There’s no shortage of natural disasters that can do a number on your home. Here in Australia, we’re prone to big storms, the occasional earthquake, hail and of course bushfires, which wreaked havoc on our lives and the economy in late 2019.

Another common natural disaster in Australia is the flood. Of the 905 disaster declarations made in Australia between 2004 and 2014, 447 were due to floods. Unsurprisingly, the worst year for floods in this period was between 2010 and 2011, when devastating floods wreaked havoc on Queensland.

Unfortunately, Queensland and NSW are currently experiencing major flooding, which is being compared to the 2011 Queensland floods. The Brisbane River peaked at 3.85 metres on Monday morning, compared to the 4.46 metre peak in 2011, and an estimated 18,000 homes have been flooded in Brisbane alone.

On a national scale, with as many as 20% of Australian homes at risk of potential flooding at some point, having flood insurance for your property might be a good idea.

What is flood insurance?

Flood insurance is a type of home and contents insurance, sometimes as an opt-in or opt-out add-on policy, that is designed to protect your home from a flood. Generally speaking, a good flood insurance policy should provide cover for:

-

Temporary accommodation if you are displaced from your home due to a flood

-

Any costs to repair your property if it is damaged structurally (some policies have a limit on this)

-

Interior damage to your property

Flood insurance usually doesn’t cover damage to things outside your property (like driveways or gardens, exterior fences etc.) or any damage that occurs within a few days of you taking out the policy.

Things like rain and storm damage tend to not be covered under flood insurance, as these will usually be covered in most standard home insurance policies. To check if your current policy covers flood damage, check your product disclosure statement (PDS). Depending on your insurer, you might be able to add flood cover for an extra cost if it isn’t already covered.

See also: What is landlord insurance and why do you need it?

What different floods does flood insurance cover?

It’s very important to know that insurers tend to have multiple different definitions for floods, as certain types of floods may or may not be covered under your insurance. Many insurers define a flood as:

The covering of normally dry land by water that has escaped or been released from the normal confines of the following:

-

a lake, river, creek or other natural watercourse (whether or not any of them have been altered or modified); and

-

a reservoir, canal, or dam.

This became the standard definition following the Queensland floods in 2011, and means there are many water-related events that insurers won’t consider to technically be a 'flood'.

For example, Budget Direct’s flood cover protects customers from floods caused by storm and rainwater and an escape of liquid. However, it does not cover ‘actions of the sea’ (such as tsunamis or storm surges), ‘underground water' (like sewage), or ‘hydrostatic pressure’, which could include leaks resulting from water pressure on pools or retaining walls.

While the definition may differ depending on your insurer, many won’t cover flood damage caused by certain events; these events may be covered under a separate kind of cover, while others won’t cover them under any circumstances.

This can be a great source of confusion. After the floods tore through Brisbane in 2011, many people discovered they weren’t actually covered because insurance companies had different definitions of what constituted a flood. Senior Account Executive at Geelong Insurance Brokers Chris Hunter said asking whether you’re covered or not is an important question.

“Any decent policy should cover damage from weather events like a storm or flash flood,” Mr Hunter told Savings.com.au.

”A simple way to remember it is this; if it comes from above it should be covered. It if comes from existing water, make sure you have flood cover.”

So you need to carefully check the terms and conditions of your policy to see what you’re covered for, and what you aren’t.

How to tell if you need flood insurance

If you live near a body of water or in a high-risk flooding zone, chances are you’ll need flood cover. But the catch is, being in an area that requires flood cover means you’ll have to pay a higher premium, or could not be covered altogether. That’s the deal with insurance: the more likely you are to have to use it, the more the insurer will charge you. You could also be charged a higher flood excess if you ever do have to make a claim.

According to Mr Hunter, whether you need flood insurance or not is dependent on how close you are to water on your premises.

“You can often view floodplain maps through government websites and also use your own judgement. If you're in an area nowhere near a body of water, you should be fine,” he said.

“But always make sure to check with an adviser for your own policy as they have the resources to see if you are at high risk.”

Special Counsel at law firm Barry.Nilsson Nick Robson said it’s worthwhile having your property insured “at a reasonable rate” if you live in a flood-prone area.

“In areas susceptible to flooding, insurers might be unwilling to provide a policy that includes flood cover. This is obviously designed to protect insurers from significant payouts in the event of extensive flooding,” Mr Robson told Savings.com.au.

“However, it also leaves some customers at risk of incurring uninsured damage.”

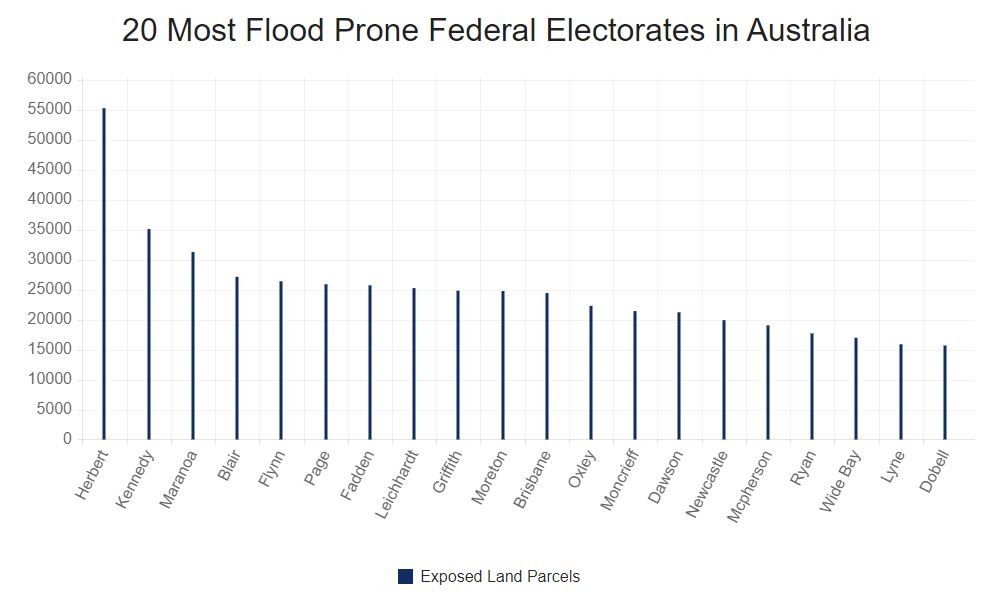

The Insurance Council of Australia (ICA) has prepared a database of the most flood-affected areas in the country, using Federal electoral boundaries for definition and then ranking for the number of flood-prone land parcels known to be in the region to help you determine if an area you’re living (or buying) in means you’re more susceptible to floods.

Source: Insurance Council of Australia, ranked by the number of and parcels with flood exposure.

Herbert in the Townsville area of North Queensland is the most flood-prone electorate in the country, with more than 55,000 land parcels exposed to floods. In fact, sixteen of the 20 most flood-affected electorates are in Queensland, with the remaining four in New South Wales. These electorates are likely to have the most expensive flood insurance premiums, but are also likely to need flood insurance the most. To check your specific electorate, check the Australian Government’s Flood Risk Information Portal to see the risk level for flooding in your home.

If you're in flood-prone Brisbane, try using the Brisbane City Council's flood awareness map or the Queensland Government's FloodCheck interactive map.

Gold Coast residents may wish to try the City of Gold Coast's City Plan interactive mapping tool.

How much does flood insurance cost?

According to insurer AAMI, over 90% of customers pay little to no additional premium for flood cover, as their address is considered to be in a low-risk area (see above). Some insurance policies will include flood cover at no extra cost, while others will include it as an optional extra. This can be a relatively minor difference. A simple quote for a house without flood cover from Budget Direct, for example, would cost around $1,500 per year on average. By adding the optional flood cover, and the annual premium would increase to $1,666 - an increase of about $166 dollars.

But for homes in a high-risk area for floods, flood insurance is likely to be much more expensive. Way back in 2013, Allianz research found the average annual flood insurance premium offered in Queensland - a high-risk state - was $8,200, and could be as high as $19,000. The average in NSW is $4,704, and can be as high as $24,000 per year. This is old data too - the average premium now is likely to be much higher.

“The main reason is that the insurance model is not best suited for events that have a certainty of happening, rather than just a chance of happening,” an Allianz spokesperson said at the time.

“For a house on a flood plain, it is a matter of when not if it will be flooded, so the flood premium starts with a simple formula that begins with the expected value of the loss divided by the anticipated frequency of loss.”

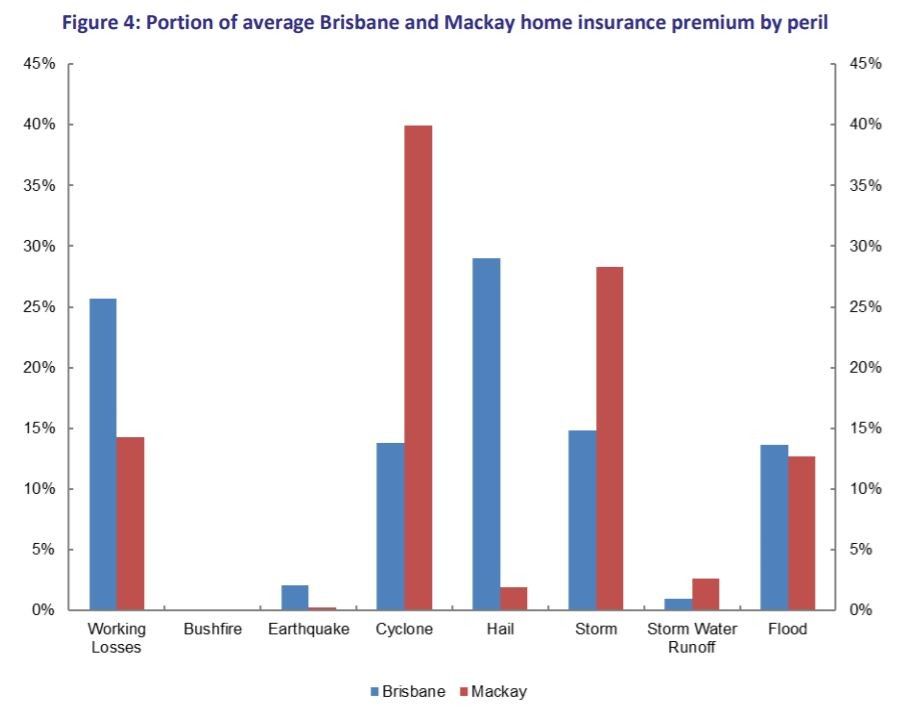

Given areas in North Queensland are even more likely to be flooded, thanks to the array of natural disasters that frequently occur there, many regions have even higher flood insurance premiums that can be virtually unaffordable for some.

North vs South Queensland home insurance premiums. Source: Treasury, 2014.

The future effects of climate change on flood insurance

If it looks like flood insurance is expensive in your region now, unfortunately, it could get a lot worse. The continued inundation of coastal and low-lying properties could mean about 5 to 6% of properties bear the risk of damage or destruction by 2030. In addition, around one in 19 property owners face the prospect of ‘unaffordable’ insurance premiums, which are defined as an annual premium of 1% or more of the property's value.

That’s according to a 2019 study by the Climate Council. The report’s author, climate risk expert Dr Karl Mallon, said the property market could continue to lose value in the decades that follow if emissions remain high.

“Some Australians will be catastrophically affected by climate change. Low-lying properties near rivers and coastlines are particularly at risk,” Dr Mallon said.

“Even for Australians who can afford to pay, general insurance currently does not cover damage from coastal inundation and erosion; events which are likely to become more common because of climate change.

“The problem affects far more homes than most people realise because planning laws haven’t kept pace with climate change.”

Naturally, Queensland government areas could be the most at-risk. According to the Climate Council’s modelling, 64% of Queensland LGAs will have 10% or more of their properties exposed to an average annual risk cost of 1% or more of the property’s value.

|

State |

2030 |

2050 |

2100 |

|---|---|---|---|

|

NSW |

23% |

23% |

28% |

|

VIC |

10% |

15% |

23% |

|

QLD |

52% |

52% |

64% |

|

SA |

8% |

8% |

10% |

|

WA |

11% |

11% |

12% |

|

TAS |

3% |

3% |

3% |

|

NT |

24% |

24% |

24% |

|

ACT |

N/A |

N/A |

N/A |

|

Average |

19% |

19% |

23% |

Percentage of local government areas affected in each state and territory. Source: Climate Council.

See also: Expert says “Consider climate change when buying a house”

“If we continue to see these extreme weather events, such as the bushfires in NSW and VIC or the floods in QLD, then we will continue to see insurance premiums rise, year on year, as insurers attempt to recoup their losses from claims heavy periods for past catastrophic events,” Mr Hunter said.

“If current trends persist, [it is] likely the government will need to intervene in the future to ensure that insurers are not made insolvent from continued extreme weather events and/or so that the end client is not hit with massive premium rises each year to offset insurer losses.”

So if you live in a high-risk flood zone, your premiums could be set to rise even further. And if you don’t live in a high-risk area, there’s a chance you could end up being in one.

“Climate change is likely to result in a higher prevalence of extreme weather events including flooding. Therefore, it is possible that areas that might not have flooded in the past could potentially flood in the future,” Mr Robson said.

“This has the potential to increase the cost of insurance in the future and, for properties more susceptible to damage, possibly diminish their value.”

Should you buy a waterfront property?

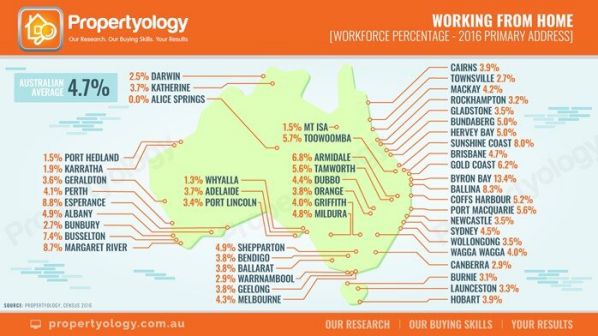

Our desire to work from home post-COVID has led many would-be buyers in Australia to retreat from the hustle and bustle of major cities to waterfront areas. Realestate.com.au’s 2021 Regional Australia Report found a sharp increase in search activity for beachfront areas such as the Gold Coast and Sunshine Coast - where prices have exploded by up to 54% throughout 2021 - while buyer’s agency Propertyology found coastal areas like Byron Bay (NSW), Surf Coast (VIC), Noosa (QLD) and Esperance (WA) are expected to become big work-from-home hotspots in the coming years.

Buying a waterfront property - whether that’s on a lake, river or if you’re really lucky, a house right on the beach - obviously has its benefits. Mainly the spectacular views and serenity you get. But such properties also have their downsides. Not only are they much more expensive than the standard suburban house, but their exposure to water and thus the elements presents an extra degree of risk, which can make owning them more expensive.

Properties next to a river can be much more likely to flood, while beachfront houses and units are also prone to sea spray, rust, erosion and of course rogue waves, though these aren’t very common in Australia.

Research by Domain in early 2020 found many home insurers are no longer insuring parts of popular beachfront areas like the Gold Coast, while other insurers are making premiums in ‘red zones’ significantly more expensive. Most policies won’t cover 'actions by the sea' as a standard inclusion (most houses aren’t near the sea after all), while adding this as an inclusion, if possible, will often make owning a waterfront property that much more expensive.

“The insurer will usually add some additional cost to your annual insurance premium for the added risk of covering damage caused by water inundation as a result of action from the sea. The same occurs with fire-prone areas as well or properties above the 25th parallel in Australia,” Mr Hunter said.

But Mr Hunter said you shouldn’t rule out a waterfront property: just make sure you know the ins and outs of your coverage and that there are no slip-ups.

“Waterfront properties definitely have their perks. As long as you've chosen the right policy coverage and make sure it covers flood and actions of the sea, there's no reason you shouldn't enjoy a good view,” he said.

How to compare flood insurance policies

If you live in a low-risk flood area, there’s a good chance that your home insurance policy will have flood cover anyway as a standard inclusion. If not, then you can add it on at a relatively low cost if you’re so inclined. If you have this option, then you can just compare home and contents or landlord insurance policies the way you normally would. You can do this by comparing quotes from multiple different insurers to get the best premiums while also looking at the policy’s excess, inclusions, exclusions, cover limits and how much of your home’s value it will cover. You should also look into the history of flooding and natural disasters in your area.

“Like most policies, premiums will be higher where the risk of loss is higher. Therefore, if a property is situated in an area that has been flooded before, the cost of the insurance cover is likely to be higher,” Mr Robson said.

“As to whether the risk justifies the higher premium - that is a question for each individual customer to make.”

It’s important to get different quotes online from a number of different providers - inputting your postcodes can give you an idea of how much you might have to pay.

Savings.com.au’s two cents

Many home insurance policies can have flood cover as a standard inclusion. If not, you can opt-in at a reasonable extra cost. This is, of course, unless you live in a high-risk flood area, in which case your premiums might become much more expensive - or you might not be able to get cover at all.

Check the government’s Flood Risk Information Portal to see the risk level for flooding in your home. This can give you an idea as to whether you’ll need flood insurance or not. While you can risk going without flood insurance, this can be a big gamble; if you’re going head-to-head with mother nature, a sensible punter would bet on nature to win. Not having flood insurance could prove to be catastrophic if your home and valuables are destroyed by one.

The most important thing you can do is to shop around and compare quotes from at least several different insurers. Different insurers might calculate risk differently, and could have different flood information than others. One insurer might offer you a much more manageable premium for flood cover compared to others, so it’s important to assess a wide range of policies.

Article originally published by William Jolly on 22 March 2021, updated by Rachel Horan on 1 March 2022

Photo by Jonathan Ford on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan