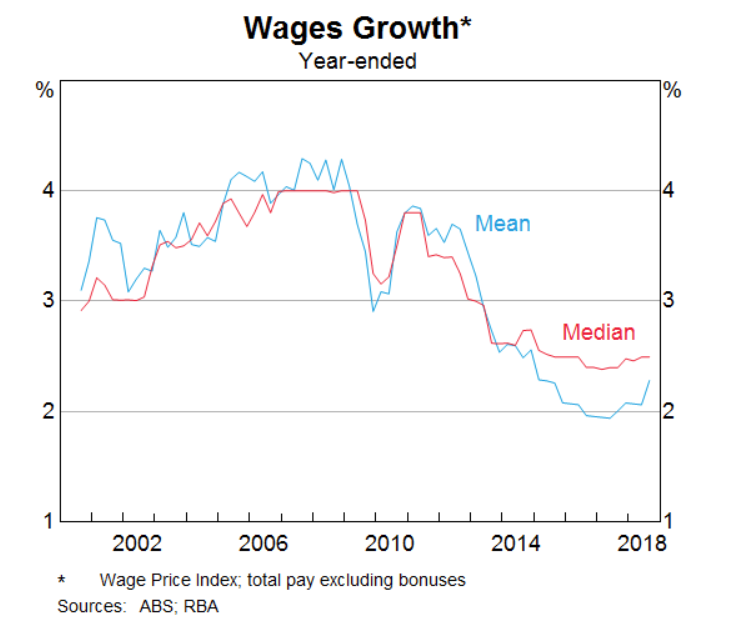

In a speech to the Australian Council of Social Service (ACOSS) in Canberra on Tuesday, RBA Deputy Governor Guy Debelle said the central bank expects wage growth to remain largely unchanged over the next couple of years.

According to Dr Debelle, the proportion of firms expecting stable wages growth in the year ahead is around 80%, while only 10% anticipate stronger growth.

The RBA has cut Australia’s cash rate to a record low 0.75% in an effort to lower unemployment, increase inflation to 2-3% and boost wage growth.

Wages growth slowed to a 15 month low of 2.2% over the year to September, unemployment jumped from 5.2% to 5.3% in October and inflation is at 1.7%.

Dr Debelle said the RBA expects the period of low wage growth to be more prolonged than in previous years.

“The more wages growth is entrenched in the 2s, the more likely it is that a sustained period of labour market tightness will be necessary to move away from that,” Dr Debelle said.

“At the same time, I don’t think there is much risk in the period ahead that aggregate wages growth will move any lower.

“Recently there has been a rise in the proportion of new Enterprise Bargaining Agreement’s (EBA) with a term of three years or more.

“The lower wages growth incorporated in those agreements suggests that wages growth of around 2.5% for EBA-covered employees will persist for longer than in the past.”

RBA data found that EBA’s that provide annual wage rises in the 2-3% range had risen from around 10% in the 2000s to almost 60% in 2019.

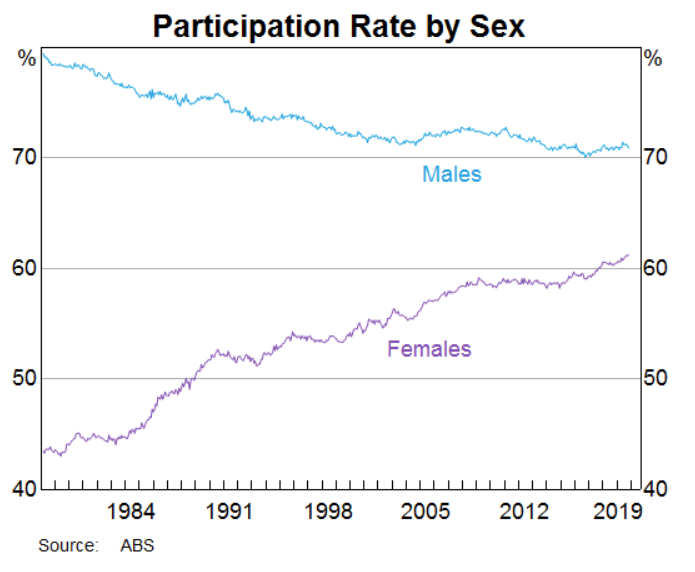

Workforce participation at an all-time high

The RBA found the share of the population participating in the labour force is at a record high, driven by higher participation of women and older workers.

“Historically more of the increase in employment has translated into a reduction in the unemployment rate than by a rise in the participation rate,” Dr Debelle said.

“However, the past couple of years have been unusual.

“The increase in employment has been met disproportionately by an increase in the number of people participating in the labour force.

“The female participation rate is now at its highest rate, and the gap between female and male participation is now the narrowest it has ever been.”

The RBA attributes the high female employment participation to mothers returning to the workforce sooner, childcare costs and an increase in the level of mortgage debt of homeowners.

Meanwhile, older workers are staying in the workforce longer due to improved health, less physically demanding jobs and the age the pension can be accessed increasing.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!