The latest Consumer Sentiment Report from real estate agent comparison service OpenAgent found that 68% of Australian home sellers surveyed last quarter expect property prices to rise in the next six months.

Only 7% expect prices will slide over the next half-year, while 24% think they will stay roughly the same.

The new figures mark a significant turnaround in sentiment from the beginning of the year.

Only 34% of those surveyed in the first quarter of 2019 expected prices to rise while 26% expected prices to fall.

OpenAgent Data Analyst Carson Teh said market expectations in Australia have never been this high.

“We started compiling data from home sellers in November 2016 for our Consumer Sentiment Report and this is the highest level of sentiment we’ve ever seen,” Mr Teh said.

“In the first quarter of this year, seller sentiment was actually the lowest we’ve seen, so this turnaround in expectations is drastic.

“The turnaround in sentiment is mostly represented in Australia’s two large property markets, Sydney and Melbourne.

“Those looking to buy have a little time to make a move before dwelling values reach the next peak, however, those looking to sell could benefit from waiting for the market to bounce back even more.

“Upsizers, in particular, should look to upgrade now before the gap between your current home and next home widens even more, whereas downsizers could do better off waiting for the market to improve.”

The latest Domain House Price Report for the September quarter 2019 support Mr Teh’s statement on Sydney and Melbourne property markets.

According to the report, Sydney’s median house price jumped by 4.8% to $1.079 million from the June quarter, with median unit prices rising 2.6% to nearly $700,000.

Melbourne meanwhile recorded a 4.1% rise in median house prices and a 3.7% jump in unit prices, to more than $855,000 and $520,000 respectively.

Former CoreLogic research analyst Cameron Kusher has also confirmed that Sydney and Melbourne are driving a recovery in house prices.

“Early signs are emerging to suggest that the housing market has stabilised, however, this evidence is much more prevalent in capital cities than regional markets. The combined regional markets have seen the magnitude of declines trend higher throughout 2019,” Mr Kusher said in late August.

“Over the coming months it will be interesting to see if the improvement continues and whether it spreads from Sydney and Melbourne to other capital cities and regional markets.”

Across all major cities, the median house price increased by 2.7% over the September quarter, although prices are still down 1% year-on-year (excluding Darwin).

Median house prices

| Capital city | Sep-19 | QoQ | YoY |

| Sydney | $1,079,491 | 4.80% | -1.60% |

| Melbourne | $855,428 | 4.10% | 0.00% |

| Brisbane | $562,847 | -1.00% | -1.80% |

| Adelaide | $538,550 | -0.60% | 0.70% |

| Canberra | $738,864 | -0.70% | 0.60% |

| Perth | $527,107 | -1.00% | -2.40% |

| Hobart | $482,960 | 1.30% | 2.60% |

| Darwin | $521,651 | 1.00% | -4.40% |

| National (excludes Darwin) | $773,635 | 2.70% | -1.00% |

| Source: Domain House Price Report |

Auctions on the up

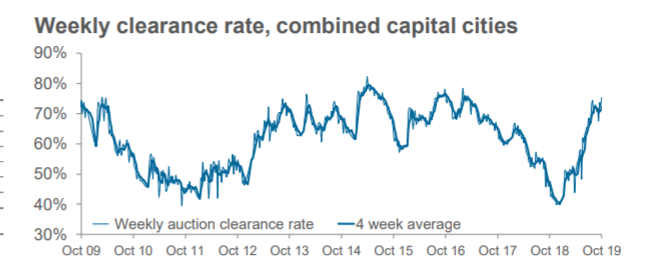

Increased seller optimism seems to already be taking effect, with CoreLogic reporting 2,610 homes taken to auction across the capital cities in the week ending 27 October 2019.

Volumes are up 33.5% on last week, which makes this the busiest week for auctions since early December 2018.

The final auction clearance rate for this week is 75.3%, meaning more than 75% of homes taken to auction were sold.

The clearance rate this time last year was a mere 47%, although volumes were much higher with just under 3,000 homes taken to auction.

The higher overall auction volumes this week can be mostly attributed to the surge in activity across Melbourne, which, according to CoreLogic, is not unusual over what is the pre-Melbourne cup weekend each year.

The data shows there were 1,528 Melbourne homes taken to auction this week with a clearance rate of 77.1%.

Property market will strengthen in 2020: NAB

NAB last week released a report stating property prices have already bottomed out and will continue to rise over the remainder of 2019 and into 2020.

NAB surveyed more than 300 property professionals, and the consensus among them was that market sentiment has improved in all states except Western Australia.

Sentiment lifted sharply in Victoria and was the highest in the country by some margin, and NAB Chief Economist Alan Oster said the results suggest Australia’s housing market is on the way to recovery.

“This marks a sharp reversal from the previous survey where Victoria and NSW were expected to be the weakest states for price growth and the only states where prices were tipped to fall,” Mr Oster said.

“That said, tight credit was again called out as the single biggest constraint on new housing development, and access to credit the biggest impediment for buyers of existing property across the country.”

NAB Hedonic House Price Forecasts (%)*

| 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|

| Sydney | 3.4 | -10 | 1.8 | 7.4 |

| Melbourne | 11.3 | -9.1 | 0.7 | 7.4 |

| Brisbane | 2.5 | 0.4 | -1.8 | 0.2 |

| Adelaide | 3.2 | 1.3 | -2.2 | -0.8 |

| Perth | -1.2 | -4.3 | -7.2 | -2.0 |

| Hobart | 11.4 | 8.3 | 1.5 | 1.8 |

| Capital city average | 4.8 | -6.7 | -0.6 | 4.5 |

Source: CoreLogic, NAB Economics. *percentage changes represent through the year growth to Q4.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Bernadette Lunas

Bernadette Lunas

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Harrison Astbury

Harrison Astbury

Brooke Cooper

Brooke Cooper