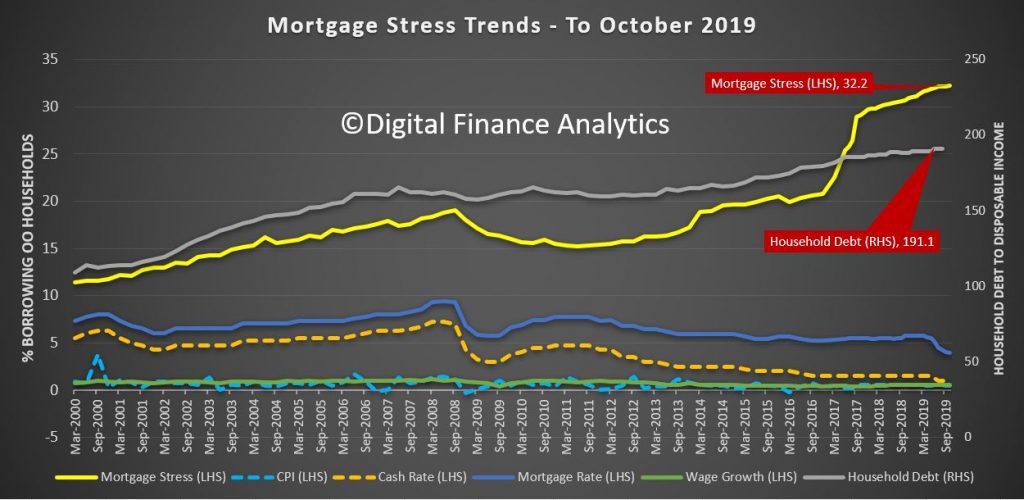

The latest Digital Finance Analytics (DFA) poll found an extra 70,000 households fell into mortgage stress in October following a slight relaxation in September.

This pushes the total number of stressed households at 1.07 million, or 32.2% of all households.

According to DFA, mortgage stress is assessed on a cashflow basis, where income and outgoings for households (including mortgage repayments) are measured.

There are different definitions for mortgage stress – some define it as 30% or more of take-home pay being spent on mortgage repayments – but DFA defines it as when household cashflows are negative.

Stressed households, according to DFA principal Martin North, are more likely to draw upon their savings, put money on a credit card or simply hunker down and not spend anything.

Mr North said there was a respite in mortgage stress levels in September off the back of recent tax cuts and tax refunds.

“Household debt is at record highs, and while costs are still rising, incomes are not in real terms. There was a spate of refinancing which helped some households, but the bulk of these were not in stress in the first place,” Mr North said.

“The rejection rates for those in mortgage stress are and remain consistently higher.”

Stress is based on a person’s current circumstances, which, according to Mr North, is partly why Monday’s weak 0.2% growth in retail sales – the weakest seen since the 1990’s recession – was so poor.

“We also examined the expense drivers of stress from our surveys – these vary across the segments with power prices, school fees and childcare, all significant, as well as housing costs overall,” Mr North said.

“This is likely to drive stress higher unless real wages start to improve, but given the current economic outlook that appears unlikely for now.”

Who’s the most stressed out?

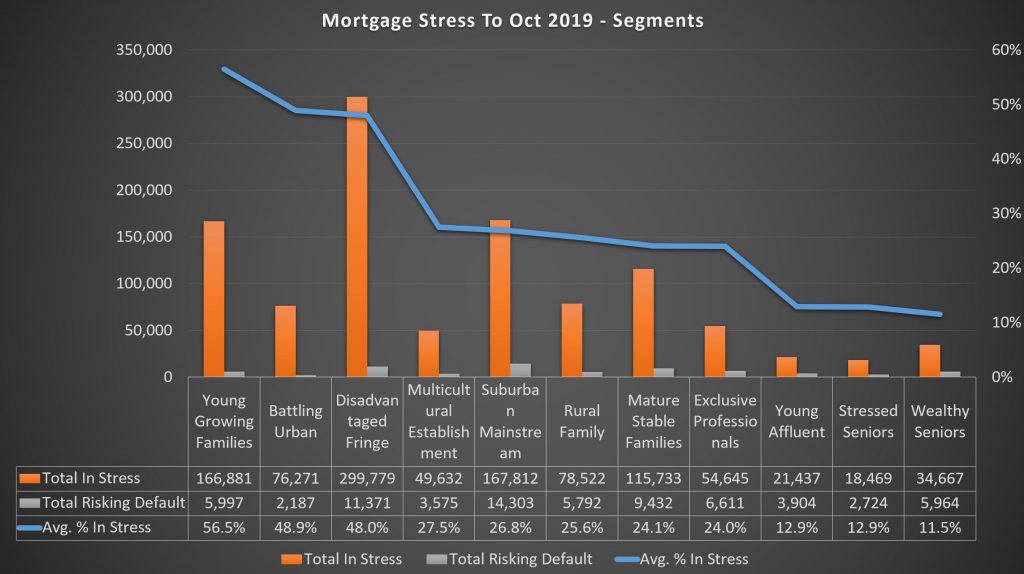

DFA analysed a range of different household types in its survey, from rural families to wealthy seniors.

Across the 11 different household segments, more than half (56.5%) of young growing families are under stress, which is equivalent to more than 166,000 households.

Urban battlers are at 48.9% stress levels (76,000 households), while even the most affluent segment – the exclusive professionals – are facing an average stress level of 24% (54,600 households).

“In other words, mortgage stress is appearing in every sector of society,” Mr North said.

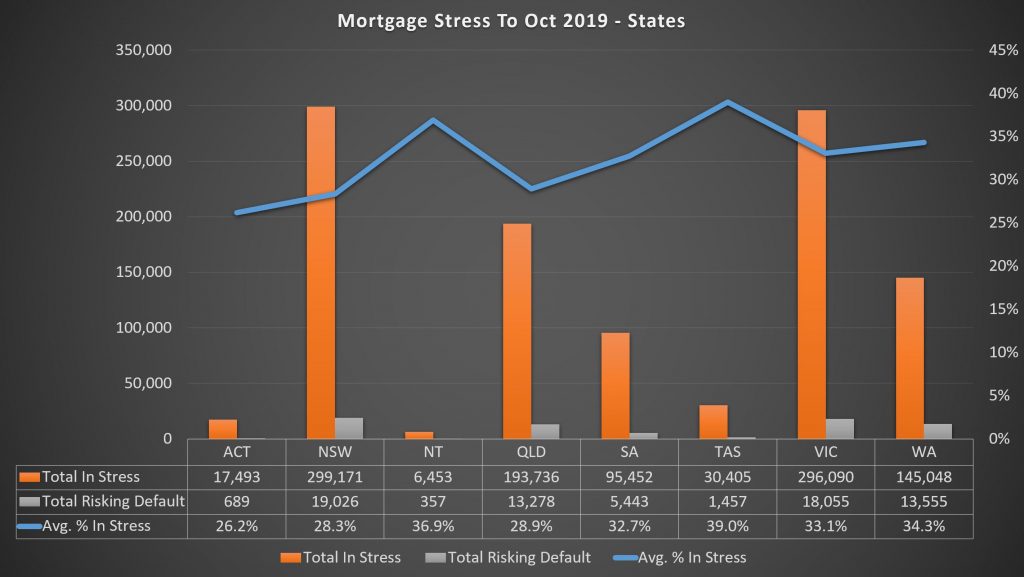

Across the states, the highest proportion of households in stress are located in Tasmania (39%) and Northern Territories (36.9%), while New South Wales has nearly 300,000 households in stress (28.3%) while Victoria has 296,000 (33.1%).

Almost half of those living in the urban region and fringe areas were also reported to be in stress.

Household confidence falls

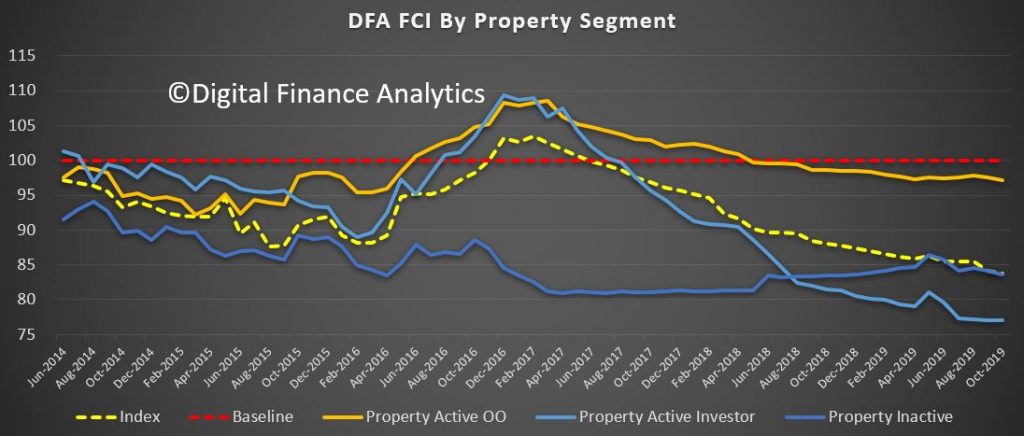

The latest DFA Household Financial Confidence Index for October is at the lowest ever point of 83.7.

According to DFA, the falls were “widespread” across each of the property segments it considers, which includes owner-occupied households and active as well as inactive investors.

“The falls were widespread across our property segments, with investors still way down, under the pressure from low net rental yields, the need to switch to principal and interest from interest only, and worries about construction defects,” Mr North said.

“Owner-occupied households were less negative, but those renting continue to struggle with higher levels of rental stress.”

One of the biggest reasons for shaky confidence is the increased cost of living: 91% of the 50,000+ households surveyed reported a higher cost of living compared to a year ago.

“There was a small fall in the costs of power, and fuel, but not enough to offset rises elsewhere,” Mr North said.

“Mortgage interest rate falls were blotted up quickly, and the tax refunds where they were received were much lower than people had been expecting.”

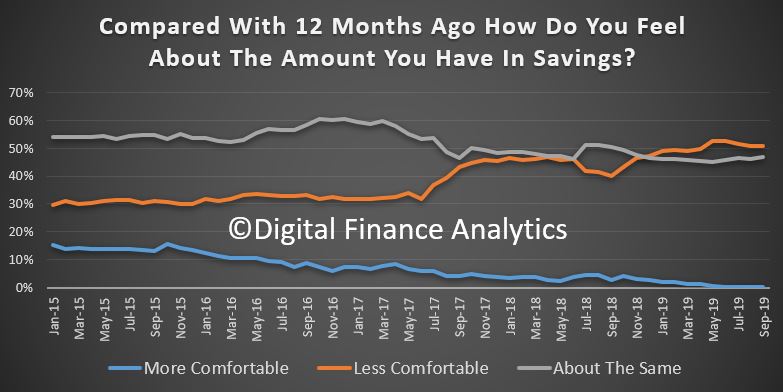

Mr North also said 48% of households are “less comfortable” than they were a year ago as well.

“Some households are deleveraging (paying down debt), while others are more concerned about the amount they owe from mortgages to credit cards and on other forms of credit,” he said.

“Lower interest rates are only helping at the margin.

“Savings are under pressure from several fronts. Some households are tapping into savings to keep the household budget in check – but that will not be sustainable.”

DFA found 27% of households have no savings at all and would have difficulty pulling together $500 in an emergency.

“The government should bring forward tax cuts”

Westpac Chief Economist Bill Evans says the government could do more to boost domestic demand and improve consumer confidence by bringing forward the legislated tax cuts to 2020.

According to Mr Evans, this week’s weak retail sales figures are supported by Westpac’s own Consumer Confidence Index, which slumped by 5.5% in October to a four year low of 92.5/100.

“We assess that the very low interest rates which the Reserve Bank has had to implement are now impacting confidence as consumers equate low interest rates with disturbing weakness in the economy,” Mr Evans said.

“The Reserve Bank has recognised that issue and is trying to balance the impact of lower rates on confidence with the benefits of lower rates through the traditional channels of lowering the AUD and boosting households’ disposable income.”

To boost demand, Mr Evans says, it is better to accelerate the personal income tax cuts which the government has already legislated for July 2022.

“Australia needs fiscal policy to complement monetary policy to boost domestic demand. The Federal Government is already committed to further structural personal income tax cuts,” he said.

“These can be brought forward from July 2022 to July 2020 if phased in over 2 years without posing an obvious risk to the Government’s commitment to a series of budget surpluses.

“As the policy debate around the May 2020 Federal Budget evolves it is to be hoped that the Government recognises the benefits to the economy of an immediate phased in introduction of the personal income tax cuts.”

As things stand at the moment, ‘phase two’ of the government’s planned tax cuts will result in moving income tax thresholds:

- Households will move from 19% to 32.5% tax rate when they hit a $45,000 yearly income (previously $37,000)

- Households will move from 32.5% to 37% tax rate when they hit a $120,000yearly income (previously $90,000)

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Emma Duffy

Emma Duffy