The figures released by the Federal Chamber of Automotive Industries (FCAI) showed a total of 38,926 new car sales in April 2020, compared to 75,550 in April of last year.

This is the largest single decrease of any month since VFACTs figures were first recorded in 1991, and the 25th consecutive month of declining new car sales year-on-year.

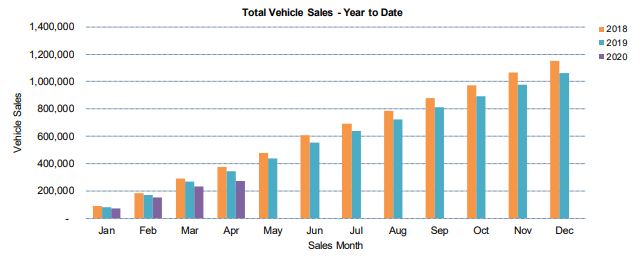

Year to date figures for April totalled 272,287 sales, down from 344,088 in 2019, equating to a 20.9% overall decline.

FCAI Chief Executive Tony Weber said the coronavirus had been a massive factor in the dismal figures.

“Clearly, the COVID-19 pandemic has had a major influence on the April sales result, and reflects a downturn in the broader economy right across the country,” Mr Weber said.

“Figures recently released by the Australian Bureau of Statistics show that 31% of Australian citizens have experienced a decrease in income due to the pandemic. In addition 72% of Australian businesses reported that reduced cash flow is expected to have an adverse impact on business over the next two months.

“These conditions inevitably impact consumer confidence and purchase decisions.”

In the market for a new car? The table below features car loans with some of the lowest fixed interest rates on the market.

| Lender | Car Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Interest Type | Vehicle Type | Maximum Vehicle Age | Ongoing Fee | Upfront Fee | Total Repayment | Early Repayment | Instant Approval | Online Application | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

6.59% p.a. | 7.72% p.a. | $588 | Fixed | New | No Max | $8 | $400 | $35,295 |

| Promoted | Disclosure | ||||||||

6.28% p.a. | 6.28% p.a. | $584 | Fixed | New | No Max | $0 | $0 | $35,034 |

| Promoted | Disclosure | ||||||||

6.52% p.a. | 6.95% p.a. | $587 | Fixed | New, Used | No Max | $0 | $350 | $35,236 |

| Promoted | Disclosure | ||||||||

5.76% p.a. | 5.76% p.a. | $577 | Fixed | New, Used | No Max | $0 | $275 | $34,599 | |||||||||||

5.99% p.a. | 6.34% p.a. | $580 | Fixed | New | No Max | $0 | $250 | $34,791 | |||||||||||

6.25% p.a. | 6.52% p.a. | $583 | Fixed | New | No Max | $0 | $195 | $35,009 | |||||||||||

6.49% p.a. | 6.84% p.a. | $587 | Fixed | New, Used | No Max | $0 | $250 | $35,211 | |||||||||||

6.29% p.a. | 7.71% p.a. | $584 | Fixed | New, Used | No Max | $15 | $250 | $35,042 | |||||||||||

5.67% p.a. | 6.10% p.a. | $575 | Fixed | New | No Max | $0 | $0 | $34,524 | |||||||||||

7.99% p.a. | 8.99% p.a. | $608 | Fixed | New, Used | No Max | $9 | $265 | $36,489 | |||||||||||

7.99% p.a. | 8.27% p.a. | $608 | Fixed | New | No Max | $0 | $200 | $36,489 |

Toyota continued to be Australia's most popular new car brand with 10,325 vehicles sold, followed by Mazda and Kia.

Toyota also boasted the three most popular individual models, with the Toyota Hi-Lux coming in first, followed by the RAV4 and the Landcruiser.

New South Wales led the states in sales volume with 11,938 vehicles sold, followed by Victoria and Queensland.

Mr Weber said when social distancing measures are relaxed and the economic hibernation is lifted, the automotive industry needs help to recover.

"We are calling on Federal and State Governments to consider the automotive industry, which employs over 65,000 people in Australia, when compiling their recovery plans,” he said.

“The JobKeeper and JobSeeker payment programs put in place by the Federal Government are a welcome initiative.

“However, we believe the scope needs to ensure high turnover and low margin businesses, such as new car dealerships, are covered.

“Initially, we would ask that the instant asset write off package is extended to further stimulate business purchasing.”

More to come..

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan