Under the reforms announced Tuesday dubbed 'First Home Buyer Choice', first home buyers in NSW will be able to choose between an upfront payment or a smaller annual property tax.

First home buyers who opt into the property tax will pay an annual property tax of $400 plus 0.3% of the land value of the property.

If the land value is $1 million, that means home buyers will pay $3,400 per year.

The NSW Government notes the property tax option will be available for properties for up to $1.5 million, helping a broader group to become first home buyers.

NSW Treasurer Matt Kean said the government had allocated $728.6 million over the next four years to help first home buyers get a foot on the property ladder.

“We know that first home buyers are being forced to enter the property market later in life and this reform will make the property market more accessible for them,” Mr Kean said.

“It will mean more NSW residents will get into their first home at an earlier age and achieve the great Australian dream of home ownership.”

Legislation to establish the property tax will be introduced during the second half of 2022 with eligible first home buyers able to apply to opt into the property tax from 16 January 2023.

For contracts exchanged in the period between enactment of the legislation and 15 January 2023, eligible first home buyers will be able to opt-in from 16 January 2023 and receive a refund upon any stamp duty already paid.

From 16 January 2023, eligible first home buyers who opt into the First Home Buyer Choice will not pay stamp duty on their purchase - the property will not be locked into the scheme if it is sold.

First home buyers will continue to be eligible to apply for full stamp duty exemption for properties up to $650,000, while stamp duty concessions remain in place for properties between $650,000 and $800,000.

ABS data shows amid booming property prices, there was a 25.7% increase in stamp duty revenue generated across all states through the 2020-21 financial year.

Since the commencement of the 2021-22 financial year, data from Revenue NSW shows to May 2022 the NSW Government has collected $13.3 billion from land-related transfer duty.

In comparison, to May 2021, the NSW Government collected $8.4 billion from land-related transfer duty – a difference of $4.9 billion.

What does this change mean for homebuyers?

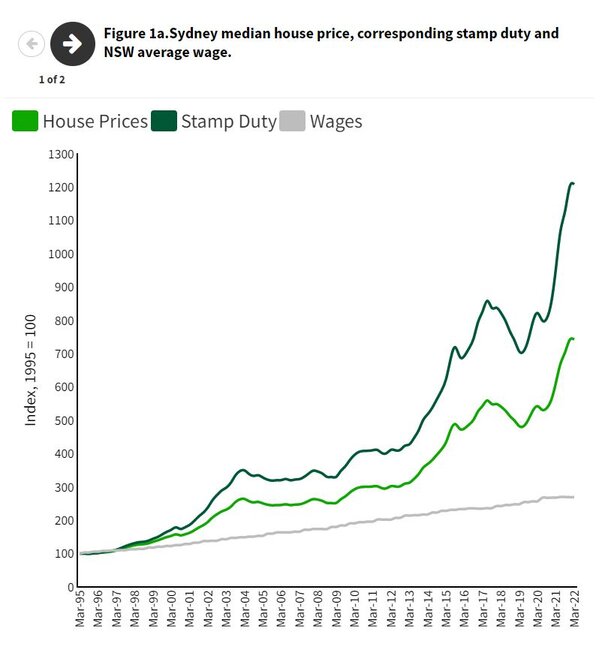

A recent report from Domain found since 2002 Sydney house prices have risen 280% while the cost of stamp duty has escalated by 406%.

Over the same period, the median house price in Regional NSW has jumped 324% while stamp duty costs have risen 524%.

Source: Domain Financial Burden of Stamp Duty Report

Comparing stamp duty versus land tax, Domain’s Chief of Research and Economics Dr Nicola Powell said it could take years to accrue the same amount of property tax compared to the upfront cost of stamp duty.

“Stamp duty reduces property transactions due to its sizeable lump sum and means people are less likely to live in a dwelling that suits their needs,” Dr Powell said.

“Based on the median house price in Sydney sitting around $1.5 million, it would have to be owned for approximately 18 years before the owner would match the upfront cost of stamp duty.

“Shifting from stamp duty to a property tax could improve housing affordability by reducing the upfront costs of buying a property. This could boost purchasing power, enabling first-home buyers to enter the market sooner.”

Source: Domain Financial Burden of Stamp Duty Report

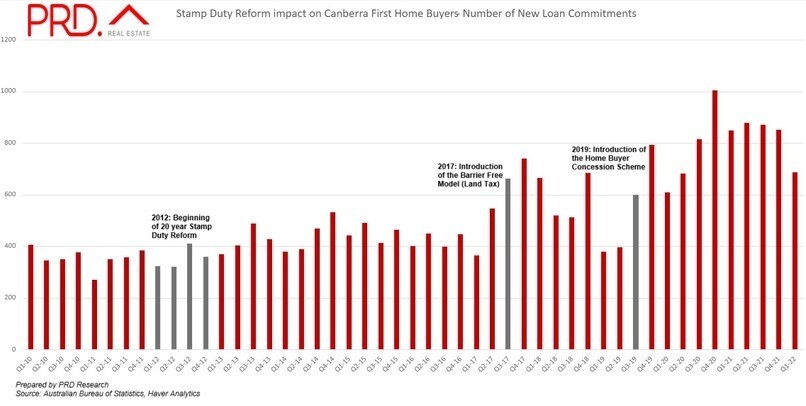

PRD Chief Economist Dr Asti Mardiasmo believes NSW can take several lessons from the ACT, having introduced a land tax in 2017 which saw an immediate influx of first-home buyers.

“After the introduction of Barrier Free Model on September 18 2017, there was an increase in the number of First Home Buyer loans in the final quarter of 2017,” Dr Mardiasmo told Savings.com.au.

“The home buyer concession scheme from 1 July 2019 allowed for more eligible home buyers in the ACT to pay reduced or no stamp duty - again, we saw an increase in the number of first home buyer loans in the third and fourth quarters of 2019.”

Source: PRD Research

Dr Mardiasmo says the ability to not have to worry about stamp duty is a relief to many buyers, given current circumstances have resulted in borrowing less due to an increased cash rate.

“The impact of this is that previously discouraged buyers, due to having less borrowing power, can decide to return to market thus keeping the demand level high,” she said.

“This ‘returning demand’ has the potential to keep price growth in the upwards trajectory due to the imbalance between supply and demand currently on display right across the nation.”

Dr Powell echoed this sentiment noting the removal of stamp duty could potentially cause prices to rise, benefitting the seller.

“However, for a buyer the cost is borne across the ongoing household budget and will factor into the holding costs associated with the home,” she said.

See Also: Why a property tax is not the answer

Will the option to choose between stamp duty or land tax benefit supply?

Dr Powell believes the current cost of property transactions can inhibit people from moving homes with the belief that they need to stay in the property for a period to “claw back” the cost of stamp duty.

“The large upfront cost of stamp duty distorts decisions we make around housing and can be a disincentive to move,” she said.

“The significant length of time people can own a house with property tax obligations may improve confidence and optionality to move houses more frequently in line with their stage of life.

“We may see an increase in the flipping of houses as the transactional costs are reduced, mobilising our workforce and encouraging property purchases.”

Image by Andy Wang via Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Harrison Astbury

Harrison Astbury

Rachel Horan

Rachel Horan