Macquarie Bank is arguably the biggest bank in Australia outside of the big four. As of March 2025 it holds over $76 billion worth of household deposits, the fifth largest in Australia. It's also growing fast, having overtaken both Bendigo and ING since 2022.

Here's what to know about the retail deposit products Macquarie Bank has to offer.

Macquarie Deposit Products

Macquarie offers a savings account, transaction account and term deposits. All of these products are accessible through the Macquarie Banking App, which has received positive reviews on user friendliness and features.

Macquarie savings account

Macquarie has just a single savings account product, creatively named the Savings Account. It has no fees and also distinguishes itself from other high interest savings accounts with a relatively high base rate, which applies to balances up to $1m. Many of Macquarie's competitors have a very low base rate on their savings accounts, with the maximum interest rates largely consisting of a 'bonus rate' that only applies if certain conditions are met each month - e.g. a minimum deposit or no withdrawals.

Macquarie also currently offers a welcome rate for the first four months. At the time of writing, this is a 35 basis point (0.35%) increase to the ongoing variable rate on balances up to $250k.

To open a savings account with Macquarie, you’ll need to have an existing transaction account under the same name.

Transaction account

Macquarie customers can also earn interest, albeit at a lower rate, on the transaction account. This also has no fees and can be linked to a debit card, as well as the aforementioned savings account. It has no fees for international purchases and also gives you access to the 'Macquarie Marketplace' which could mean a discount up to 12.5% at certain retailers.

Term Deposits

Macquarie also offers a range of term deposit products, with terms from one month to five years. Macquarie TDs have a minimum deposit size of $5,000, and interest rate discounts for more regular interest payments. Early withdrawal requires at least 31 days notice and incurs a penalty and break fees, although this may be waived in cases of financial hardship or medical emergencies.

Getting a Macquarie Bank savings account

Eligibility

If you're interested in opening a savings account or term deposit with Macquarie you'll need to:

-

Be a permanent resident of Australia

-

Be over 12 years old

-

To provide your full name, date of birth, contact details and residential address

-

To provide a valid Australian ID (including drivers licence, passport, Medicare card or birth certificate).

-

To provide your tax file number.

Turnaround time

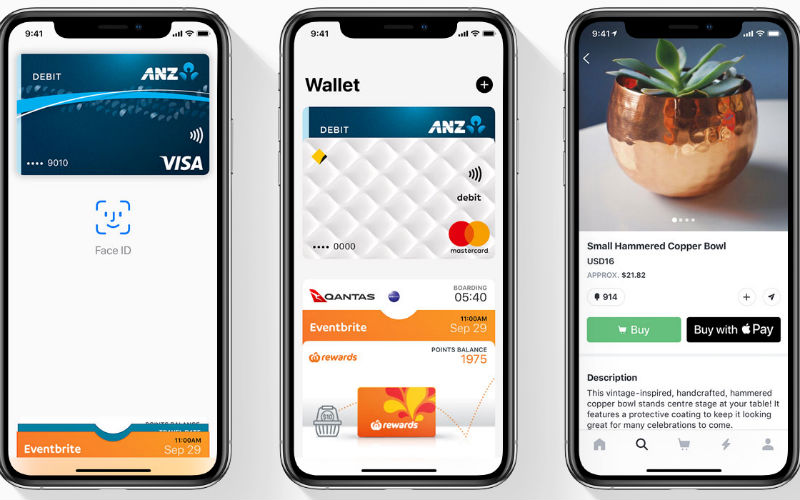

Macquarie Bank has significantly upgraded its digital infrastructure in recent years. Its digital onboarding process is powered by cloud-based technology, which means customers can apply for transaction and savings accounts, have their identity verified and load their debit card instantly to Apple or Google wallet platforms in ‘under a minute’.

Macquarie Bank Savings Account review

"Macquarie delivers a one-two punch with its savings and transaction accounts. Its savings account rate, while not the sharpest, is favoured for having no hoops to jump through, and a high balance cap of $1 million. It also has a competitive four-month introductory rate on balances up to $250,000.

What sets Macquarie apart is the addition of its transaction account, which must be one of the only such products in Australia to bear any semblance of an interest rate.

The Mastercard debit card also features no foreign currency conversion fees, making it a worthy overseas travel companion. Hot tip: If you're in Japan, Mastercards can withdraw for free in 7-Eleven ATMs. The card looks pretty premium, too, sitting in your wallet.

One major downfall of the debit card is it doesn't feature Eftpos, so payments are only routed through Mastercard, which could attract higher merchant fees.

The app is very intuitive to use, and has all you need right at your fingertips with none of the bloated, unnecessary features. Its authenticator app is one of the best-in-business, providing security and verification prompts for online purchases and large transfers, without being intrusive.

Quite often on high-interest savings accounts, there is little incentive to move all your banking across to the institution, but Macquarie certainly challenges that notion. "

-Harrison Astbury, InfoChoice Research Analyst

First published on April 2025

Picture by Micheile Henderson on Unsplash

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan