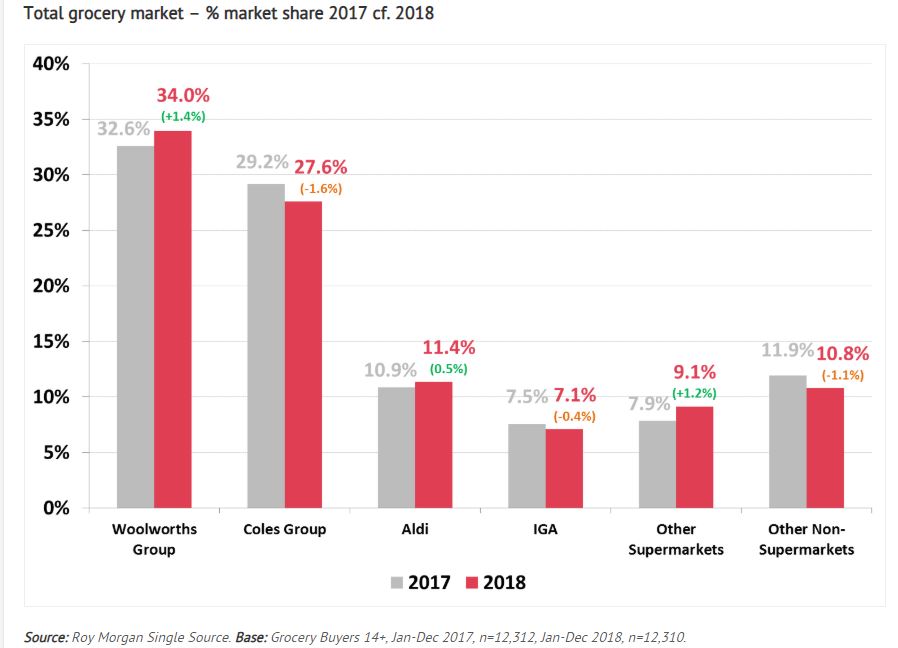

Market research company Roy Morgan’s latest report on Australian supermarkets revealed Woolworths extended its grocery market share by 1.4% points, increasing its lead ahead of Coles and Aldi.

Coles Group, which last year separated from Wesfarmers, saw its market share slip -1.6% points over the year to 27.6%.

Meanwhile, Aldi had a small rise of 0.5% points to 11.4% of total grocery market spend.

Roy Morgan CEO Michele Levine said Woolworth’s impressive performance puts it in a strong position to deal with increasing competition.

“The successful year for Woolworths has been built upon strong performances across the four key categories of fresh food,” Ms Levine said.

“Woolworths has grown its market share in dollar terms for fresh meat, fresh deli, fresh bread and also fresh fruit and vegetables and is the market leader in all four categories ahead of main rival Coles.”

According to the report, over 50% of fresh food market spend is with either Coles or Woolworths.

That could change in the near future, with German ‘hypermarket’ Kaufland due to enter Australia’s competitive $100 billion grocery market.

Ms Levine said Coles’ recent demerger from Wesfarmers gives the group an opportunity to refocus on its core business ahead of Kaufland’s arrival.

“Kaufland has already bought six industrial sites in Melbourne at which it plans to open its successful ‘hypermarkets’ over the next two years before rolling out stores Australia-wide following in the footsteps of fellow German retailer Aldi,” she said.

“In addition to

Australian consumers will be hoping the increasing market competition will drive prices lower and help them save thousands, with groceries being one of the highest costs of living for households.

For feedback or queries, email dominic.beattie@savings.com.au

Photo by Fancycrave on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!