Up's owner occupier variable rate will drop 5 basis points down to 5.45% p.a. (5.45% p.a. comparison rate*).

Up - a brand of Bendigo and Adelaide Bank - has a 'No Haggling' policy, which means the variable rate is the same for all customers, so that rate will apply for all new and existing customers.

Only a handful of lenders in Savings.com.au's database have an advertised variable rate lower than 5.45% p.a. - and none of those products allow lending up to 90% Loan to Value Ratio, as Up does.

Up also includes an offset account on this product, typically an extra cost.

However with the RBA widely expected to cut the cash rate on 12 August, variable rates could be reduced by at least 0.25% across the board, so customers will be waiting to see if this affects whether Up will pass on any rate cut in full.

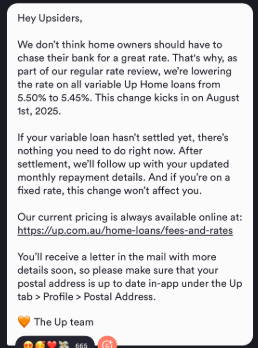

The message Up customers received on Thursday

How much will my repayments go down?

Here's how this cut will affect Up customers with various sized loans, assuming a 30 year loan term:

| Outstanding loan amount | Estimated minimum monthly repayments at 5.50% p.a. | Estimated minimum monthly repayments at 5.45% p.a. | Monthly savings | Annual savings |

|---|---|---|---|---|

| $200,000 | $1,135.58 | $1,129.31 | $6.27 | $75.24 |

| $400,000 | $2,271.16 | $2,258.62 | $12.54 | $150.48 |

| $600,000 | $3,406.73 | $3,387.94 | $18.79 | $225.48 |

| $800,000 | $4,542.31 | $4,517.25 | $25.06 | $300.72 |

Worked out using the Savings.com.au repayments calculator

A mid-year gift to customers?

Lenders rarely adjust variable rates for existing customers without a cash rate cut so this surprise announcement has been welcomed by Up home loan holders.

It might not be entirely a gesture of goodwill though - late last year Up did the opposite and increased its variable rate 0.05% out of cycle.

This change could be seen as simply rolling back that adjustment, which Bendigo CEO Richard Farrell said was "testing price elasticity".

Elasticity is a measure of how demand responds to changes in price, so that increase was likely to see how many customers refinanced away from Up after it slightly increased rates.

Savings.com.au has reached out to Up to clarify the rationale behind this latest rate cut.

Any chance the RBA doesn't cut?

Despite this slight rate relief many Up customers will likely still be paying close attention to the outcome of the August monetary policy meeting, now just over a fortnight away.

Most economists are expecting the RBA to cut the cash rate next month by at least 25 basis points.

As borrowers will remember from July though, the RBA isn't afraid to shock everyone and the outcome will still likely be contingent on the June quarter inflation figures, set for release next week.

Unemployment is up and the monthly price information suggests inflation continues to moderate, though at a recent speech at the Anika Foundation, RBA governor Michele Bullock played down the 'shock' labour force figures, saying it was in-line with expectations.

Nonetheless there may be some nervous mortgage holders in the lead up to 30 July, when the Q2 numbers drop.

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

|

Picture by Ethan Robertson on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!