REA's PropTrack report showed new listings nationally picked up by 24.2% month-on-month in January, bouncing back from the typical end-of-year slowdown experienced in December.

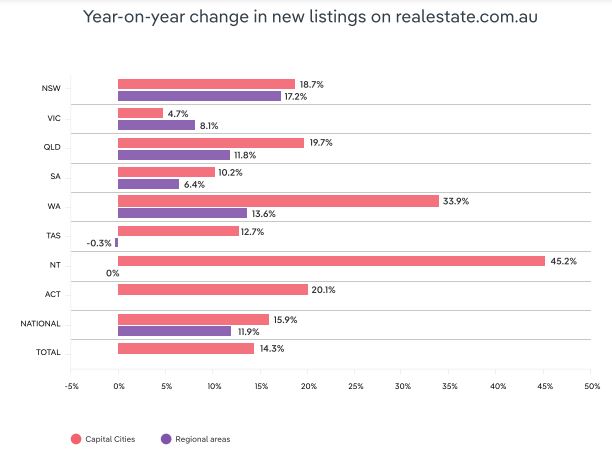

Nationally, new listings were 14.3% higher than they were in January 2021.

Capital cities saw the busiest January for new listings since 2014 according to the data.

New listings across the capital cities surged 55.6% compared to December as activity resumed after the end of year break.

This busy start to the year saw new listings up 15.9% compared to January 2021. All capital cities recorded year-on-year increases in new listings.

Source: REA

According to the report, regionally, the year started more subdued, though the end-of-year slowdown was not as pronounced in these areas as it was in the capital cities.

New listings in regional areas declined 6.7% in January compared to December. However, conditions remain more favourable for buyers than in 2021, with new listings in January 11.9% higher than in January 2021.

What's next for the property market?

REA's report predicts some headwinds to the property market in 2022.

"While measures of buyer demand remain strong, they have eased from the levels seen in late 2021," the report said.

"At the same time, record levels of new supply coming to market in the final months of the year have helped ease how competitive the market has been for buyers.

"Strong economic outcomes and rising inflation mean that rate rises will probably happen earlier than expected – potentially as early as later this year – which may start to cool buyer appetite.

"This means that, while selling conditions are set to remain strong, we are likely to see some tempering from the dominant levels of buyer demand experienced in late 2021."

Asking prices flattening: SQM Research

New data from SQM shows asking prices over the past 30 days to 1 February 2022 had levelled out in capital cities.

Sydney and Melbourne asking prices fell by 0.6% and 1.2% respectively for houses, and 0.7% and 0.4% for units.

Brisbane asking prices rose by 0.3% for houses and 0.1% for units. Perth asking prices fell by 0.3% for houses and 1.1% for units.

Adelaide asking prices for houses rose by 1.1% and 1.5% for units. Canberra asking prices for houses fell by 0.3% and rose by 2% for units.

Darwin asking prices for houses fell by 1.2% and 2.1% for units while Hobart asking prices for units rose by 0.6%.

Louis Christopher, Managing Director of SQM Research said the market is slowing, albeit mildly.

"Available properties on the market remain tight," he said.

"At just under 201,000 properties available for sale, we are currently having the mildest of slowdowns in the national housing market.

"Going forward, we are recording a move towards more auction listings over February with scheduled auctions up by about 15% compared to this time last year. But we are not anticipating a massive surge in total new listings.

"With the prospect of higher inflationary pressures, we believe the risks are moving back towards the upside of a stronger market in the first quarter of 2022. Upon which APRA will be forced to take further action in the absence of any RBA rate hike."

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure |

Image by John Towner via Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Brooke Cooper

Brooke Cooper