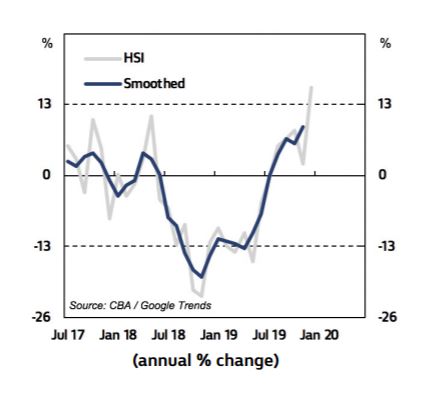

The latest Commonwealth Bank (CBA) Household Spending Intentions Series data (HSI) showed home buying intentions moved higher again in December after moving up in November.

Based on CBA'S own household transactions data and Google Trends analysis, the series suggests household spending intentions are now at a record high.

Chief Economist Michael Blythe said the data confirms dwelling prices should continue to rise in the first half of 2020 after a strong finish to 2019.

The improvement in HSI home buying intentions also suggests the economic drag from falling residential construction should be nearing its end.

"Past cycles show that leading indicators like building approvals turn about three months after home buying intentions start to lift," Mr Blythe said.

"A bottoming in the construction cycle would remove a major growth drag on the economy, and also helps retailing.”

CBA's data reflects a trend seen in last week's November lending indicators data from the Australian Bureau of Statistics (ABS), which showed lending commitments rose 1.8% that month.

Total Australian housing loan commitments rose to $18.59 billion, with owner-occupiers the key driver of the rise, accounting for $13.35 billion of that figure.

ABS Chief Economist Bruce Hockman said loan commitments for owner occupier housing rose 1.6%, representing a record sixth straight month of growth.

“The value of new loan commitments for investor housing also rose in November, up 2.2 per cent, however, over the longer term this series remains down on recent peaks in activity," Mr Hockman said.

Experts predict lending commitments to continue to rise if the Reserve Bank cuts the cash rate again in early February.

Aust housing finance commitments up solidly again in Nov, consistent with the pick up in the property mkt.

— Shane Oliver (@ShaneOliverAMP) January 16, 2020

This data relates to the flow of new lending whereas credit data relates to the total stock of debt, which is lately impacted by rapid debt paydown.

(Bloomberg table) pic.twitter.com/sKSqdAyG81

Commbank's data also suggests the wealth effect - the theory that people spend more as the value of their assets rises - is starting to re-emerge.

There are some early signs of a ‘wealth effect’ from the housing market supporting spending on motor vehicles, albeit from a very low level, as well as travel and entertainment,” said Mr Blythe.

“A positive wealth effect could help other forms of spending as well.

"In December, travel spending intentions continue to trend higher and entertainment spending intentions are improving at a respectable pace."

According to CBA's results, Motor Vehicle spending intentions are up, as are intentions for entertainment and travel.

Intentions to spend on education and health/fitness are down, while retail spending intentions are flat.

This flat trend, according to CBA, remains a disappointing outcome relative to the stimulus applied via interest rate cuts, tax rebates and the turn up in dwelling prices.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Harrison Astbury

Harrison Astbury