Research from the Organisation for Economic Cooperation and Development (OECD) says Australia needs to move away from relying on personal income taxes to garner public finances.

This would include hiking GST, while also cutting stamp duty in favour of a recurrent land tax.

"With young and low-paid workers now hit hard by the COVID-19 crisis, effective activation policies will be key to avoid scarring effects on the long-term unemployed and to support job reallocation," the overview said.

Modelling from PwC last year found increasing GST to 12.5% could net up to $40 billion in tax revenue, however did say GST is 'regressive' due to it disproportionately affecting low-income households.

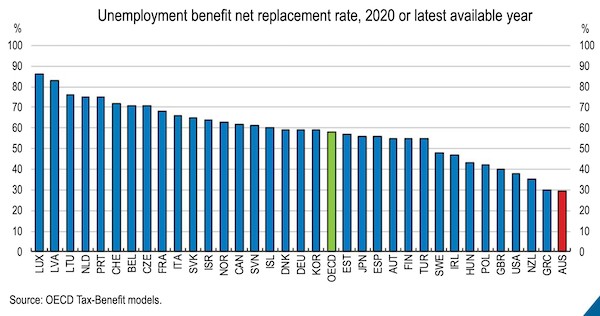

The OECD also called for Australia to review its unemployment benefits system, as it sits last among OECD countries in terms of how much it replaces regular income, replacing just 30% of a regular wage - behind the United States and Greece (chart below).

The Government has already proposed cutting income taxes, with the changes expected from 2024-25 scrapping the existing 37% bracket, reducing the 32% bracket to 30%, and broadening it to $200,000, as below.

While income taxes would get cut, the shortfall would be made up for in reducing private pension tax breaks, such as the family home, and reducing the capital gains tax discount.

"Rethinking institutional frameworks related to fiscal and monetary policy and ensuring an adequate social safety net would leave the economy better prepared to face future shocks," the research overview said.

Photo by David Clode on Unsplash

Denise Raward

Denise Raward

Harrison Astbury

Harrison Astbury

Brooke Cooper

Brooke Cooper

Harry O'Sullivan

Harry O'Sullivan

William Jolly

William Jolly