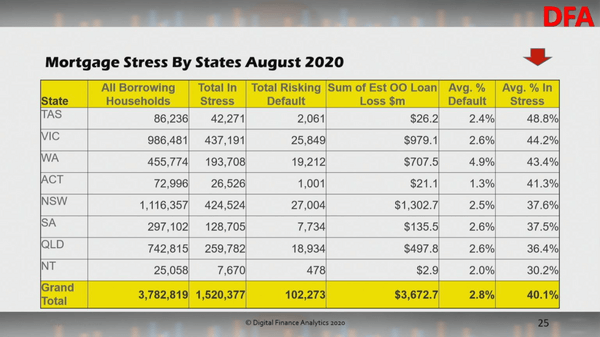

New data from Digital Finance Analytics (DFA) shows that for August 2020, the mortgage stress rate rose to 40.1%, which equals 1.5 million households.

DFA defines mortgage stress as when household cashflows are negative, rather than the more widely used measure of a household paying more than 30% of their income on mortgage or rent.

"Stress is assessed in cash-flow terms, and when money in is not sufficient to cover the costs of the mortgage and other regular outgoings, the household is flagged as stressed," said DFA principal Martin North.

Buying a home or looking to refinance? The table below features home loans with some of the lowest variable interest rates on the market for owner-occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

The figures show that a massive 102,273 households are at risk of defaulting on their mortgages with Tasmania, Victoria and Western Australia leading the way.

In Tasmania, almost half (48.8%) of households are under mortgage stress, making it the most financially stressed state in the country just behind Victoria with 44.2% of households under mortgage stress.

In Western Australia, 43.4% of households are behind or struggling to make their mortgage repayments.

Source: Digital Finance Analytics

Mr North said Stage 4 lockdown restrictions in Victoria could worsen rates of mortgage stress.

"The August 2020 data from our surveys continues to tell a sorry tale of more households feeling the pinch, whether they are mortgaged, renting or investing," Mr North said.

"Within the numbers there was a slid in Victoria in particular reflecting the latest lock down and the rising pressure on business there."

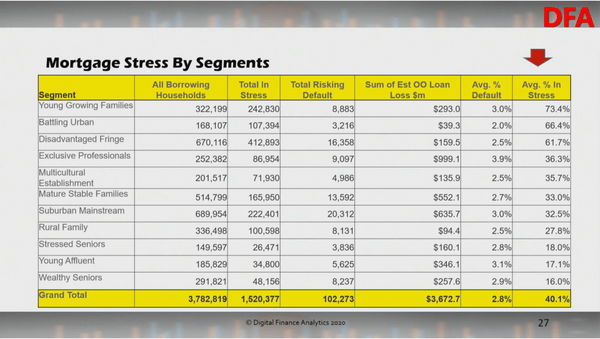

The data found that young growing families and urban households, which includes many first home buyers, were under the most mortgage stress.

Source: Digital Finance Analytics

Rental stress also remains a significant issue, with over 41% of renters (1.7 million households) struggling to afford their rent.

Again, young growing families and urban households were the most impacted, with 74% of young families under rental stress.

The data also found that investors are struggling, with 25% (826,000 households) under water or trying to offload their investment properties as rentals slide and property values decline.

Expect a rise in mortgage defaults, forced sales

Mr North said we could expect to see more mortgage defaults and forced sales.

"Clearly the fiscal cliff, which is now legislated, will push more over the edge. Expect higher default levels over the next few month, more forced sales and less household consumption," Mr North said.

A new report from analyst firm S&P Global has also predicted a rise in mortgage arrears and defaults in the final months of 2020, as the deadline for mortgage deferrals fast approaches. The Australian Banking Association (ABA) has announced it will extend the mortgage deferral period by another four months for customers experiencing ongoing financial difficulty.

S&P Global's mortgage report said the number of mortgage arrears and defaults will largely depend on when mortgage support measures end.

“We expect arrears to begin surfacing in the second half of 2020, and losses to emerge in 2021,” the report said.

“Mortgage arrears performance is meanwhile likely to vary by state and territory, reflecting their different paths to economic recovery.”

The report identified Sydney’s inner, southern and other south west regions, Melbourne’s east and the Mornington Peninsula and Queensland’s Gold and Sunshine Coasts as "hardship hot spots" as those areas have been more exposed to lockdowns and drops in tourism.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Rachel Horan

Rachel Horan