Despite having a national scope, Savings.com.au is distinctly Brisbane - all of its staff are in Brisbane, and all have been affected by the most recent floods in some shape or form.

In my household, we were bucketing floodwater out of our laundry while laying down sandbags most of Sunday night.

Below is my own backyard - for reference down the back became chest deep... yes I waded through.

But we got off lightly.

With that said, when the dust (or mud) settles, what might happen to home prices?

Will the Brisbane floods affect home prices?

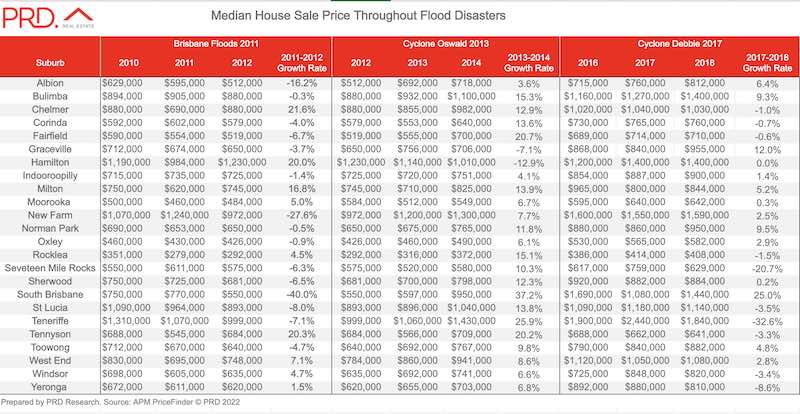

Research from real estate network PRD indicates the hardest-hit suburbs to record median house price falls in the 12 months after the 2011 floods included Albion (-16.2%), New Farm (-27.6%), and South Brisbane (-40%).

These price swings could have been driven by an array of market influences besides the floods though.

"The Brisbane property market has seen extraordinary growth since COVID-19, and even more so with the promise of the Olympics in 2032," PRD chief economist Dr Diaswati Mardiasmo told Savings.com.au.

"Will the 2022 floods dampen market growth? The short answer is maybe, and if it does, it will be a small dip for a short period of time."

Propertyology's head of research Simon Pressley said affected homes represent a small proportion of Brisbane housing.

"The Queensland LGAs that have been heavily impacted include Brisbane, Lockyer Valley, Noosa, Sunshine Coast, Gold Goast, Gympie, Fraser Coast and Scenic Rim," Mr Pressley told Savings.com.au.

"Collectively, there are 1.5 million dwellings in those LGAs. I’ve heard reports of circa 15,000 dwellings affected by this flood event, most only require minor repairs and a clean.

"About 2,000 properties had water above floor-level - that’s less than 0.2% of all dwellings.

"For perspective, the arrival of COVID was significantly more disruptive than this flood, yet Australian real estate boomed.

"If anything, the torrential rain will cause a reduction in the volume of properties listed for sale and for rent at a time when they are already at record lows."

Will it spook potential buyers?

Dr Mardiasmo said home buyers looking to nab a bargain might be hit with high flood insurance premiums.

"More often than not after a flood event, buyers and investors become more aware of risks and thus hesitate to purchase in the area," she said.

"This allows for buyers who have been hunting for a property for a period of time to enter the market, with the knowledge that they may need to pay for a higher insurance premium.

"In a market where supply is low, particularly in certain areas that would normally have high liveability - for example a desirable school catchment, close to public transport, plenty of green spaces and parks, close to shops and amenities - the risk of flood damage can often be mitigated."

What about interstate buyers?

"Investors, especially those from interstate who bought their property sight-unseen would be worried," Dr Mardiasmo said.

"Some might even be spooked about not purchase a property in Greater Brisbane. This is not a surprise, especially as the period between floods has shortened.

"There were 37 years between 1974 and 2011 floods, whereas now there was only 11 years.

"However given the current rental demand and supply imbalance, and the prospect of international borders opening, any deterrence for investors would be short-lived."

Brisbane in 2011. Source: Andrew Kesper via Wikimedia Commons

Explaining post-2011

The 2011 floods left an indelible scar on the residents of Brisbane and surrounds.

These latest floods brought back fresh trauma from the 'one in 100-year' event.

The ABS' median unstratified transfer price shows Brisbane's detached house price went from $460,000 in December 2010 to $450,000 in March 2011, and bottomed out at $430,000 in December 2011.

It didn't breach the $460,000 threshold again until December 2014.

However, Mr Pressley said there were other factors at play during this time.

"Brisbane’s local economy directly prior to its infamous 2011 flood was horrible, whereas conditions are noticeably better now," he said.

"Buyer confidence was very low then. Housing supply was higher then. Household equity is higher now. Interest rates are lower now.

"In February 2011, Brisbane had 27,800 dwellings for sale and 4,500 for rent. Those metrics today are 16,000 and 3,900, respectively.

"An extra 435,000 people live in Brisbane now than in 2011.

"It is always dangerous to draw property market comparisons to past natural disasters."

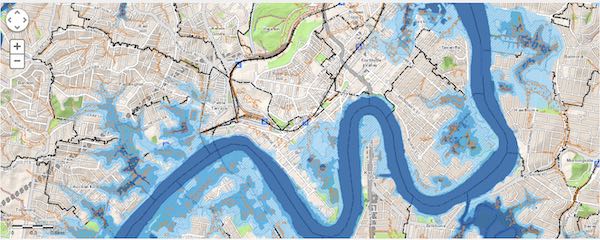

Identifying flood-prone suburbs

Encompassing the Brisbane LGA, home to more than one million residents and covering more than 1,000 sq km, the Brisbane City Council has an interactive flood map.

You can input your address to see how flooding might affect your neighbourhood.

Dark blue denotes a 5% chance or 'high likelihood' of annual flooding.

Brisbane is also home to numerous waterways beyond the Brisbane River - it is not uncommon for other bodies of water such as Kedron Brook and Breakfast Creek to swell after heavy rain.

Image: Interactive Flood Map (Brisbane City Council)

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

|

Photo by Pixabay on Pexels

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

.jpg)

Bernadette Lunas

Bernadette Lunas

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Alex Brewster

Alex Brewster