Former NRL player Jarryd Hayne is from Minto, and there have been two serial killers who struck in Frankston, so home buyers will be in with some pretty good company.

Archistar's 'First Home Buyer Affordability Index' report measures home loan repayments as a proportion of average weekly earnings.

The overall index has fallen to just 72.57 (lower index equals more affordable), the lowest ever score since the index was pegged at 100 in 2007.

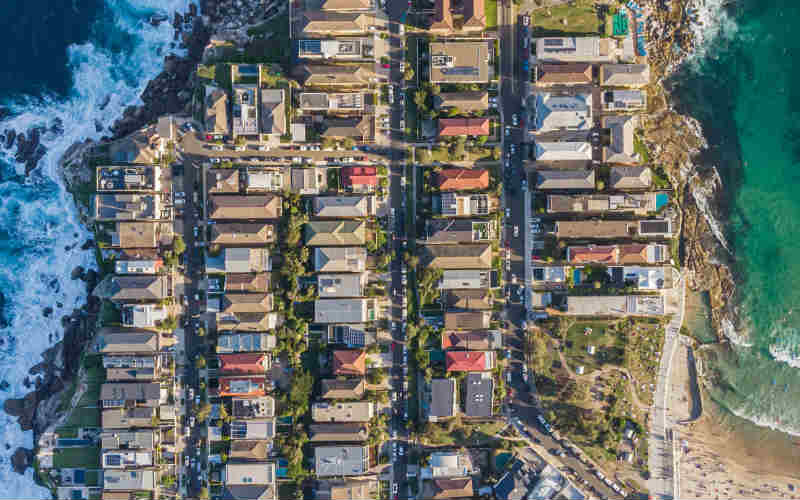

However, to find affordable suburbs in the capital cities, you're going to have to be a bit creative with your locations, with Minto and Frankston being just some of the colourful suburbs, claiming median house prices of $662,500 and $440,000 respectively.

Sydney

In Sydney, home buyers searching for affordability are looking in suburbs including Bradbury ($595,000), and Campbelltown ($655,000), as well as Minto.

For units, home buyers will see suburbs including Lakemba ($369,999), and Blacktown ($430,000).

This is less than half the price of the median home value of more than $1.1 million.

Melbourne

In Melbourne, it's a similar story - Melton ($419,000) for houses, and Frankston ($367,500) for units.

Other affordable housing suburbs include Melton South ($467,514, and Meadow Heights ($475,000).

These prices sit at about half the capital city median of $847,965.

Brisbane

For Brisbane, some of the most affordable suburbs for houses arguably aren't even in Brisbane - Lowood ($265,000), Laidley ($269,000) and East Ipswich ($279,000).

For units, Beenleigh was most affordable, coming in at $235,000.

Admittedly, some of Brisbane's cheapest units are in inner-ring suburbs, including Annerley ($319,000), and Moorooka ($329,500), though this is only slightly below the city-wide unit median of around $348,000.

Adelaide

Adelaide is also spoilt for choice, including Salisbury North ($267,000) on the list of most affordable houses.

One of Australia's worst serial killers, John Bunting (Snowtown), coordinated his murders from his Salisbury North home.

Perth

Perth remained relatively affordable compared to other capitals, with a median house price of $548,308.

Orelia came in at $240,000, Medina at $262,000, and Armadale at $265,000.

Will this 'affordability' last forever?

Overall, however, all states reported falls in the index in September: Victoria led with a 6.5% fall.

NSW remains the least affordable state, with its index trending 9.5% higher than the national benchmark.

This is generally supported by CoreLogic data that indicates the best-performing suburbs in 2020 were leafy, blue ribbon ones in Sydney, such as Vaucluse, with a median home price of more than $5.3 million.

See Also: Is Australia in a Housing Bubble?

Further, Archistar's chief economist Dr Andrew Wilson said improvements in affordability could be short-lived.

"Lower prices, lower interest rates and higher incomes have all acted to improve affordability to record levels for Australian first home buyers over the September quarter," he said.

"However, with rates set to remain steady for years together with ongoing weak incomes growth and higher house prices, the recent sharp improvements in affordability are likely to be short-lived.”

Photo by Cindy Tang on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

.jpg)

Denise Raward

Denise Raward

Rachel Horan

Rachel Horan