This is only our second obituary, after the RBA cut its Term Funding Facility mid last year.

We could have said 'RIP QE' in the headline but we didn't want readers to think Queen Elizabeth II had passed.

It's probably only a matter of time before the RBA unleashes its coroner and dissects the QE patient.

Rest in Peace, good sir - you will be missed.

For the better part of two years, the RBA intervened in the secondary Australian Government bond market, called quantitative easing or 'QE' for short.

It purchased up to $4 to $5 billion a week in Australian and state government bonds, and over the past two years the RBA nearly doubled its balance sheet, growing to $640 billion.

While QE helps out the Federal Government in a big way, it also had a knock-on effect in interest paid on things like home loans, which dropped sharply through 2020 and 2021.

Yes the cash rate was 0.10%, but in reality the overnight rate was closer to zero due to these bond purchases.

How does this actually affect the public?

It was the first time the RBA unleashed QE, which indirectly gave around $350 billion for the Federal Government to play with.

The sheer quantity of bonds purchased eased the yield, lowering the amount of interest the Government pays on its debt.

Government-wise there's a lot of debt, but as a proportion of GDP it's low by global standards.

The 2021-22 Budget projected that the Commonwealth government’s gross debt would hit $963 billion at 30 June 2022. This is around 45.1% of GDP.

Net debt is expected to be $729 billion or 34.2% of GDP.

The interest the government pays on its debts has real-world consequences.

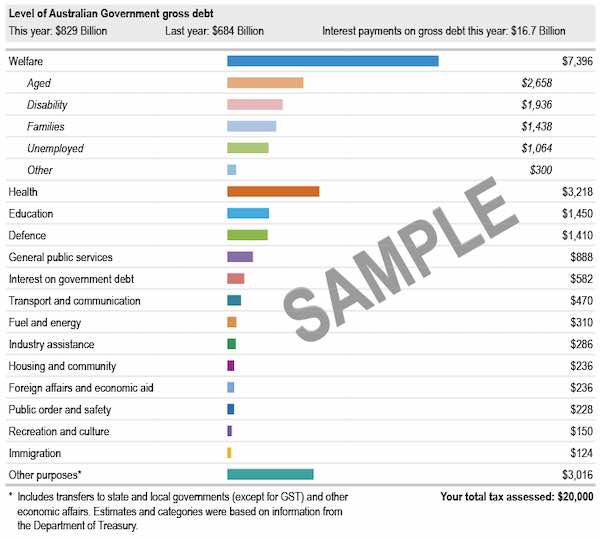

For example, in the chart provided by the tax office below, someone with a $20,000 tax bill would pay nearly $600 of that towards government interest.

That could instead be put towards other meaningless stuff... like roads, or healthcare.

Why would the RBA want to switch off QE?

An important note here is that the RBA as part of its QE program doesn't go directly to the Government and purchase bonds from Josh Frydenberg and co.

The RBA is an active participant on the secondary market, purchasing government bonds from institutional players like superannuation companies, big banks, insurance companies and so on.

The quantity of bonds purchased raises their price, but lowers the yield i.e. the interest rate. Any interest the RBA receives on bonds are fed back into Government coffers.

So you've got the RBA holding the bag on some expensive bonds, and if yields were to rise (as they would by a cash rate rise), it would lose a fair bit of money.

From the RBA's own estimates, a two percentage point rise across yields could result in a $27.4 billion loss for the central bank on domestic bonds.

That $27.4 billion would essentially line the pockets of the large institutional investors - private companies.

Is the RBA foreshadowing an increase in the cash rate? For its Governor Dr Philip Lowe, the answer is no.

"Ceasing purchases under the bond purchase program does not imply a near-term increase in interest rates," Dr Lowe said as part of the RBA's monetary policy decision at the start of February.

"As the Board has stated previously, it will not increase the cash rate until actual inflation is sustainably within the 2 to 3% target range.

"While inflation has picked up, it is too early to conclude that it is sustainably within the target band.

"The Board is prepared to be patient as it monitors how the various factors affecting inflation in Australia evolve."

The RBA will decide whether to re-invest bond maturities at its meeting in May.

Confusing, right?

All you need to know is the days of cheap money could be coming to an end - home loan rates could increase, while punters battle with inflation.

Lead image generated by https://mpaulweeks.github.io/tombstone/

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

.jpg)

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Hanan Dervisevic

Hanan Dervisevic