The Australian Taxation Office (ATO) recently cracked down on car-related deductions, limiting the number of methods that can be used to claim deductions.

CEO of peer-to-peer car sharing platform Car Next Door Will Davies says many people still trip up over car-related expenses, and can even end up paying up to $4,200 in fines for providing ‘misleading information’ in their tax returns.

“Many car owners don’t know about all of the deductions they could be claiming when they rent their car out,” Mr Davies said.

In the market for a new car? The table below features car loans with some of the lowest fixed and variable interest rates on the market.

| Lender | Car Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Interest Type | Vehicle Type | Maximum Vehicle Age | Ongoing Fee | Upfront Fee | Total Repayment | Early Repayment | Instant Approval | Online Application | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.99% p.a. | 7.12% p.a. | $580 | Variable | New | No Max | $8 | $400 | $34,791 |

| Promoted | Disclosure | ||||||||

6.52% p.a. | 6.95% p.a. | $587 | Fixed | New, Used | No Max | $0 | $350 | $35,236 |

| Promoted | Disclosure | ||||||||

6.28% p.a. | 6.28% p.a. | $584 | Fixed | New | No Max | $0 | $0 | $35,034 |

| Promoted | Disclosure |

Renting-out personal vehicles is becoming more and more prevalent thanks to share-economy apps like Car Next Door, and Mr Davies said the clarification around car sharing tax requirements comes at a time of significant growth.

“We have seen a dramatic rise in the last 18 months with the number of members signing up to borrow cars tripling,” he said last year.

“The number of bookings per vehicle is also up 40 per cent.”

Now, with Australia in a recession and unemployment rising, many Australians are looking to side-hustles to pay their bills, such as renting out their car.

Mr Davies said the biggest change people can make use of during this pandemic is increase the sharing or business use percentage to get more deductions as a result.

“By declaring your income and claiming deductions you’re actually likely to be better off than if you just ignore it and think the ATO won’t notice your side income,” he said.

To help people avoid paying that $4,200 fine and to maximise their tax deductions, whether their car is used as a rental or if its used for work, Mr Davies has shared the seven biggest mistakes people make when claiming car-related deductions.

Don’t claim your normal travel to and from work.

“This isn’t claimable, even if you do a small work-related task like picking up the mail. Even if there’s no public transport available when you head home after working overtime, it’s not claimable either.”

Carrying equipment not-required by your employer is a no-go.

“If you can’t prove this is required by your employer or there’s no safe place to store your equipment at work, then it’s not claimable.”

Salary-sacrificing agreements are not claimable

“Be careful not to ‘double dip’ on car expenses – you can’t claim expenses that have already been paid for by your employer, including salary sacrificing arrangements.”

Always keep records

“One of the most common mistakes car owners make is claiming car costs using the ATO’s cents-per-kilometre method, without the records to back them up.

“You can claim up 5000km a year at 68c per kilometre in 2019 tax year, but this is not a ‘free pass’ – you must be able to provide documentation.

“If you rent your car out, the car-share platform should be able to provide you with a summary of all of the kilometres driven during bookings, to make it easy to claim.”

Don’t forget depreciation

“Many car owners forget to include depreciation when they’re adding up their annual car expenses at tax time.

“If you use your car for work or rent it out, ask your accountant about how you should calculate depreciation as it may add thousands to your allowable deductions.”

Claim all allowable expenses for renting your car out

“Any money you earn from renting out your car is considered taxable income and must be declared on your tax return, but you can also claim expenses for the portion of your car costs that relate to the rental activity, or a simple 68 cents for every kilometre your car is driven by borrowers.”

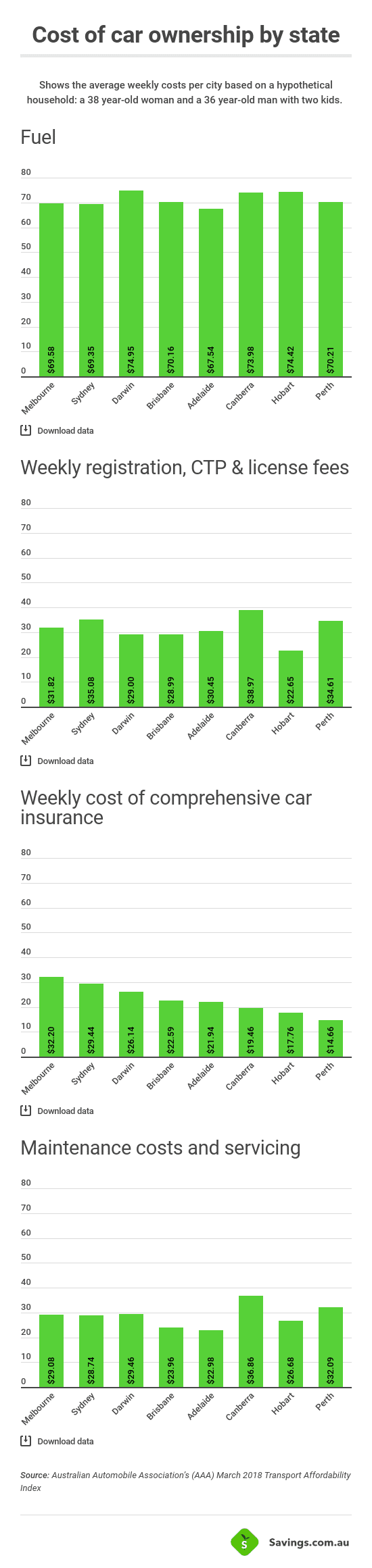

Mr Davies says the expenses that can be claimed while renting a car out include the entire membership fee as well as the common car expenses, such as registration, insurance, fuel and servicing costs.

Getting the rules for cars and vans mixed up

"You’d be forgiven for not knowing that there’s a difference, but the ATO has different rules for claiming deductions if you rent out a panel van, ute or other small cargo vehicle than if you’re renting out a car."

As a general rule, the following things are tax-deductible on work-related car expenses, according to both Car Next Door and the ATO:

- Carrying tools or other equipment needed for your job

- Travelling from home to an alternative workplace (like a client’s office) then back to your main workplace or home

- Travelling to meetings, conferences or events required by your employer

- Travelling between two separate workplaces where you are employed and delivering or picking up items, as required by your employer.

Plus, if you rent your car out you can claim your entire membership fee, plus some or all of your biggest expenses like registration, insurance, servicing, cleaning, depreciation and fuel.

Tax returns for the 2019/20 financial year can be handed in as soon as 1 July 2020, and have a deadline of 31 October, or May 2021 if you're using a tax agent.

Disclaimers

Savings.com.au does not provide tax advice. This material has been prepared by Savings.com.au and is for informational purposes only, and is not intended to provide, and should not be relied on for tax advice.

For tax advice relevant to you, visit the ATO or consult an independent tax advisor.

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan