Fact Checked

| Lender | Car Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Interest Type | Vehicle Type | Maximum Vehicle Age | Ongoing Fee | Upfront Fee | Total Repayment | Early Repayment | Instant Approval | Online Application | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.99% p.a. | 7.12% p.a. | $580 | Variable | New | No Max | $8 | $400 | $34,791 |

| Promoted | Disclosure | ||||||||

6.28% p.a. | 6.28% p.a. | $584 | Fixed | New | No Max | $0 | $0 | $35,034 |

| Promoted | Disclosure | ||||||||

6.52% p.a. | 6.95% p.a. | $587 | Fixed | New, Used | No Max | $0 | $350 | $35,236 |

| Promoted | Disclosure | ||||||||

6.09% p.a. | 7.22% p.a. | $581 | Variable | New | No Max | $8 | $400 | $34,874 | |||||||||||

6.59% p.a. | 7.29% p.a. | $588 | Fixed | New | No Max | $0 | $499 | $35,295 | |||||||||||

5.67% p.a. | 6.10% p.a. | $575 | Fixed | New | No Max | $0 | $0 | $34,524 | |||||||||||

6.69% p.a. | 6.86% p.a. | $590 | Fixed | New, Used | No Max | $0 | $120 | $35,379 | |||||||||||

6.99% p.a. | 8.12% p.a. | $594 | Variable | Used | No Max | $8 | $400 | $35,634 | |||||||||||

7.49% p.a. | 7.90% p.a. | $601 | Fixed | New, Used | No Max | $0 | $295 | $36,060 | |||||||||||

7.99% p.a. | 8.20% p.a. | $608 | Fixed | New | No Max | $0 | $150 | $36,489 | |||||||||||

8.20% p.a. | 8.27% p.a. | $611 | Fixed | New, Used | No Max | $0 | $0 | $36,670 | |||||||||||

6.29% p.a. | 7.30% p.a. | $584 | Fixed | New, Used | No Max | $9 | $265 | $35,042 | |||||||||||

9.49% p.a. | 10.93% p.a. | $630 | Fixed | New, Used | No Max | $13 | $395 | $37,795 | |||||||||||

6.28% p.a. | 6.28% p.a. | $584 | Fixed | Used | No Max | $0 | $0 | $35,034 |

| Promoted | Disclosure | ||||||||

6.59% p.a. | 7.72% p.a. | $588 | Fixed | New | No Max | $8 | $400 | $35,295 |

| Promoted | Disclosure |

Stop guessing. Start saving.

Your car loan comparison sorted.

We hunt the best car loans – you claim the savings.

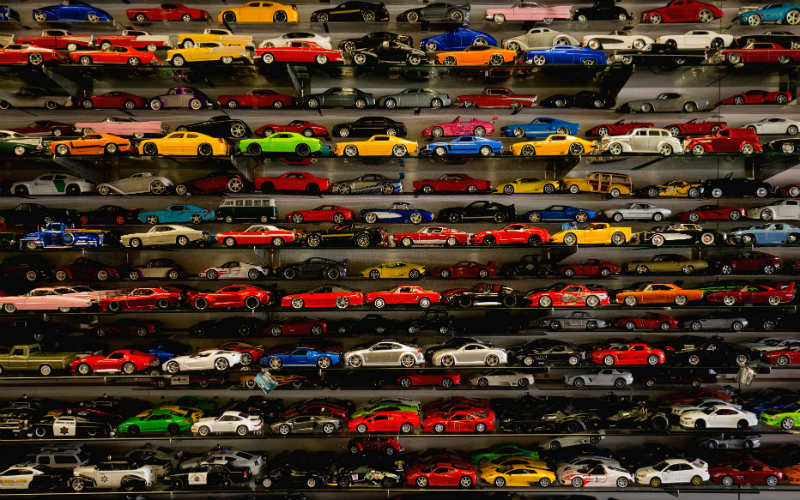

Whether you’re buying a new or used car, easily compare car loan rates, fees and features.

We track the car loan market – so you don’t have to.

800+ car loan products from 70+ lenders updated daily. From green car loans to car loans with pre-approval - we’ve got you covered.

Your lender’s not gonna tell you about a better deal – but we will.

Monthly low-rate car loan deals and offers, handpicked by our experts.

Frequently Asked Questions

Car loans and dealer finance can be acceptable methods of car financing, so long as you do your due diligence and shop around. Dealer finance can often have faster approval times and lower interest rates compared to car loans, but they can also be less flexible and more restrictive. If you're torn between the two, consider walking into a dealership with a pre-approved car loan under your belt and negotiating with the dealer to see if they can offer a better rate. For any type of car financing, be sure to take all the fees into account and look at what the total cost of the finance would be at the end of the term.

A secured car loan is one where an asset (the car you’re buying) is used as collateral against the loan, and can be reclaimed by the lender if repayments aren't met. Unsecured car loans do not use your car as security. Secured car loans are generally less risky for lenders to provide than unsecured car loans, so they often have lower interest rates. Read more about secured vs unsecured car loans!

If you have bad credit, you can boost your chances of being approved for a car loan by: being realistic in your expectations & picking a modest car, being honest in your application, save some money beforehand, obtain stable employment, and clean up existing debts. Also work towards improving your credit history beforehand by paying bills and credit card repayments on time.

Your eligibility for a car loan will depend on a variety of factors such as: the car model, whether the car is new or used, the lender and the loan you're applying for, your income, your credit rating and history, your assets and liabilities, and your history of savings. Having a bad credit rating doesn't disqualify you from getting car loans, but you might find it harder to get a good one.

Basic car loan requirements often include:

- Proof of a steady, reasonably high income

- Proof of identity: driver's license, Medicare card, passport etc.

- Proof of residence

- Proof of your ability to save money (try three-six months)

- Proof of your assets (like shares) and liabilities (like credit card debt)

Not having these on hand could reduce or eliminate your chances of having a loan application approved.

There are lots of different car loan terms available, but most reputable lenders will allow terms between one and seven years, with 10 years usually the maximum. Your car loan term is how long it would take to pay off the car loan without any extra repayments.

Yes, you can refinance your current car loan to a different car loan with different terms, or a different lender with a lower interest rate. When refinancing a car loan, the money borrowed from the new loan will cover the balance of your previous car loan, allowing you to pay off that old car loan before moving onto the new one.

Car loans can be both secured and unsecured, but the majority of them are secured, meaning the car is used as security against the loan. Should you fail the repay the loan, the car can be repossessed by the lender. Unsecured car loans (which are essentially personal loans) don't have the car as a security, but tend to come with higher rates to compensate for this.

A pre-approved car loan can be beneficial as it lets you know what you can afford before you go out to buy a car. To get a pre-approved car loan:

- Compare car loan providers to make sure you’ve found the right one

- Check your credit rating before applying

- Gather all of the necessary documents (100 points of ID, income, proof of employment, assets and liabilities etc.)

- Contact your chosen lender and tell them you want to apply for pre-approval

Do your research, choose an honest & transparent lender.

When it’s time for a new car, you might think it’s worth paying an extra percent or two at the dealership to get the car sooner - but we assure you that is not the case.

Many lenders, particularly online lenders like us, offer car loan pre-approval, and far lower interest rates than dealerships, potentially saving you hundreds, if not thousands on your car finance. Some can even turn around an approval and settlement for you in record time, so there’s no reason not to head to the dealership with your finance sorted so you’re prepared to buy.

Our top tip - always read through the fine print and opt for someone transparent and honest to help you with your car loan.

Alexi Falson

Alexi Falson