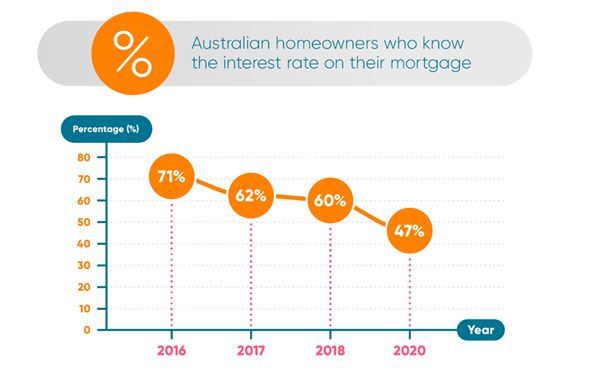

A survey from Mortgage Choice found only 46.5% of respondents knew their current home loan interest rate, down from 71% in 2016 and 60% in 2018.

Despite this complacenecy, many respondents said COVID-19 had put them under increased financial pressure.

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Over 62% of people said the pandemic had caused them to worry more about money, with 65.6% trying to boost their resilience by saving more, spending less and improving their financial knowledge.

Chief Executive Officer at Mortgage Choice Susan Mitchell said borrowers could put more money in their pockets simply by knowing their interest rate and looking to improve it.

"Our research suggests that Australians are more focused than ever on their finances, yet many are being complacent with their biggest expense and potentially biggest saving," Ms Mitchell said.

"There has never been a better or more important time for all Australians to take charge of their financial wellbeing.”

Source: Mortgage Choice

Borrowers could be forgiven for not knowing their rate, given the Reserve Bank (RBA) has cut rates by 65 basis points in the last year alone, with mixed response from lenders.

Few lenders passed on the RBA's most recent cut in November to existing variable rate home loans, with many instead taking the knife to fixed rates, offering sub 2% fixed loans.

Asked how often they reviewed their home loan, 13.7% of survey respondents said never, 44.4% said every couple of years, and 41.9% said annually.

Ms Mitchell urged borrowers who hadn't reviewed their home loan in the last two years to speak to their broker or lender to negotiate a lower interest rate.

"Let's say your principal and interest rate is 3.99% and shopping around with the help of a mortgage broker enables you to drop by 50 basis points to 3.49%.

"On a 30-year home loan of $600,000, the savings could be in the vicinity of $170 a month."

Homeowners aged 30 to 39 were the most likely to not know their interest rate (64.5%), with those aged 50 to 59 years close behind at 56.4%.

"It's so important to know your interest rate because if you’ve been complacent the chances that you are paying too much are extremely high," Ms Mitchell said.

"Every Australian should make it a New Year resolution to review their home loan."

With the Reserve Bank stating the cash rate will remain unchanged for at least three years, given the forecasted long and uneven recovery from COVID, there is unlikely to be the wealth of rate cuts from lenders seen in the last year.

Attention has turned to fixed rates, and there is speculation the big four will claw back market share lost to non-banks and neobanks.

Among the lures enticing borrowers to switch lenders are cashback offers, which are more likely to be offered by bigger institutions taking advantage of the RBA's term funding facility.

Photo by Gabrielle Henderson on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Harrison Astbury

Harrison Astbury

Rachel Horan

Rachel Horan