According to the Australian Tax Office (ATO), over 2.2 million Aussies owned one or more investment property in 2018. There’s a reason property investment is so popular; it’s typically considered a safe investment, with a report from ASX and Russell Investments finding residential property averaged returns of 10.2% p.a. in the 20 years to December 2017.

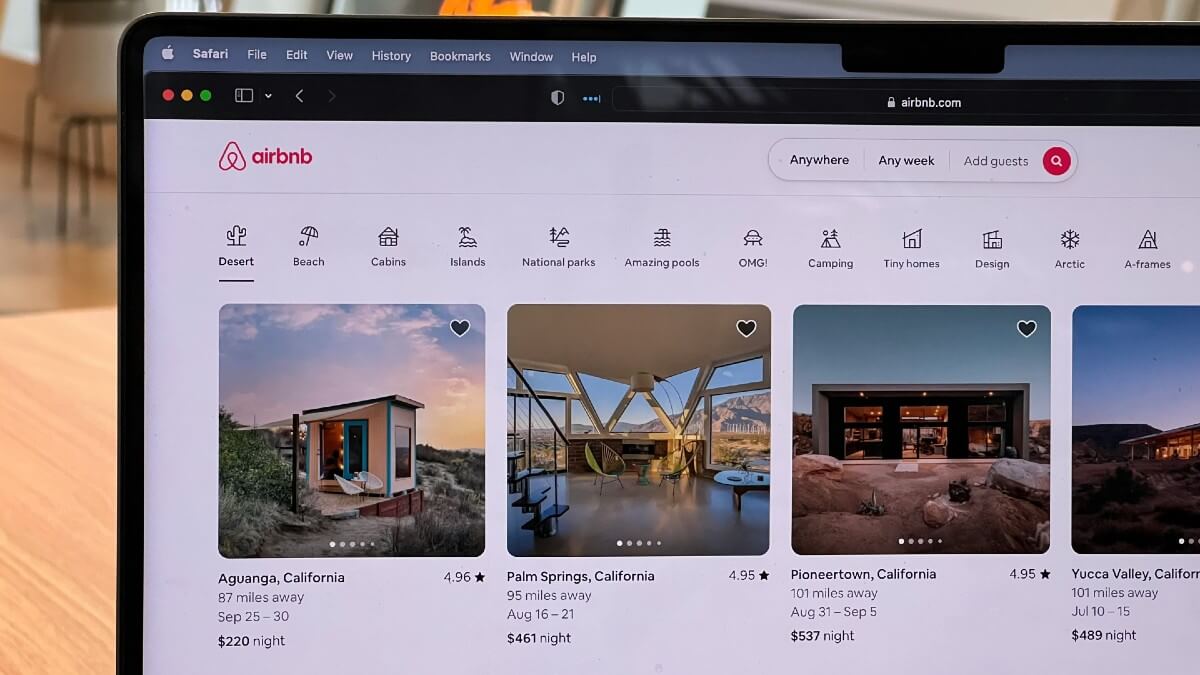

So is it possible to take a shortcut and turn your home into an investment property and try and take advantage of these potential returns?

Buying an investment property or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for investors.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

What’s the difference between the home you live in and an investment property?

The homes property investors choose to live in are often very different from the properties they invest in.

One major difference is often the location. Owner-occupiers are generally looking for a suburb that suits their lifestyle, one that has access to amenities like schools and shops, and is close to their work. In contrast, investors often look for suburbs favoured by renters (e.g. student-friendly areas near universities), ideally with strong capital growth opportunities and high rental yields.

Owner-occupiers also tend to have more consideration for the specific needs of the occupants. If they have a large family, they may want a large garden and pool, two garage ports, and a large living area. Investors will buy a home with a specific demographic in mind, be that a CBD unit for a young professional couple, or a large suburban home for a family.

Financing an investment property purchase can also be different from buying a home as an owner-occupier. Owner-occupier loans typically have lower interest rates than investment home loans, as owner-occupiers are likely to hold onto the property for longer than an investor because they’re living in it.

What to consider before turning your home into an investment property

If you decided to convert your home into an investment property you’ll be required to tell your lender you are doing so. It’s unlikely the lender will switch you to an investor home loan, but they may have conditions that prevent you from renting out the home. You should speak with them prior to making any decisions.

You also need to consider the tax implications of your move. You may be able to claim the home you used to live in as taxable asset, but if you then sell the property, your capital gain (should you have one) will be affected by your previous occupancy. Jo Natoli from The Rental Specialists told Savings.com.au the best course of action was to speak to a finance professional before making any sort of move.

“You'd need to have a really good chat to an accountant before you actually did convert your home, to make sure that you get everything from a paperwork and financial perspective sorted,” Ms Natoli said.

Ms Natoli also urged people to consider their emotional attachment to the home they live in.

“You need to be able to switch from being a homeowner to an investment property owner and a lot of people, when they rent out the home they've been living in, hang onto that emotional attachment, which can become difficult down the track.

Josh Tesolin, 2020 RateMyAgent Agent of the Year, told Savings.com.au people should consider what they would be looking for in a rental property if the shoe were on the other foot.

“If you were going to rent a home – what would you be looking for? Turning your property into a clean, low maintenance and liveable home is what will allow you to charge a higher rent and attract tenants,” Mr Tesolin said.

“It's also important to ensure that your home is in excellent condition before you take it to the rental market. Anything that poses a maintenance problem will be a deterrent to potential tenants.”

What are the benefits of turning your home into an investment property?

Co-founder of Freedom Property Investors Scott Kuru told Savings.com.au there were three main benefits to turning your home into an investment property.

“One, it may produce more borrowing capacity to get into more assets, that's the first thing that it may do,” Mr Kuru said.

“The second thing that it will do is create more cash flow in your life, and the third thing it will do is produce tax deductions in your life.”

Mr Tesolin said turning your home into an investment home had a number of benefits, including an easy way to potentially maximise rental income.

“Turning your home into an investment property has a variety of benefits, including building your property portfolio, increasing your personal income and potentially gaining additional equity that will help you purchase more properties or even pay off your own mortgage,” he said.

“As previously mentioned, if you can turn your single property into two separate rental homes, the financial benefits you reap will be unmatched.

“A granny flat or duplex will not only add value if you ever choose to sell your investment property, it will help guarantee a second income.”

Ms Natoli said rental income was arguably the biggest benefit of turning your home into an investment property.

“The benefits are simply having somebody paying off your mortgage or helping to pay the mortgage and retaining that asset and reaping the benefits of capital growth over time.”

What are the risks of turning your home into an investment property?

Mr Tesolin said the risks of turning your home into an investment property include the fact that wear and tear on the property was almost guaranteed, and that your property may not be desirable to renters.

“When you turn your home into an investment property, the house will never be treated the same way as it was previously and damage will accrue over time,” he said.

“Additionally, if you initially purchased your home without considering it as an investment property, it is highly unlikely that you put thought into what makes a property attractive to renters.

“You may not have thought about proximity to transport, schools and community centres – and this can deter a high rent return.”

Ms Natoli said there were always risks with investment properties, and turning your home into one carried much the same risk.

“The biggest risk is not getting your paperwork and financial business in order before you do convert, because it can have very serious and expensive consequences down the road,” she said.

Should you turn your home into an investment property?

Mr Kuru said there were a number of factors involved as to whether it was a good idea to turn your home into an investment property.

“One, can you rent a different home in the area you want to live in for way less or at least a little bit less or equal to what you're paying on your current home or mortgage?

“If the rent is higher it doesn't make any sense, if it won't increase your borrowing capacity, and, it'll affect you negatively and affect your cash flow

“But if you can rent a different property and you can improve your cash flow position and you convert your bad debt on the house you are living in, into good ‘investment‘ debt, with associated cash flow and tax deductions - then you may in fact actually want to make that move.”

He added that if people were in the consolidation phase of their investment journey, converting may not be the right move.

“This is when you start to sell down assets and take all the equity out and put it somewhere safe and nice and beautiful to produce cash flow and then go off and retire or live life on your terms.

“If you are in this stage or towards the end of your asset accumulation stage, then it may actually not be the right thing to move out of your home because you're going to increase the amount of tax that you're going to have to pay.”

Mr Tesolin strongly opposed the idea and said an investment property should ideally never have been lived in.

“I would recommend purchasing a property with the intention of making it an investment,” he said.

“Buy when the market isn’t at its peak, so that the rent return can cover the mortgage.

“Additionally, when you buy a property with the intention of making it an investment, you can more thoroughly explore your subdivision options and ensure the property has room for a granny flat for that second rental income.”

Ms Natoli said people should hang onto property wherever they could, and if they can turn it into an investment property, do it.

“I'm a big advocate of holding property as an investment class and I think there’s no point in selling a property if it's not going to cost you anything, or if it's going to cost you very little, to hold onto it.”

Savings.com.au’s two cents

There’s a big difference between an investment home and the home you live in.

There’s no rules or laws saying you can’t turn your home into an investment property, but you need to consider if somebody else would like to live there and if it has any potential for capital growth.

If not, it may be better to stay put, or sell up.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan