According to Westpac’s Housing Sentiment Survey, 53% of Australians were eager to take advantage of current market conditions, with the RBA’s two cash rate cuts creating new opportunities for buyers.

Next home buyers were the most upbeat segment, with 71% feeling more confident about the market than last year and 66% believing now is a good time to purchase their next home.

The survey also found 62% of Australians intend on making some sort of change to their housing situation in the next five years, motivated by:

- Interest rates (20%)

- Falling house prices (18%)

- The desire to live in a new area (17%)

Meanwhile, the amount of Australians looking upsize to a bigger home has doubled to 24% from 2018.

However, options are thought to be limited, with 18% of next home buyers feeling challenged by a lack of property listed on the market.

Will Ranken, General Manager of Home Ownership at Westpac, said favourable market conditions have created a desire for larger homes.

“Record low-interest rates have created a positive environment for homeowners to not only get ahead on their mortgage repayments but to also purchase their next home,” Mr Ranken said.

“Australians looking to upsize, many of which are families, are particularly motivated to purchase a larger space.

“When you consider more young people are choosing to live with their parents longer than ever before, it’s no surprise many are hoping to purchase a bigger home to help future-proof their family.”

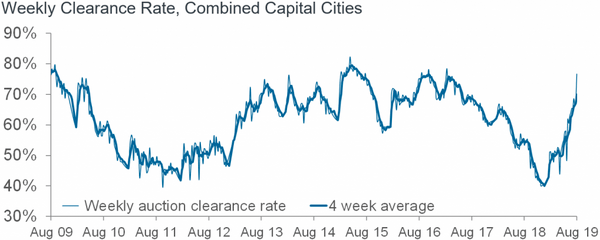

Auction clearance rates record two-year high

The research from Westpac also revealed Australian homeowners are now 50% more likely to sell their home compared to 2018, with 10% intending to sell in the 12 months.

“We’ve seen a recent rise in auction clearance rates, so it could be an opportune time for sellers to capitalise on growing demand, particularly in the lead up to spring; the time of year when house hunters tend to be the most active,” Mr Ranken said.

The research echoes CoreLogic data, showing capital city auction markets recording the highest preliminary clearance rate in over two years.

Source: CoreLogic

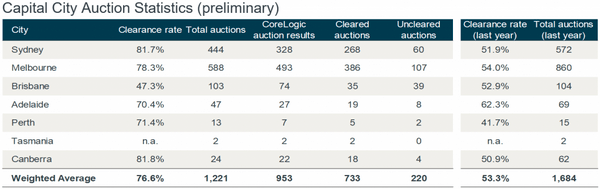

There were 1,221 homes taken to auction across the capitals this week, returning a preliminary clearance rate of 76.6%, up from the 67.8% clearance rate of 1,111 homes the previous week.

It’s expected the final rate will revise lower but still hold above 70%, a feat not achieved since May 2017.

In the same week last year 1,684 homes were taken to auction, with only a 53.3% clearance rate.

Source: CoreLogic

Sydney recorded an impressive preliminary clearance rate of 81.7% across 444 auctions, compared to 572 auctions returning a final rate of 51.9% in the same week last year.

588 auctions in Melbourne returned a preliminary clearance rate of 78.3%, in contrast to the same week last year, returning a clearance rate of 54.0%, across 860 auctions.

Across the smaller auction markets, Brisbane saw higher auction volumes week-on-week while Adelaide, Canberra, Perth and Tasmania all saw fewer homes taken to auction.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Arjun Paliwal

Arjun Paliwal

Jacob Cocciolone

Jacob Cocciolone