The latest REA Insights Buy or Rent 2021 Report found it will be cheaper to buy than rent around 57% of houses across Australia, based on modest house price growth of 3% a year over the next decade.

That analysis also found that over the next ten years the share of units that will be cheaper to buy than rent is close to 75%.

Realestate.com.au economist Paul Ryan said record low mortgage interest rates have made it more affordable for people to enter the property market, although saving for a deposit remains an issue for first-time buyers.

"Interest rates can currently be fixed below 2% per year and the Reserve Bank of Australia has committed to maintaining low interest rates until at least 2024," Mr Ryan said.

"This certainty that mortgage costs are not going to increase rapidly provides comfort to buyers borrowing larger amounts."

Source: REA

The analysis found that if interest rates remain low, moderate property price growth will likely offset the additional costs of owning, like stamp duty, maintenance and council or strata rates.

It also assumes that buyers already have a 20% deposit saved, which Mr Ryan said would remain the biggest hurdle for first home buyers with house prices rapidly rising.

"Many would-be buyers can already afford loan repayments, but struggle to save a deposit while renting" he said.

"Continued price growth may cause additional concern for many in this position."

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

The cheapest suburbs to buy instead of rent

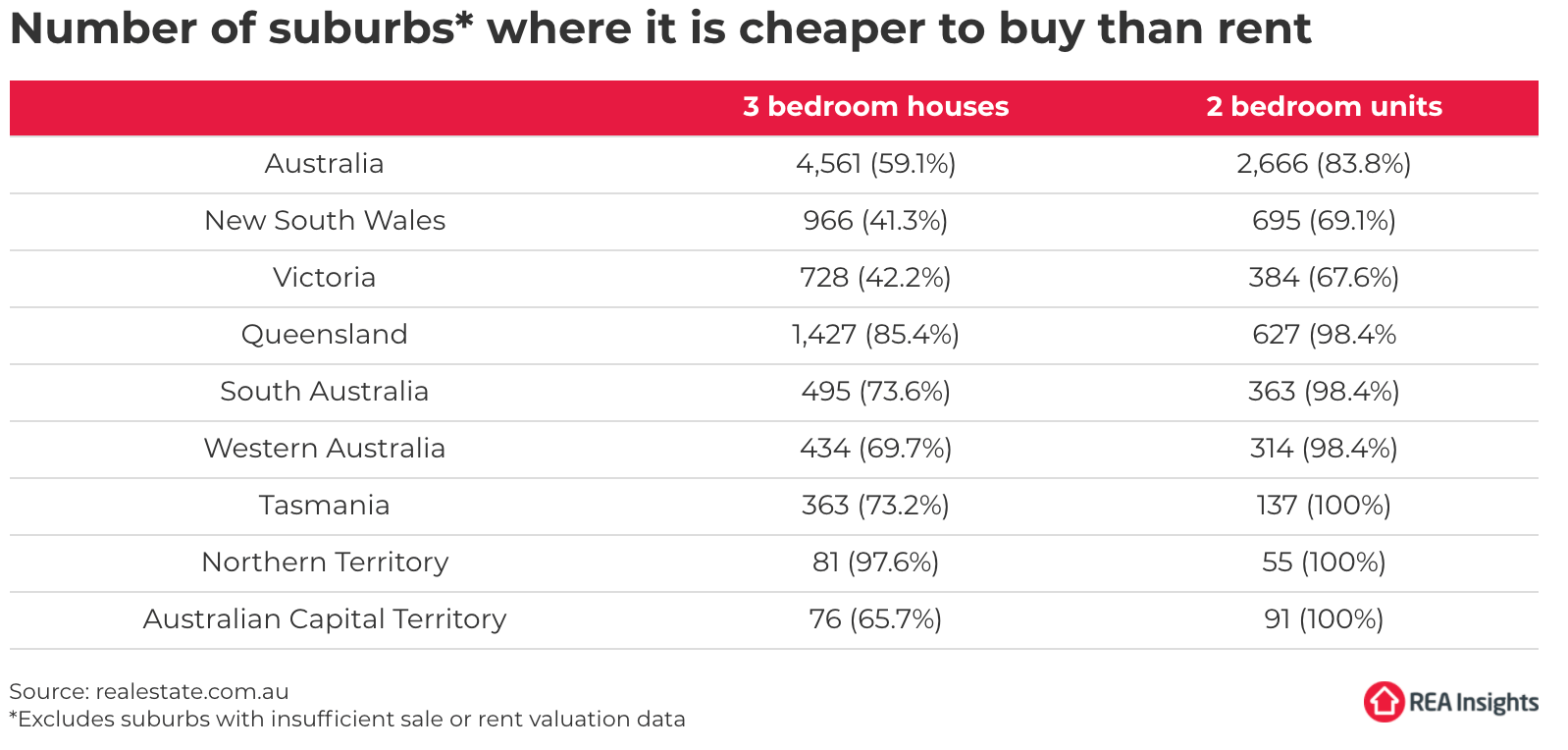

Unsurprisingly, the analysis found conditions are the most favourable for buyers outside the biggest capital cities.

More than 60% of houses and almost all units outside of New South Wales and Victoria are estimated to be cheaper to buy than rent in a decade.

"Affordability is driving demand and as a result it is likely we will continue to see strong regional price growth," Mr Ryan said.

The Northern Territory offers the most opportunities for house buyers, where it's cheaper to buy than rent in almost 98% of suburbs.

Similarly, 100% of two-bedroom apartments in the Top End are cheaper to buy than rent.

Queensland is the next best state for affordability, with 85% of suburbs cheaper to buy a three-bedroom house than rent.

In Greater Brisbane, the suburb with the largest price differential to buy a three-bedroom house as opposed to rent, was Kilcoy, with an estimated monthly difference of $1,014.

Brisbane's top ten list was dominated by suburbs in regional areas, with Lockrose, Waterford, D'Aguilar and Toogoolawah making the list.

Buying a three-bedroom house in Sydney's Tacoma would be $578 cheaper than renting.

Again, Greater Sydney's top ten list was largely full of suburbs in regional Central Coast, where prices surged 13.6% in the last 12 months.

In Greater Melbourne, Waterford Park would be $472 cheaper to buy than rent a three-bedroom house.

Renting still a cheaper option inner-city

Renting still remains the cheapest option for almost all inner-city areas, but particularly in Sydney and Melbourne.

According to REA more than 60% of houses and just under half of units in New South Wales and Victoria are estimated to be cheaper to rent over the next 10 years.

"While rents do not typically adjust as quickly as prices, the COVID-19 pandemic and the cessation of international travel saw significant reductions in asking rents in inner city Sydney and Melbourne," Mr Ryan said.

"As such, renting in these inner-city areas is currently considered cheap, relative to their very high asking prices."

Unsurprisingly, the suburbs where it's cheaper to rent than buy are in the most expensive inner-city areas.

In Sydney, it would be a whopping $11,413 cheaper per month to rent than buy a three-bedroom house in exclusive Vaucluse over a ten-year period.

In Melbourne, it would be $8,672 cheaper to rent than buy a house in Toorak, while in the Greater Perth area, renters would save $6,491 per month by renting a house rather than buying in Peppermint Grove.

Brisbane renters would pocket an extra $2,725 a month by renting, not buying, a three-bedroom house in the trendy riverside suburb of Teneriffe.

Photo by Parag Gaikwad on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Emma Duffy

Emma Duffy

Harrison Astbury

Harrison Astbury