The second iteration of Switzer Financial Group's "Switzer Fear, Greed & Hope survey" shows over half of Australians (62.8%) surveyed would prefer to invest in stocks over property, term deposits and other investments.

The same number (62.8%) of stock investors believe now is a good time to invest in the sharemarket.

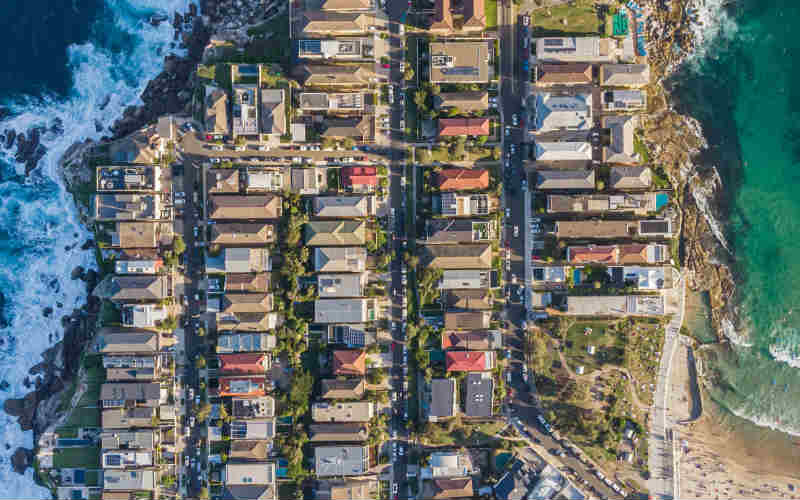

Switzer Financial Group Director Peter Switzer said the results fly in the face of Australia's obsession with property.

"Even though Aussies are often portrayed as addicted to property, the coronavirus crash has seen 63% of those investors surveyed prefer stocks, while only 10% think bricks and mortar looks attractive," Mr Switzer said.

"And those so worried that they only want to invest in government-guaranteed bank term deposits numbered 10%, which suggests 90% aren’t spooked by the coronavirus economic threats."

The survey found that 54% of the 3,000 respondents think property prices will fall in the coming 12 months, compared to 66% who think share prices are on the way up.

According to the survey, 37.4% of investors believed the stock market would crash in 2021 when surveyed in February.

Now, 40.7% believe the stock market will crash in 2025 or later.

When asked what stocks they would invest in, Australians said they think CSL and Macquarie Group are the stocks that will perform best over the next 12 months.

“This shouldn’t really be surprising as both these companies are world class and serious export-income earners," Mr Switzer said.

"But it indicates that so-called ‘mums and dads’ (or retail) investors are becoming more sophisticated analysts of the share market.

"I suspect the combination of online trading and the escalation of financial education, especially around stock market trading, have created a smarter group of retail investors who might have ‘eaten the lunch’ of the smarties who run funds."

The survey found that 39.8% of respondents said they haven't changed their investing strategy due to COVID-19, while 38.7% have become more conservative and 21.5% have become more aggressive as a result.

Bank stocks have surged this week, with shares in NAB up +4.7%, followed by ANZ (+4.5%), Westpac (+4.4%) and Commonwealth Bank (+2.2%).

Similar gains were seen in smaller banks, with shares in Bendigo and Adelaide Bank up +4.1%, Bank of Queensland (+2%), Macquarie (+1.6%) and AMP (+2.7%).

“This great move up for stocks out of the bear market is a welcome trend that tells us that there’s an expectation that our economic future is looking miles better today than it did one, two and six weeks ago,” Mr Switzer said.

The survey featured more than 3,000 respondents made up of middle and mature aged investors who are either full-time workers or retirees.

It should be noted that the majority of this database prefer to invest in stocks.

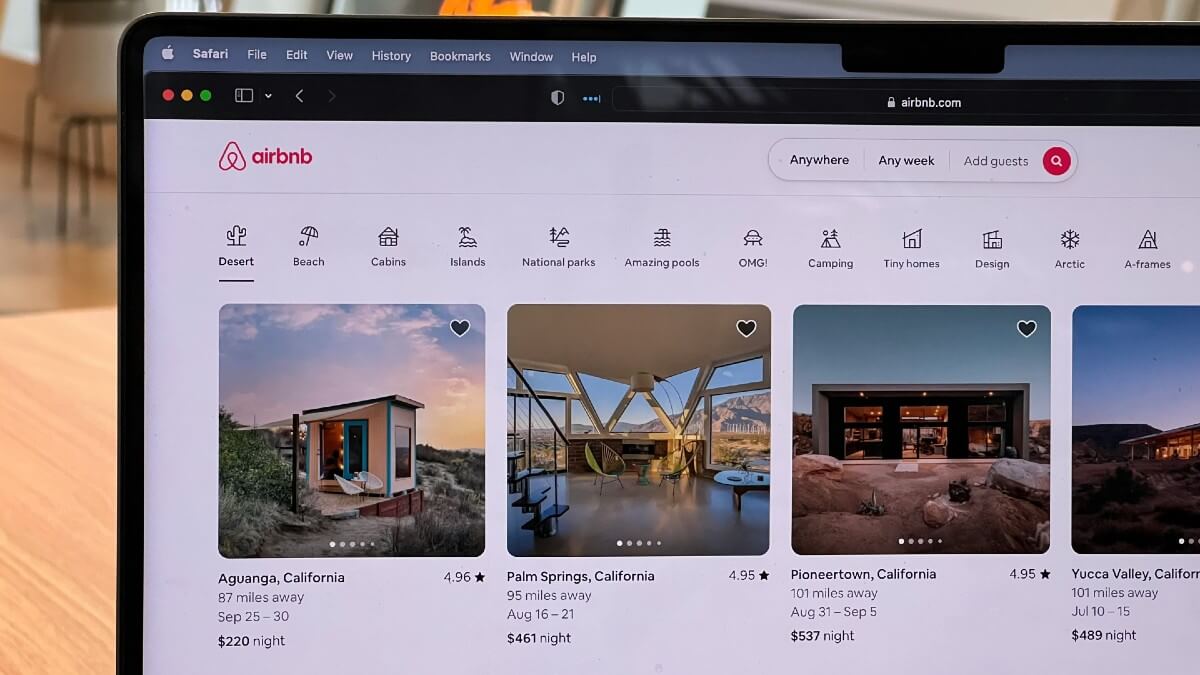

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Alex Brewster

Alex Brewster

Harry O'Sullivan

Harry O'Sullivan