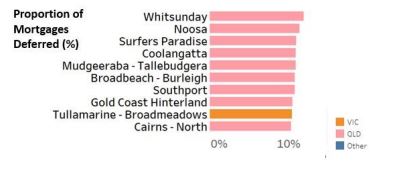

That's according to new analysis from credit reporting agency Equifax, which found Noosa, Surfers Paradise, Coolangatta and the Whitsundays had the highest proportion of deferrals compared to the national average.

Looking to compare low-rate, variable home loans? Below are a handful of low-rate loans in the market.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

General Manager Advisory and Solutions at Equifax Kevin James said the data revealed the extent of the damage to the tourism-dependent Queensland regions.

“Tourism is a major industry for Queensland, and with international and domestic visitors curtailed during the pandemic, tourist hotspots have faced reduced occupancy rates, lower incomes and higher levels of unemployment leaving mortgage holders feeling the pinch," Mr James said.

"With the Queensland border beginning to reopen to parts of NSW and SA this week, we expect to see a bounce back as tourism dollars start to flow back into the region."

Proportion of mortgage deferred by accounts

Source: Equifax

The release of the data coincides with the Queensland eviction ban ending today, with the state the only one in Australia deciding not to extend the moratorium on residential evictions.

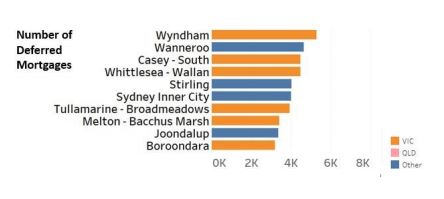

Melbourne suburbs show signs of heightened mortgage stress

Tullamarine-Broadmeadows on the outskirts of Melbourne was the only non-Queensland location to make the top ten list of mortgage deferral hotspots.

However, several other Melbourne fringe suburbs also showed signs of heightened mortgage stress in May when the data was collected.

Analysis showed Wyndham, Casey-South, Whittlesea-Wallan, Melton-Bacchus Marsh, and Boroondara all had a high number of mortgage deferrals compared to the national average.

Number of mortgages deferred by accounts

Source: Equifax

Mr James said the financial hardship seen as these suburbs could be attributed to a higher prevalence of lower socio-economic suburbs, with low-income households and young people just starting out on the property ladder.

“COVID-19 is having a particularly negative effect on the employment of young people," he said.

"For those without significant savings, it isn’t easy to service a home loan when cash flow dries up.

"We know Melbourne’s second lockdown will have further exacerbated the difficulties we’ve seen in our initial analysis on the available May data."

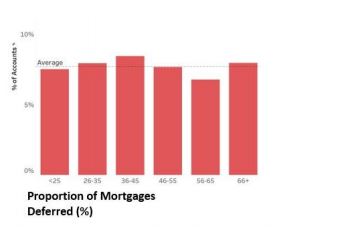

Middle-aged Aussies struggling to pay their mortgage

Equifax found Australians aged 36 to 45 were the most likely age group to defer their mortgage repayments through the pandemic.

“There are more middle-aged people seeking mortgage payment relief than any other age group," Mr James said.

This group is likely to have relatively high outstanding mortgage balances and may have been harder hit with business lay-offs or lower-income from JobKeeper payments.”

The 26 to 35 age group fared only marginally better, accounting for the second-largest number of mortgages deferred.

Over 66-year-olds also had higher levels of deferrals, which was likely a reflection of deferred investment property loans.

Proportion of mortgages deferred - age by account

Source: Equifax

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Arjun Paliwal

Arjun Paliwal

Jacob Cocciolone

Jacob Cocciolone