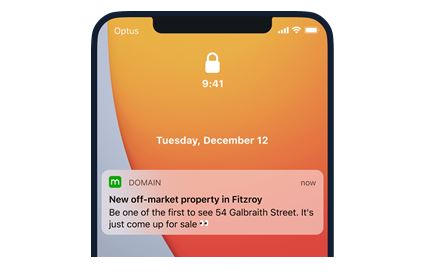

Available now for properties in Victoria, New South Wales and Queensland, the alerts give house-hunters early access to properties that match their search criteria before they're officially listed on Domain.

Looking to compare low-rate, variable home loans? Below are a handful of low-rate loans in the market.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Jason Chuck, Group Director, Consumer at Domain, said the alerts addressed many of the common pain points buyers and sellers face throughout the traditional property journey.

"Too often, buyers miss out on properties they love. Off-market properties give buyers a competitive edge by helping them get in early," Mr Chuck said.

"Buyers can preview, inspect and make an offer before other buyers.

“For sellers, it removes the downtime between when your property is signed with an agent, and the weeks before it is officially listed.

"Instead of waiting weeks until the paperwork, marketing and photography is ready to officially list, you can start reaching high-intent buyers within days and often hours from signing with an agent. "

Buying 'off-market', also known as a 'silent sale' or 'hidden listing', refers to purchasing a property that hasn't yet been widely advertised.

To sign up to the service, create a property alert on Domain, enter what you're looking for and become a Domain member and you'll get off-market properties delivered to you via email and app notifications.

Source: Domain

Mr Chuck said the notifications would help savvy buyers going into what was expected to be a bumper spring selling season.

"The last six months have brought with it unfamiliar territory and while COVID sent buyer demand into hiatus, activity from people likely to buy has rebounded in all capital cities apart from Melbourne," he said.

"In fact, it’s significantly higher compared to last year in these cities, with many looking to the outer suburban areas.

"Competition is tough so any off-market edge buyers and sellers can have is important.”

Domain launches new tool for agents

Domain has also launched a tool for real estate agents to match with buyers who know what they want and are looking to nab a quick sale.

'Early Access' matches high-intent property seekers with off-market properties in close to 30 minutes after a sales authority has been finalised and all documentation has been uploaded.

The tool is designed to drive competition, build early momentum and allow potential sellers to list their property with minimal marketing investment while also gaining valuable market insight.

Domain Group Director Commercial Tony Blamey said Early Access put more momentum behind the property from the very first step of the selling journey.

“Agents and vendors can gain good quality price feedback in uncertain times by instigating high intent property seeker interest early," Mr Blamey said.

"These insights then play a crucial role in understanding the market conditions to inform the broader marketing campaign once the property is officially listed.”

Joe Ledda, Director at Hocking Stuart, said his agency had already seen the benefits of Early Access and was positive about how it will help the sellers and buyers alike.

"Early Access helps us reach buyers we haven’t been able to reach before. We’ve used it on a few properties already and one received 10 enquiries, and that’s even before it was listed,” Mr Ledda said.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!