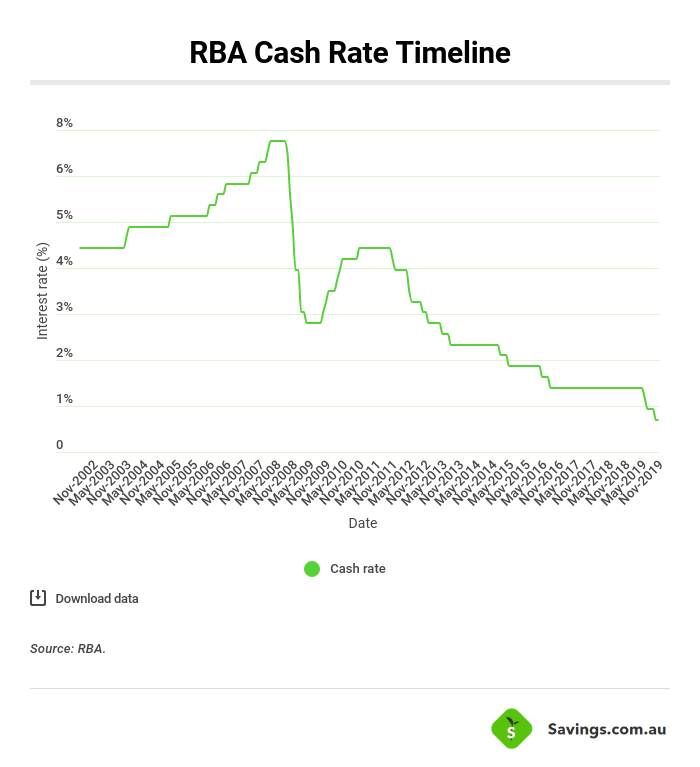

Australia’s central bank decided to keep the cash rate unchanged at 1.00% in its September meeting today, following another hold in August and two 25 basis point cuts in June and July.

RBA Governor Philip Lowe said in his statement that growth is expected to strengthen over the next couple of years.

“The outlook is being supported by the low level of interest rates, recent tax cuts, ongoing spending on infrastructure, signs of stabilisation in some established housing markets and a brighter outlook for the resources sector,” he said.

“The main domestic uncertainty continues to be the outlook for consumption, although a pick-up in growth in household disposable income and a stabilisation of the housing market are expected to support spending.

“Mortgage rates are at record lows and there is strong competition for borrowers of high credit quality.”

According to Mr Lowe, interest rates could be set to drop further if necessary.

“It is reasonable to expect that an extended period of low interest rates will be required in Australia to make progress in reducing unemployment and achieve more assured progress towards the inflation target,” he said.

“The Board will continue to monitor developments, including in the labour market, and ease monetary policy further if needed to support sustainable growth in the economy and the achievement of the inflation target over time.”

This was the most expected outcome prior to the decision – The Australian National University RBA Shadow Board reported a 71% expectation of a rate hold.

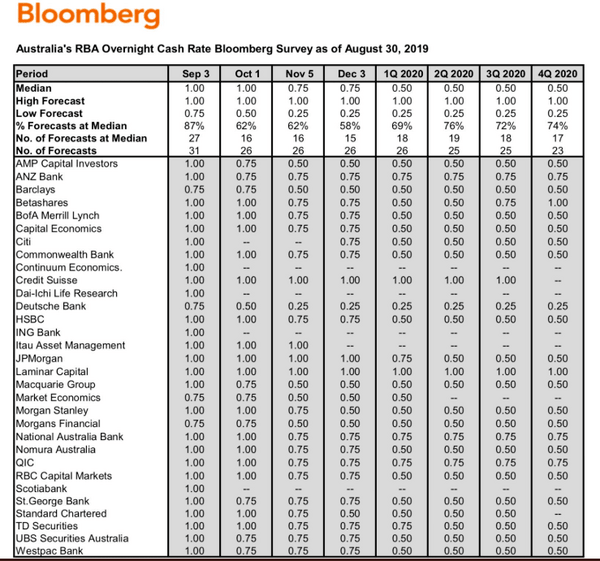

Furthermore, just four of the 30 economists surveyed by Bloomberg predicted a rate cut to 0.75% in September.

The latest two rate cuts in June and July led to a bounce in property prices according to CoreLogic data, particularly in Sydney and Melbourne.

The 1.6% and 1.4% monthly value increases in Sydney and Melbourne were the biggest rises seen since April 2017, and CoreLogic research director Tim Lawless said this was likely a key topic of conversation during the RBA’s board meeting.

“Clearly housing market conditions are responding to lower interest rates as well as the recent loosening of loan serviceability rules from APRA and the positive influence of the stable federal election outcome,” Mr Lawless said.

“The recent step-up in the pace of value growth is likely to raise some concern that the lowest mortgage rates since the 1950’s is fuelling renewed housing market exuberance at a time when household debt remains around record highs.

“High levels of household debt are manageable while interest rates are very low, however if debt levels remain elevated when interest rates eventually rise, the risk is that households will need to dedicate more of their income towards servicing their debt and less towards spending.”

According to Mr Lawless, continued housing value acceleration in the coming months could lead to credit policy being tightened to try to keep a lid on household debt.

“Limiting lending to borrowers on high debt to income ratios could be one option, or introducing hard limits on high LVR lending could be another mechanism that would reduce the risk of a further build-up in household debt whilst at the same time allow borrowers to access housing credit and take advantage such low interest rates,” he said.

Many prominent economists predict the cash rate to plummet by a further 50 basis points by the first quarter of 2020, with at least one cut expected to occur before 2019 is out.

There are even those who believe we could soon see an interest rate of 0.25% by the end of next year.

Don’t wait to switch

There may not be too many home loan providers dropping rates this month thanks to the lack of a rate cut, but Mortgage Choice CEO Susan Mitchell’s advice to borrowers is to not wait to be offered a better deal from your lender, because “it won’t happen”.

“The RBA may have held the cash rate this month but we have seen a 50 basis point cut to the cash rate since June, which has made the interest rate environment extremely competitive,” Ms Mitchell said.

“Lenders are fiercely competing for new customers, which puts borrowers in a great bargaining position if they are prepared to switch lenders.”

Ms Mitchell also said the current market offers great opportunities for all sorts of buyers, including first home buyers and those looking to refinance.

“With home loan interest rates at levels not seen since the 1950s and dwelling values finding a floor in some capital cities, those who wish to get their foot on the property ladder should speak to their local mortgage broker to put their best foot forward when preparing and submitting a home loan application.”

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Bernadette Lunas

Bernadette Lunas

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Brooke Cooper

Brooke Cooper