The Federal Chamber of Automotive Industries’ (FCAI) new vehicles sales figures for September show a 6.9% decline of new car sales in September 2019 compared to September 2018.

This is a decline of 6,530 vehicles.

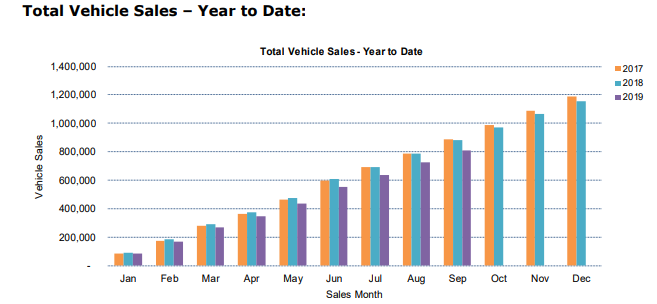

Year-to-date (January 2019 – September), a total of 811,464 new vehicles were sold, a decrease of 69,541 vehicles, or 7.9% over the same period last year.

FCAI Chief Executive Tony Weber said these slower sales are in line with the broader economic environment in Australia.

“Of particular concern to the industry is the restrictive regulatory lending conditions currently facing consumers,” Mr Weber said.

“The question has to be asked – are these results telling us we have made it too difficult for people to finance basic purchases in today’s Australia?”

Responsible lending and access to credit – such as car loans – have been a hot topic lately, with the Treasurer himself pushing particularly hard against overly stringent lending standards.

“It’s in everyone’s interest that the aspirations of hard-working families are not collateral damage in this regulatory process,” Treasurer Josh Frydenberg said at a property summit last week.

“If responsible lending laws are applied too stringently, they will also negatively impact consumer behaviour.

“Clearly, the risk that the provision of credit may cause substantial hardship to some should not result in a significantly reduced ability to access credit by the vast majority of borrowers.”

September car sales – by the numbers

Toyota was the market leader in September, followed by Mitsubishi and Mazda.

These brands made 15,166, 8,990 and 8,168 sales in September respectively.

Year-to-date, Toyota remains the market leader with 154,515 sales so far in 2019.

| Rank | Car brand | Total sales YTD | Total sales September 2019 |

|---|---|---|---|

| 1 | Toyota | 154,515 | 15,166 |

| 2 | Mazda | 79,057 | 8,168 |

| 3 | Hyundai | 66,489 | 7,245 |

| 4 | Mitsubishi | 64,506 | 8,990 |

| 5 | Ford | 48,604 | 4,783 |

| 6 | Kia | 46,360 | 5,128 |

| 7 | Nissan | 38,343 | 4,651 |

| 8 | Volkswagen | 37,709 | 3,816 |

| 9 | Holden | 34,215 | 2,863 |

| 10 | Honda | 34,210 | 3,404 |

In terms of individual cars, the Toyota Hilux was (as usual) the most popular, with 3,364 individual sales in September.

This is a 22.5% fall from September last year however.

The third most popular car, the Mitsubishi Triton, led Mitsubishi’s charge up the rankings with a 61.6% increase in sales to 3,001.

| Rank | Vehicle | Sep-19 | Sep-18 | % diff |

|---|---|---|---|---|

| 1 | Toyota Hilux | 3,364 | 4,338 | -22.5% |

| 2 | Ford Ranger | 3,116 | 3,228 | -3.5% |

| 3 | Mitsubishi Triton | 3,001 | 1,857 | 61.6% |

| 4 | Hyundai i30 | 2,447 | 2,508 | -2.4% |

| 5 | Mitsubishi ASX | 2,419 | 2,138 | 13.1% |

| 6 | Mazda CX-5 | 2,335 | 1,506 | 56.4% |

| 7 | Toyota Corolla | 2,219 | 2,917 | -23.9% |

| 8 | Kia Cerato | 2,022 | 1,574 | 28.5% |

| 9 | Nissan XTrail | 1,769 | 1,908 | -7.3% |

| 10 | Mitsubishi Outlander | 1,731 | 1,404 | 23.3% |

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!