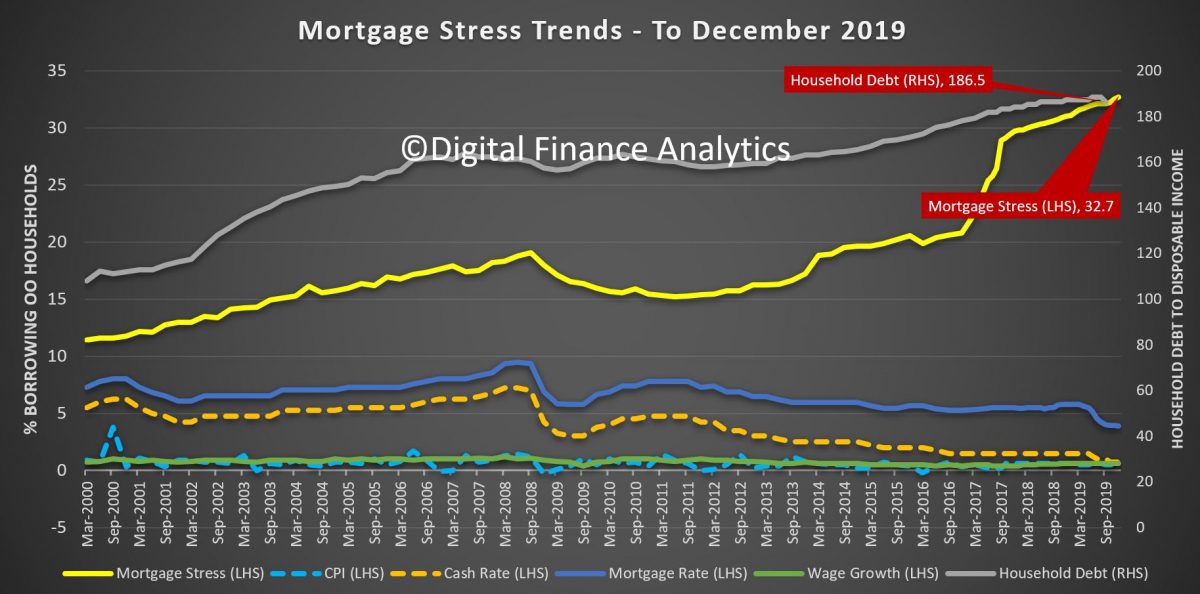

The Digital Finance Analytics (DFA) Mortgage Stress Trends Data to December 2019 found the number of households in mortgage stress - defined by DFA as when household cashflows are negative - rose to 32.7% of all borrowing households.

The number for October was 32.2%.

That 32.7% figure represents 1.1 million households across the country, with more than 83,000 households predicted to be in default, despite the lower cash rate and "deeply discounted mortgages".

Source: DFA

"Stress is assessed in cash-flow terms, and when money in is not sufficient to cover the costs of the mortgage and other regular outgoings, the household is flagged as stressed," DFA principal Martin North.

"Granted they may have the capability to tap into deposits, pull down on credit cards, or even sell property, but on a regular basis they are in strife. We find a significant gap between those we assess as at risk, and those who believe they do have financial difficulty.

"Many adopt the head in the sand approach and hope things will improve, but given the current economic outlook, we think that is a courageous stance to take."

The graph above shows Australia's average debt-to-income ratio remains high at 186.5, although there has been a recent drop from 191.

Mr North says he expects stress levels to continue to rise given current economic conditions.

"Households would do well to draw up a cash flow, to identify money in and money out, determine which spending is essential and prioritise accordingly," he said.

"And remember, if you are in financial difficulty banks have an obligation to assist, so go talk to them, early. Avoid the head in the sand posture, as it leaves other parts horribly exposed."

He also said DFA would soon be releasing its household financial confidence (HFC) index, which highlights the challenging issues for households.

The HFC index for October 2019 was at its lowest point ever of 83.7, with the increasing cost of living a concern for 91% of the 50,000 homeowners surveyed.

Which states are the most stressed?

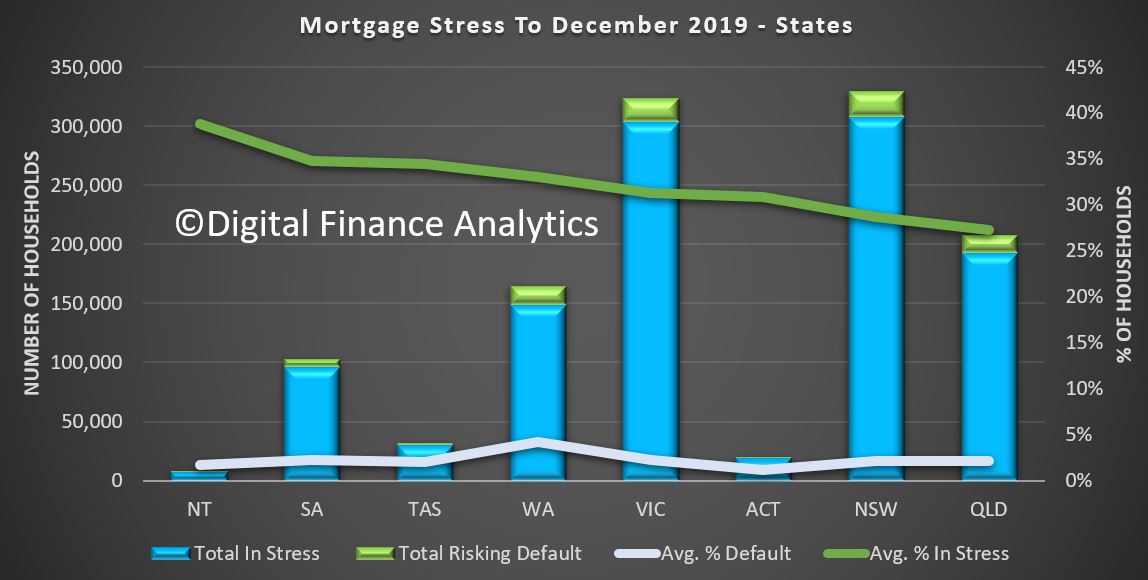

New South Wales, Victoria and Queensland reportedly have the highest levels of stress in the country, which may have something to do with the fact these states have the most expensive median property values in the country, according to CoreLogic data.

Victoria has a proportionally higher stress reading compared to New South Wales, however, with both of these states having just over 40% of households in mortgage stress.

The Northern Territory, South Australia and Tasmania have some of the lowest levels of mortgage stress but the highest proportion of households in difficulty, while West Australia has the highest risk of default over the next 12 months at 4.2%.

Source: DFA

Across the top postcodes, Toowoomba 4350 (48%), Liverpool 2170 (49%) and Fountain Gate 3805 (59%) have the highest portion of households in stress.

Even bigger numbers can be seen when divided by regions.

Central West Queensland has a mortgage stress rate of 75%, although this is only 300 households, while Alice Springs has a 65% stress rate with 2,000 households exposed.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Harrison Astbury

Harrison Astbury