The market is awash with savings account products that spruik handsome interest rates. Understandably, these are splashed front and centre of marketing campaigns designed to catch the eye of savers looking to grow their deposits.

But high interest savings account rates often come with more than a few hoops to secure their maximum interest rates.

The trick is to match your savings account to financial habits and your personal commitment to achieving the best return on your dollars. Here's how to do it.

How do I find the best savings interest rate for me?

Let's start off with the basics. If you're after a good interest rate on your money, you'll need to be looking at savings accounts, not transaction accounts.

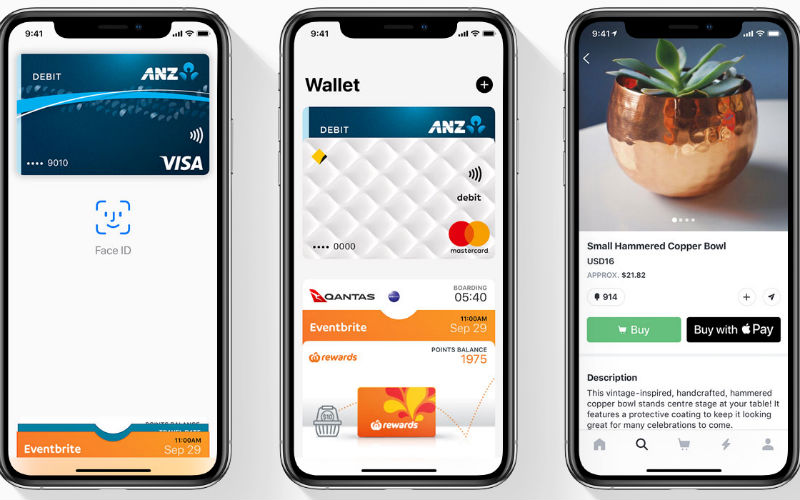

Yes, they're different. In a nutshell, transaction accounts are for day-to-day banking and are usually linked to a debit card. The bad news is they earn barely any interest - sometimes none at all.

Savings accounts, on the other hand, generally pay you some interest but typically don't come with a debit card. Here's a good article that explains all the ways they differ: What's the difference between savings accounts and transaction accounts?

Some savings account considerations

Once you're sure you're looking at savings accounts, you'll need to do a little more investigating before simply plugging your money into the product with the highest advertised interest rate. That number may be the best rate the account will get you, but it doesn't mean you'll automatically receive it.

For a start, some savings accounts come with eye-catching introductory or honeymoon interest rates that typically feature in large font. These generally last for a fixed period (usually three or four months) before reverting to a less-dazzling rate.

Other savings products may just hit you with their top rate - also known as the bonus rate - and it will be up to you to find out how to achieve it. The terms and conditions will generally be set out somewhere in smaller print.

If you don't meet the specified requirements, you will end up being paid what's called the base interest rate. This can be around 0.00%-0.05% p.a. which isn't too flash at all.

For more information, see The different types of savings account interest rates

What are some common conditions for achieving bonus interest rates?

Savings accounts that come with conditions in Australia typically have one, two, or a combination of the following:

-

Customers must deposit a set amount into their accounts each month (generally from an external account)

-

Customers must have a linked transaction account where a set amount must be deposited each month (also generally from an external account such as an employer depositing wages or salary)

-

Customers make a certain number of transactions each month using a linked transaction account

-

Customers make no - or limited - withdrawals in a month

-

Customers must grow their savings account balance over the month (excluding interest earnings)

How to make sure you get your savings account top rate every month

When you choose a savings account product, you need to be honest with yourself. How reliable will you be ensuring you meet your account's requirements to get paid the maximum interest rate every month?

It seems many Australians aren't exactly on the ball. A study by the Australian Competition and Consumer Commission in 2023 found 71% of all savings accounts with a conditional interest rate didn't receive the bonus rate during the study period.

Its report calculated Aussies were missing out on billions of dollars of interest on savings each year because of conditions that are difficult for customers to meet and keep track of.

The report recommended banks and other ADIs be made to alert their customers to give them a chance to meet bonus conditions. So far, few have moved to implement that (although some have so we'll talk more about those soon.)

In light of that, before you go signing up to a dazzling savings account interest rate, you need to assess your own suitability as a depositor.

Tips on how to meet bonus rate conditions

-

Automate deposit requirements

When you set up your account, automate as much as possible to ensure your default has you achieving the bonus rate every month. Make sure the minimum deposit amount is coming in either directly from your employer, or another account where you hold funds. You'll also need to pay attention if the minimum deposit amount changes and adjust accordingly.

-

Automate transaction requirements

If you need to make a set number of transactions a month to receive bonus interest, set up some automatic payments to come from the account (or a linked transaction account, depending on the conditions). These can be regular smallish weekly or monthly payments such as subscription services like Spotify or Netflix, gym membership, mobile phone, health insurance, etc. Alternatively, get into the habit of using that account for fairly regular transactions such as buying coffee or a weekly grocery shop to give yourself the best chance to hitting the minimum transaction target.

-

Have another account

If the account has a no - or limited - withdrawal condition, make sure it's your rainy-day or emergency savings account and not one you'll be needing to dip into too often. You'll also need to judge how much you can feasibly deposit into it each month without starving. You may want to consider splitting your savings between a high-interest and an unconditional savings account (more on these below) so you can more easily - and cheaply - access your savings if you think you'll need to.

-

Set up your own alert system

Some banks may provide alerts or offer in-app facilities to check on your bonus-saving progress (more on this below) but the vast majority don't. This is where you may need to set up your own system, using your phone calendar or another method, to prompt you to check on whether you're on track to earn bonus interest that month. Make sure you give yourself enough time to act before the cut-off date and be clear on exactly what you need to do to ensure you achieve the maximum interest.

Unconditional savings accounts

If you're not a detail person or your life is busy enough, you may be better off searching for an unconditional savings account that still offers a decent rate. It likely won't be as high as the maximum rate offered on a conditional account but if you're guaranteed of getting it every month, it may work out that you earn more in interest each year than if you'd signed up for the bonus interest account and only got the maximum rate every so often.

Most institutions offering a high-interest savings account with conditions will also offer an unconditional savings product so it's worth checking those rates too.

One thing you may need to keep an eye on with unconditional savings accounts is whether they offer an introductory rate and what it reverts to after the honeymoon period is over. Many also come with balance caps so make sure you match the product to the amount you'll be looking to keep in the account to maximise your interest.

See also: Quick Guide to Macquarie Bank Savings Accounts

Which banks alert customers to their bonus savings rate eligibility?

Each of the big four banks say they prompt customers to help them achieve bonus interest rates although not all make clear exactly how and when they do this and, more importantly, how effective it is.

In May 2024, Westpac introduced a new mobile phone push notification system to alert their customers on how to earn bonus interest. Westpac said its prompts are designed to help customers better understand opportunities to earn bonus interest and allow them to act quickly.

NAB's digital-only bank Ubank also says it issues "friendly nudges" to help its customers achieve bonus interest on their high-interest savings account product.

Other banks say there are features within their apps to allow customers to check on their eligibility to achieve bonus interest. But there is a difference between a checking facility and an alert. If you're the type that needs alerting, consider those savings account products that offer real-time alerts.

The ACCC had recommended banks offer clear communications and information to their customers if they were about to lose entitlements to their bonus interest. By choosing an institution that does this, you are also sending a message to other deposit-takers that they may need to do the same to get your cash.

The ACCC also recommended banks conduct annual assessments of their customers' success in achieving bonus interest rates and suggest whether other products may better suit their needs. It is unclear whether any institution has taken up this recommendation. Certainly, none has announced it has done so.

Savings.com.au's two cents

It seems the banking sector has become more enamoured with the low base rate and bonus rate savings account model, with increasingly complex conditions around achieving the maximum rate.

Indeed, many of the highest savings account interest rates on the market are generally introductory rates or come with conditions - or both.

To ensure you are receiving the best rate you can on your savings, you need to assess your own suitability as a customer for achieving the maximum interest rate. This requires you to be entirely clear on what the conditions are, show commitment to meeting them, and regularly monitoring your account to ensure you're on track.

If that doesn't sound like you, you may be better off opting for an unconditional savings account that will pay you a decent (but usually not the market-high) interest rate every month without you having to do anything at all.

No matter what savings account you opt for, be sure to check balance limits that interest will be paid on. Many deposit-takers will only pay their highest interest rate on set balance amounts with the rate dropping significantly for any sum over that. Banks are generally not in the habit of alerting you to when you exceed the deposit amount so you will need to be vigilant as your savings accrue.

It's also good practice to regularly review the savings account market to see if there are better interest rates out there and, just as importantly, fewer conditions for achieving them that may better suit your circumstances.

Below is a list of some of the highest interest-earning savings accounts on the market to start you off, but don't forget to carefully check the fine print.

- Bonus variable rate for the first 4 months on balances up to $250k and high variable ongoing rates.

- No fees and no monthly requirements to earn interest.

- Easily open an account online in 3 minutes.

Image by Andrea Piacquadio via Pexels

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan