The loans are only available through mortgage brokers, facilitated through 86 400’s platform.

The fully digitised home loan process means brokers will be able to process loan applications faster than they have before, according to 86 400 Home Loans Lead Melissa Christy.

“We’re aiming for six times faster than the average of the big four banks, so customers will know within 24 hours if they’ve been approved,” Ms Christy told Savings.com.au.

86 400 home loans

Despite being a new bank, 86 400 have a broad range of home loans on offer:

- There are loans for investors, refinancers, purchasers and owner-occupiers

- Each of these loans have fixed and variable rate options, both with redraw facilities

- Those who opt for a variable rate will be able to link to multiple offset accounts (both 86 400 Pay and Save accounts)

- Fixed interest rates start at 2.88% p.a. and variable interest rates start from 3.09% p.a. (comparison rates differ, see 86 400’s website for a full list of rates)

- There are interest-only (IO) as well as principal and interest (P&I)

How 86 400’s home loan application process works

Robert Bell, CEO of 86 400 said the neobank has spent eighteen months working through the key pain points for customers and brokers before developing smart technology solutions.

“We set out to create an entirely new, smarter approach to the home loans application and through technological innovation and collaboration with equally innovative partners we’ve done just that,” Mr Bell said.

The digital bank has partnered with an array of companies to speed up the mortgage application process, including CoreLogic, Equifax, MaxID, FMS, Loanworks, Simpology and Mogoplus.

Ms Christy said they’re able to achieve faster mortgage application times by replacing paperwork with digital verification of identification, income and expenses.

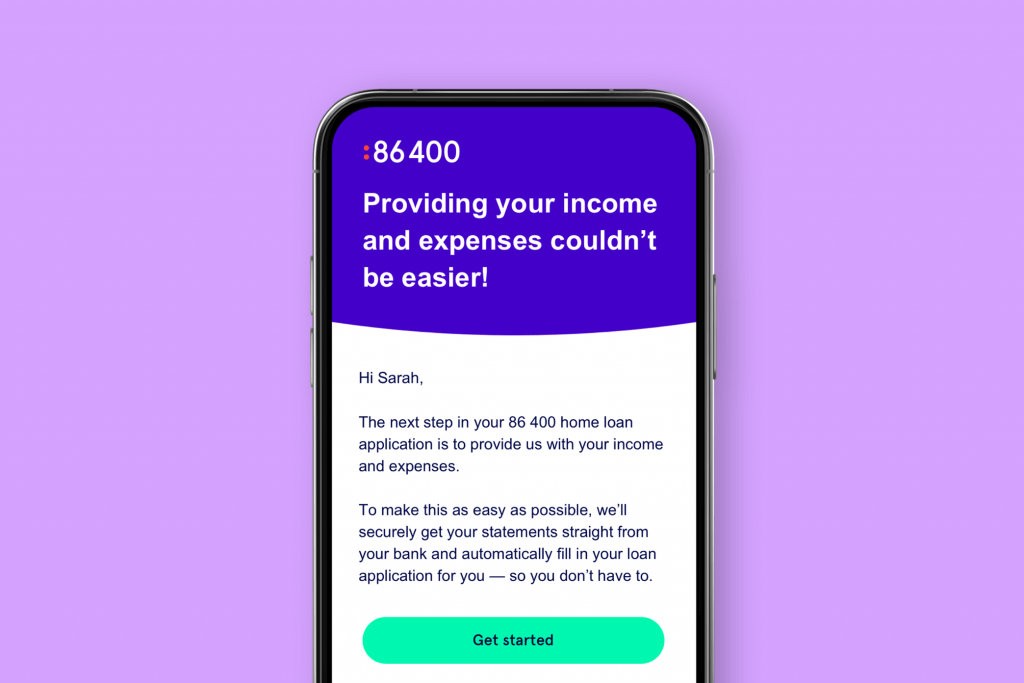

“Once applicants have met with their broker, they electronically provide their income and expenses. This data is categorised, verified by the applicants and automatically populated into the application. This happens in minutes and saves the applicant the lengthy process of having to manually pull this information or provide paper documents,” Ms Christy told Savings.com.au.

Source: 86 400

“Applicants also go through identity verification on their mobile and sign their loan documents electronically. By using smart technology we are able to get a very accurate picture of the applicants’ financial position upfront and save time and effort for both the applicant and the broker along the way.”

Rather than having to submit physical documents, smart technology means applicants are only required to submit a contract of sale for purchases, and no documents are needed to refinance. Borrowers will also benefit from electronic statement capture, electronic signatures, and simplified identity verification on your mobile.

86 400 is also partnering up with two mortgage aggregators, Vow Financial and Specialist Financial Group. Together, that equates to 2,800 mortgage brokers in Australia offering home loans from 86 400 as of today.

While 86 400 isn’t the first lender to offer digital home loans (Tic:Toc and Athena currently offer online home loans) 86 400’s offering is unique in that it’s partnering with mortgage brokers.

While not ruling out the possibility of offering home loans directly to customers down the track, Ms Christy said many borrowers apply for their mortgage through a broker.

“We are progressively rolling out with selected brokers, as brokers currently make up almost 60% of all home loan processes in Australia. They also provide the customer with important face-to-face contact for such a big financial decision and can assist the customer to find the best lender and best product to suit their specific circumstances,” Ms Christy said.

“We know mortgage brokers drive competition and choice for consumers, which is why we have focused on erasing their pain points so they can deliver the best value to customers. This is the first offering in recent years that offers real, tangible benefits to both brokers and homebuyers.”

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harrison Astbury

Harrison Astbury

Harry O'Sullivan

Harry O'Sullivan