The average Australian now expects that the annual cost of running a vehicle (including registration, insurance, fuel and maintenance) is $15,754.

This is according to a sample of over 1,040 drivers in Carbar's Future Finance and Mobility Report, an annual study into finance trends in the automobile industry.

This is up 78% from the equivalent results in 2022, where motorists suggested their average spend was $8,926.

These figures are in-line with the estimate in the RACV's cost of ownership study that car maintenance in Australia costs between $10,000 and $25,000, depending on make and model.

RACV research also indicates the Nissan Patrol and Toyota Landcruiser are some of the most expensive cars to run.

The surge in fuel prices was a significant contributor to the increase in expected running costs, with the average annual spend jumping from $1,991 in 2022 to $2,929 in $2023.

Of the respondents, 60% said that they weren't in control of their petrol costs, more even than those who were struggling with their grocery bills (53%).

Inflation though has penetrated many of the other aspects of car ownership.

Annual parking costs are this year expected to be $1,101 (up 235% from 2022), while the average Aussie driver can expect to shell out $1,800 in insurance fees (up 85%).

After eight successive cash rate hikes from the RBA, higher interest rates have also seen a jump in car repayments, which are now up to $1,652 from $781 in 2022.

State governments are also adding to the cost burden for careless motorists, who are expected to pay 227% more in infringement fines this year, up to $986.

Are used vehicles more cost-effective?

The report also revealed a reversal of the 2022 trend towards used cars.

One in three (33%) of Australians indicated their interest in buying a vehicle in 2023.

Of these people, 20% said they were interested in a new car, compared to 16% in the market for a used car.

About 42% of those interested in buying a car said they were concerned about the reliability of second hand vehicles.

However, Carbar co-founder and CEO Des Hang said cost of living pressures would also likely erode any advantage to pursuing a newer vehicle.

"We believe increased demand for new vehicles will reverse course as more Australians realise both the ongoing cost of purchasing a new vehicle and also the delays seen with accessing them," Mr Hang said.

"Cost of living pressures have already put a dent in new car orders, and we believe this trend will continue.”

Another upward trend revealed by Carbar was continued interest in electric vehicles.

Baby Boomers (22%) have overtaken Gen Z (21%) as the generation most likely to buy an electric car if money was no issue.

What about ditching the car entirely?

Well over half (60%) of respondents said that the cost and hassle of owning a car stresses them out.

Almost a third of those in the market for a car reported that they were considering postponing or even rethinking their decision to buy a car.

Meanwhile, 3% of respondents (a number that equates to over 550,000 Australians over 21 when extrapolated across the population) say they intend to sell their car this year and not replace it.

Advertisement

In the market for a new car? The table below features green car loans with some of the lowest interest rates on the market for low-emissions vehicles.

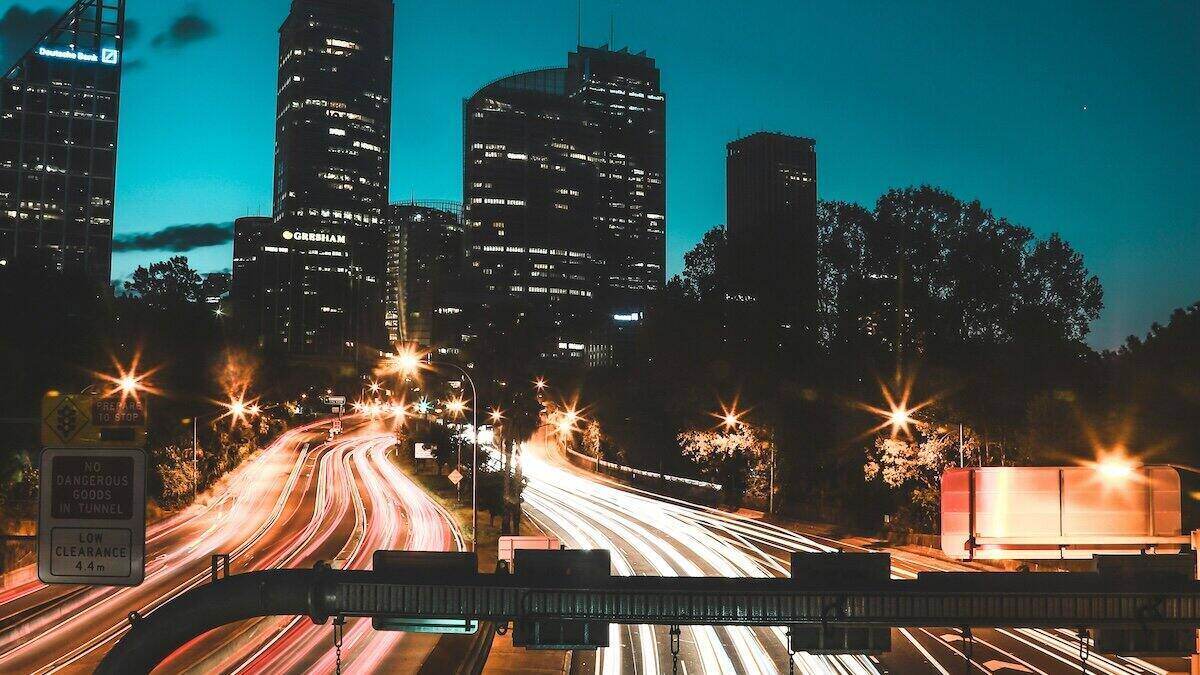

Picture by Charlie Deets on Unsplash

Harry O'Sullivan

Harry O'Sullivan

Brooke Cooper

Brooke Cooper

Harrison Astbury

Harrison Astbury