The 25 basis point increase takes the cash rate target out of emergency territory and brings it to 0.35%.

This was contrary to many forecasts of a rise by 15 basis points.

Other economists such as AMP Capital's Dr Shane Oliver called on the RBA to be more aggressive and hike the cash rate by 40 basis points.

At Tuesday's monetary policy meeting, RBA Governor Dr Philip Lowe said now's the time to turn the "extraordinary monetary support" tap off.

"The economy has proven to be resilient and inflation has picked up more quickly, and to a higher level, than was expected. There is also evidence that wages growth is picking up," Dr Lowe said.

"Given this, and the very low level of interest rates, it is appropriate to start the process of normalising monetary conditions."

Last week ABS data showed headline inflation hit 5.1% with underlying inflation hitting 3.7% - well above the RBA's target band of 2-3%.

"The Board is committed to doing what is necessary to ensure that inflation in Australia returns to target over time. This will require a further lift in interest rates over the period ahead," Dr Lowe said.

In comes the RBA's 'business liaison'

There was some speculation the RBA could hold, wanting to see more positive wages data - the next data is due for release on 18 May.

The latest wages data is for the December 2021 quarter, rising 2.3% at an annualised rate.

RBA Board members previously said they would not hike until wages growth was sustainably around the 3% mark, however they did not define what sustainably meant.

On Tuesday Dr Lowe referenced a "business liaison", who suggested that wages growth is picking up quickly.

"While aggregate wages growth was subdued during 2021 and no higher than it was prior to the pandemic, the more timely evidence from liaison and business surveys is that larger wage increases are now occurring in many private-sector firms," he said.

No reinvestment of bonds

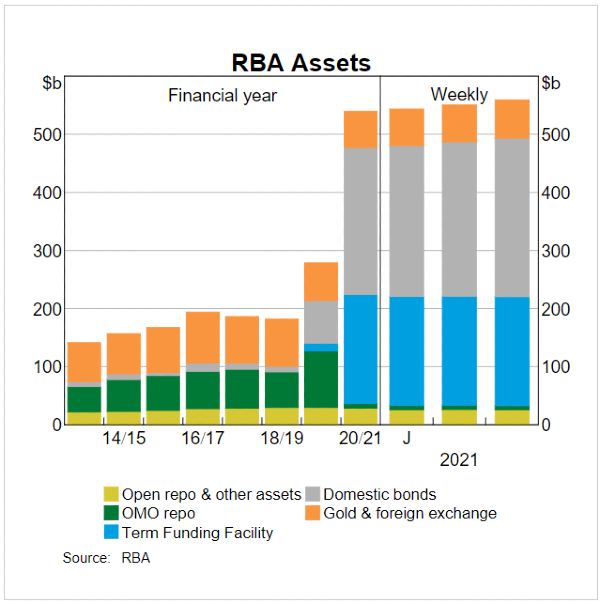

The RBA turned off the quantitative easing tap in February, and said it will wait until May to assess if it should reinvest the proceeds - i.e. interest - from its bond purchases.

It decided not to, and Governor Lowe said the aim is to reduce the Bank's balance sheet "significantly" over the next couple of years.

This would coincide with the end of the $200 billion Term Funding Facility.

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure |

Photo by Phil Goodwin on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

.jpg)

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Hanan Dervisevic

Hanan Dervisevic

Harrison Astbury

Harrison Astbury