be paid interest.

That’s because, in the case of the former, the company would have sent your details to ASIC but not the money itself and, in the case of the latter, the money is not technically unclaimed.

Here are the interest rates those claiming lost funds might expect to realise:

|

Financial year |

Interest rate |

|

2013-14 |

2.5% |

|

2014-15 |

2.93% |

|

2015-16 |

1.33% |

|

2016-17 |

1.31% |

|

2017-18 |

2.13% |

|

2018-19 |

1.9% |

|

2019-20 |

1.33% |

|

2020-21 |

2.19% |

|

2021-22 |

1.11% |

|

2022-23 |

5.09% |

|

2023-24 |

7.02% |

Source: ASIC

How can you make sure you don’t lose track of your money?

While there’s no time limit on claiming lost money and it’s safely held by government coffers during its hiatus, you should still avoid losing track of it in the first place.

Especially as some of the amounts listed on the register are huge – coming in at millions of dollars!

Losing track of an entire bank account or a share portfolio could mean the loss of thousands for several years.

Make sure you do the following simple things to avoid your money going onto the unclaimed money register:

-

Make at least one transaction to, from, or within bank accounts you wish to keep open once every seven years

-

Make sure you update your details whenever you change address, change your phone number, change email address, and especially if you change your name

It might also be worth keeping a record of any and all the places you store your money, whether that be in multiple different bank accounts, superannuation funds, share trading platforms, or somewhere else.

There are some budgeting apps that can help you do this. You can also check out our ultimate guide on budgeting and saving for more info on how to keep track of all your money.

Savings.com.au’s two cents

Life can get busy, and when it does it’s easy to lose track of a few dollarydoos here and there.

After all, we’ve all been guilty of putting something valuable in a ‘safe place’ only to forget where that safe place was.

Perhaps you stored a grand in an old bank account, you opened a now-ancient super account in your job-hopping days, or you missed the memo on a deceased relative’s estate – if you’ve lost cash somewhere, you’re not alone.

Hundreds of thousands of people have ownership of some amount of unclaimed money in government coffers around the country.

We’re all about being smarter with our money here, so wouldn’t it make sense to do a quick search of unclaimed money registers to see if you’ve missed anything?

And once you’ve made sure you don’t have any unclaimed money, make sure it stays that way by properly consolidating all your money and keeping a record of where it is.

Photo by Markus Winkler on Unsplash

Harrison Astbury

Harrison Astbury

Brooke Cooper

Brooke Cooper

Harry O'Sullivan

Harry O'Sullivan

William Jolly

William Jolly

Emma Duffy

Emma Duffy