This is according to RACQ’s monthly fuel price report, which found Brisbane was a close second and had the most expensive fuel of the five large capitals at 154.7 cpl, up 10.3 cpl from September.

The data from the average fuel prices in Perth, Darwin, Canberra, Melbourne, Adelaide and Sydney were all cheaper than Brisbane:

- Perth was cheaper by 10.0 cpl

- Darwin was cheaper by 7.6 cpl

- Canberra was cheaper by 6.6 cpl

- Melbourne was cheaper by 5.2 cpl

- Adelaide was cheaper by 5.1 cpl

- Sydney was cheaper by 2.6 cpl

Hobart diesel users were punished at the bowser as well, paying 160.8 cpl, 6.3 cpl more than the second most expensive capital, Canberra.

Perth was the cheapest capital for unleaded at 144.7 cpl, while Darwin had the cheapest diesel at 145.8 cpl.

| City | Average ULP Price (cpl) | ULP Retail Margin (cpl) | Average Diesel Price (cpl) | Diesel Retail Margin (cpl) |

| Brisbane | 154.7 (10.3) | 17.9 (8.1) | 149.6 (3.8) | 10.8 (2.6) |

| Adelaide | 149.6 (0.9) | 13.2 (-1.4) | 149.0 (2.3) | 10.3 (1.1) |

| Canberra | 148.1 (4.8) | 12.8 (2.8) | 154.5 (2.0) | 16.1 (0.9) |

| Darwin | 147.1 (7.4) | 6.3 (5.4) | 145.8 (-0.5) | 3.5 (-1.4) |

| Hobart | 155.4 (3.6) | 13.4 (1.6) | 160.8 (1.5) | 16.5 (0.4) |

| Melbourne | 149.5 (3.5) | 13.7 (1.2) | 149.3 (3.1) | 10.9 (2.0) |

| Perth | 144.7 (3.4) | 9.0 (1.4) | 149.0 (2.4) | 10.7 (1.5) |

| Sydney | 152.1 (7.5) | 16.8 (5.5) | 150.2 (2.7) | 11.8 (1.6) |

Source: RACQ

Club spokesperson Renee Smith said price increases were a result of a shortening of the price cycle leading to two high points in October.

“Price cycles usually last for about a month, but the last cycle was only about 23 days long, which meant we saw two peaks last month,” Ms Smith said.

“Both hikes were led by the major fuel companies, BP, Coles, Caltex and Woolworths, who’re all too often the first to hike and lift their prices to the highest levels.

“The good news for drivers was it took longer for retailers to jack up the costs, and prices fell back down quicker.

“We saw the small chains and independents holding lower prices for longer, meaning drivers had greater access to cheaper fuel.”

Ms Smith reminded drivers to do their research and look for alternatives to the bigger players.

“We’ve never had so much technology available through price comparison apps like RACQ’s Fair Fuel Finder, which allow us to find the cheapest retailers,” she said.

“By shunning the high-priced retailers, fuel companies will be forced to compete for business and lower their prices.”

Toyota the first choice for new car buyers

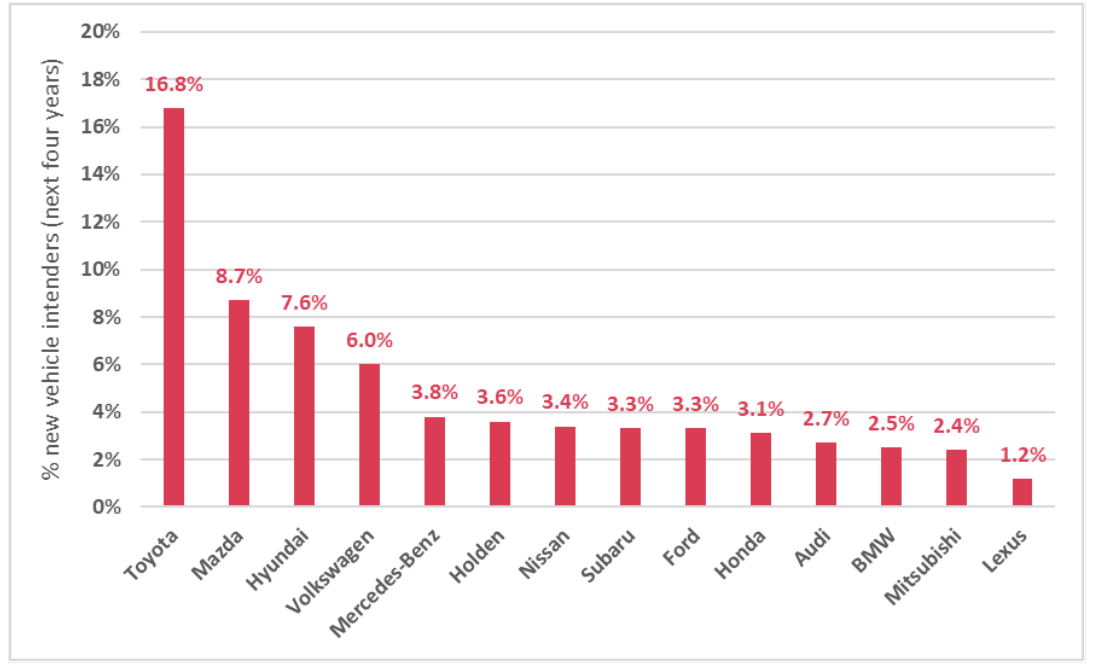

New data has found that Toyota is the most popular vehicle brand among Aussies who intend to purchase a new car in the next four years.

Roy Morgan’s latest Automotive Leading Indicators report found as of September 2019, the percentage of Australian ‘new vehicle intenders’ planning on purchasing a Toyota was 16.8% (322,000).

This was followed by Mazda with 8.7% (168,000), Hyundai with 7.6% (145,000) and Volkswagen at 6% (115,000).

New vehicle buying intentions by brand

Source: Roy Morgan

Roy Morgan CEO Michele Levine said the feedback of this group is vitally important to car manufacturers.

“Roy Morgan’s new vehicle buying intention data is a powerful indicator and feedback tool for car manufacturers,” Ms Levine said.

“Not only does it provide positive feedback on current business strategy and advertising campaigns, but it also allows manufacturers to anticipate future sales trends.

“Toyota should be very pleased by this latest data, which shows that for a considerable proportion of Australians soon to be on the hunt for a new set of wheels, it is at the top of their list and well ahead of the competition.”

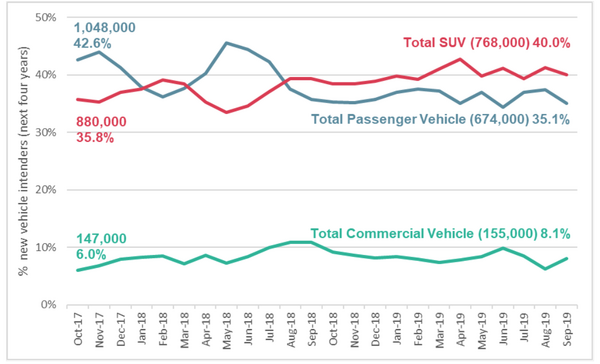

Looking at types of vehicles Australian intenders are set on buying, SUVs are the most popular, with 40% (768,000) planning an SUV as their next purchase.

This is followed by passenger vehicles at 35.1% (674,000) and commercial vehicles at 8.1% (155,000).

“We’ve all seen the growth in popularity of SUV’s on the roads around us, but what this data tells us is that we can expect SUV numbers to continue to increase,” Ms Levine said.

“The rise in SUVs has come at the expense of the standard passenger vehicle.”

New vehicle buying intentions by segment

Source: Roy Morgan

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan